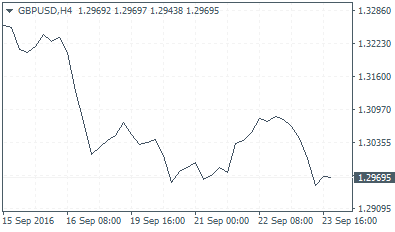

The British pound could have enjoyed a rather healthy week, coming off from the previous week’s low of $1.2996, but the rally failed as prices soon tumbled by Friday’s session. GBPUSD closed this week at $1.2969 after failing to build up on the FOMC gains and of course BoE’s Kristin Forbes hawkish comments. BoE’s Carney was also scheduled to speak, but he did not make any references to monetary policy.

GBPUSD Chart

Talks of “Article 50″ shows GBP is still vulnerable

Although the UK’s economic calendar last week was soft it was Thursday’s comments by British foreign secretary, Boris Johnson that sent the currency lower, with the declines seen accelerating by Friday’s session.

Speaking in an interview in New York, Boris Johnson reportedly told Sky News, “The expectation is from the early part of next year; you will see an Article 50 letter. In that letter, I’m sure that we will be setting out some parameters for how we propose to take this forward.” Johnson further went on to say that it would take less than two years to conclude the uncoupling between the UK and the EU.

His comments were however quickly shot down by officials from 10 Downing Street. An official from the Prime Minister’s office said that “The decision to trigger Article 50 is hers,” about the PM Theresa May. “She will be doing it at a time when she believes it is in the best interest for Britain. The Prime Minister’s position has not changed,” officials said.

BoE Forbes: Concerns on QE

Speaking at an event in London, Bank of England policymaker Kristin Forbes stated that she was concerned about the central bank’s stimulus program and the impact on pension funds and corporate bonds. Forbes was one of the dissenters who voted for a 25bps rate cut but dissented against expanding the asset purchase program in August this year.

“I felt that the appropriate amount of stimulus given what we actually knew about the weakness in the economy was a modest stimulus … That made it a cleaner decision,” Forbes said.

In a clear hint on future policy actions, the policy maker said that if she felt that there was too much stimulus in the economy, she would prefer to vote for a rate hike than unwinding asset purchases. Forbes also made it clear that she would not oppose the central bank’s current asset purchase program.

BoE looks to regional agents ahead of November meeting

At the September meeting, the Bank of England left interest rate unchanged at 0.25%, and asset purchased steady at £435 billion. The central bank, however, said that it would be closely assessing the economy and that a decision to cut interest rates would be taken at the November meeting.

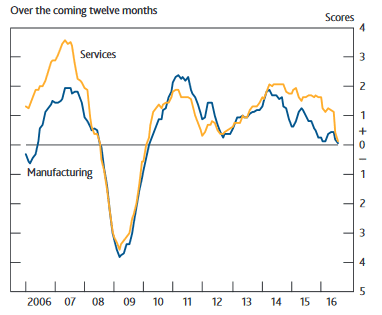

Economic data so far from the UK has been encouraging, although most of the data have been forward looking. While the PMI’s have managed to rebound, other economic indicators such as jobs data are yet to catch up. The most recent labor market information in the UK, for August, showed that wages grew at a slower pace, while the number of jobless claimants also rose by 2400. The jobs data has been overall positive, but the cracks are evident.

Last week, the Bank of England dug into its regional network of agents scattered across the country to scout for clues on the economy. The regional agents are part of the monthly BoE policy making process giving an assessment of the economy directly to policymakers.

With the central bank signaling potential rate cuts in November, the regional agents are expected to report their findings which could gain more weight. Last Wednesday, the officials’ report showed that the British economy was appearing to slow down after the referendum but growth was still on track with consumer spending offsetting cautious behavior from companies.

It is unlikely to expect the Bank of England to introduce further rate cuts at the November meeting, given the way things are currently; still economic data for September will be no doubt carefully monitored, and any weakness could quickly add into increasing bearish bets on the GBP.

In the meantime, last week showed that despite the recent strength in the British pound, things are not the way they seem. If the sterling’s reaction to the comments is anything to go by (despite being quickly dismissed), there could be further declines in store for the GBP, when Article 50 is triggered.