The markets are moving relatively quickly and forecasts are being adjusted. EUR/USD is trading at levels last seen in November 2003 and it’s now time for a downward revision to the pair’s forecasts.

BNP Paribas presents the case for revising down the outlook for the upcoming months, with explanations:

Here is their view, courtesy of eFXnews:

Early this week, BNP Paribas highlighted the downside risks to its year-end EUR/USD forecast.

“Price action early in the year suggests those risks are starting to transpire and we have revised our Q4 EURUSD target,” BNPP projects.

BNPP outlines the following factors behind this revision:

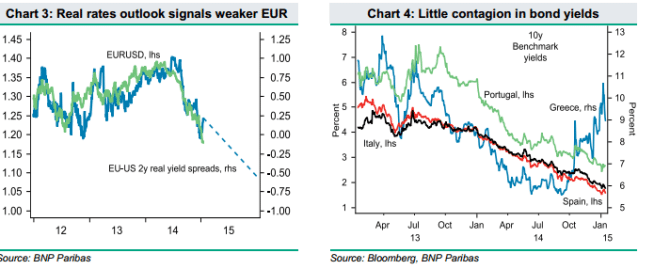

Even moderate ECB QE success implies a weaker EUR. “We believe the ECB will do enough to get at least partial success in convincing the market it will reach its inflation goal, implying EURUSD could fall further. Our 1.10 target does not appear particularly aggressive, as our cyclical CLEER fair value model is currently signalling 1.12 based on our economists’ macroeconomic forecasts,” BNPP clarifies.

Long-term EURUSD valuations are not yet extreme. “With BNP Paribas’ FEER – our long-term valuation model – indicating a fair value of 1.32, EURUSD is at its most undervalued level since 2003. However, the pair would need to fall below 1.13 (the bottom of the +/- 1 standard deviation corridor) before being considered significantly overvalued by historical standards,” BNPP argues.

Look through Greek election uncertainty. “One factor that is not driving our weaker EUR call is renewed sovereign risk. Greek yields have been rising in line with the political uncertainty but those of Portugal, Spain and Italy have not. With no contagion risk, Greek politics should not be a significant driver of EUR weakness,” BNP adds.

New Forecasts:

BNPP nows sees EUR/USD at 1.15, 1.12, 1.11, and 1.10 by end of Q1, Q2, Q3, and Q4 respectively.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.