- Real Non-Farm Payrolls expectations may be too high.

- The US dollar has yet to undo its Mid-East related gains.

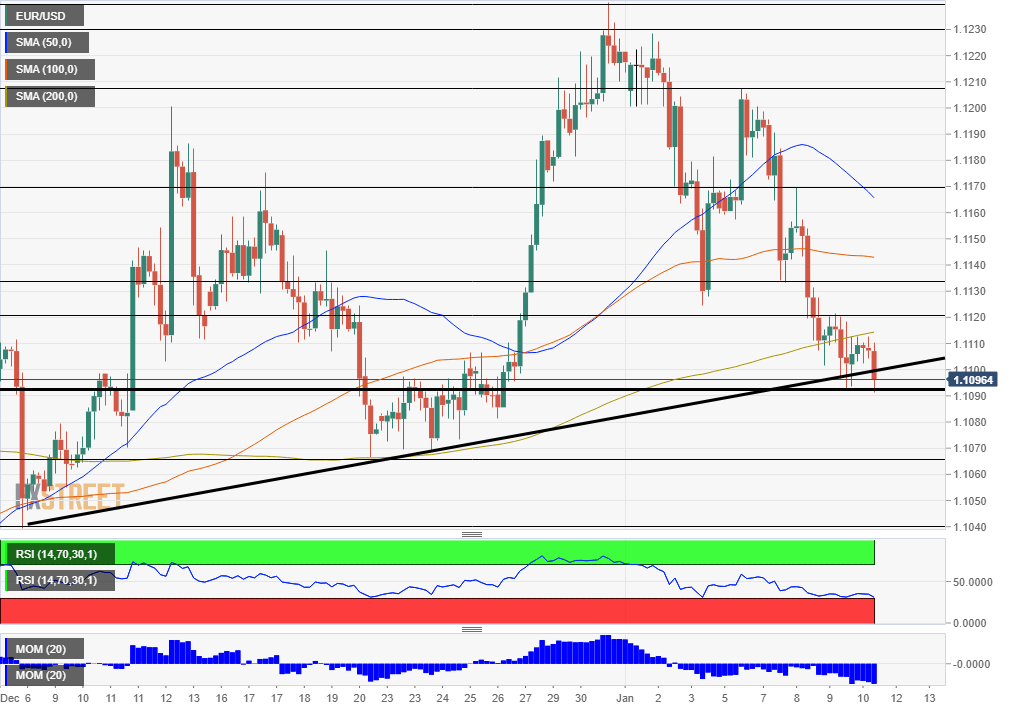

- Friday’s four-hour chart is showing oversold conditions.

The king of forex indicators is back – anticipation to the first post-holidays Non-Farm Payrolls is keeping traders at the edge of their seats.

The economic calendar is showing an expected increase of 164,000 jobs in December, lower than 266,000 seen in November. Average Hourly Earnings carry expectations for an annual advance of 3.1%, matching the previous month.

The Federal Reserve signaled it is on hold – but it can always change its mind. How will the world’s most popular pair react? Here is the bullish case for EUR/USD:

1) Real expectations are higher

ADP’s private-sector labor report beat expectations with a rise of 202,000 jobs in December – on top of a significant upside revision to November. The ISM Non-Manufacturing Purchasing Managers’ Index also exceeded forecasts with 55 points – and an improvement in the employment component. The services sector is America’s largest.

These leading indicators have altered real market expectations, which are probably closer to 200,000. When expectations are high, the chance for a disappointment rises as well.

Markets are therefore likely to shrug off a strong number but react adversely to a low figure.

2) Dollar yet to unwind from Mid-East tensions

The US and Iran stepped back from the brink of war on Wednesday when Iran seemed to deliberately refrain from killing Americans and President Donald Trump did not promise new military action.

Oil, gold, the yen, and even Bitcoin retreated from the highs they reached after the killing of Qassem Suleimani, a top Iranian general.

However, the dollar remained strong.

Are investors waiting for the NFP before they unwind the greenback trade? They could do it regardless of the outcome. Tensions ahead of the release may be keeping the dollar bid.

3) Oversold conditions

The Relative Strength Index on the four-hour chart is flirting with 30 – the line indicating oversold conditions. While the pair dropped below the 200 Simple Moving Average and momentum is to the downside, an upside correction cannot be ruled out.

Support awaits at 1.1090, which was Thursday’s low, followed by the mid-December trough of 1.1065. Next, we find 1.10, a round number, and 1.0960.

Resistance awaits at 1.1120, which EUR/USD down in recent days, followed by 1.1135, a swing low from early in the week. 1.1170 and 1.1205 were swing highs in early 2020.