Former Trump confidant Michael Flynn has turned against the President and this is rattling markets. Stocks, bond yields, and the dollar are falling quite a bit.

Flynn has agreed to testify against Trump and according to the reports, he will say that Trump knew about his dealings with Russia just before the President was inaugurated. This comes at a critical time: just as Republican lawmakers were getting ready to pass a major tax bill, something that had helped the greenback so far this week.

For EUR/USD, this means a bounce from the lows. So far this week, everything went in favor of the dollar and against the euro. The bombshell from Mueller helps the euro recover.

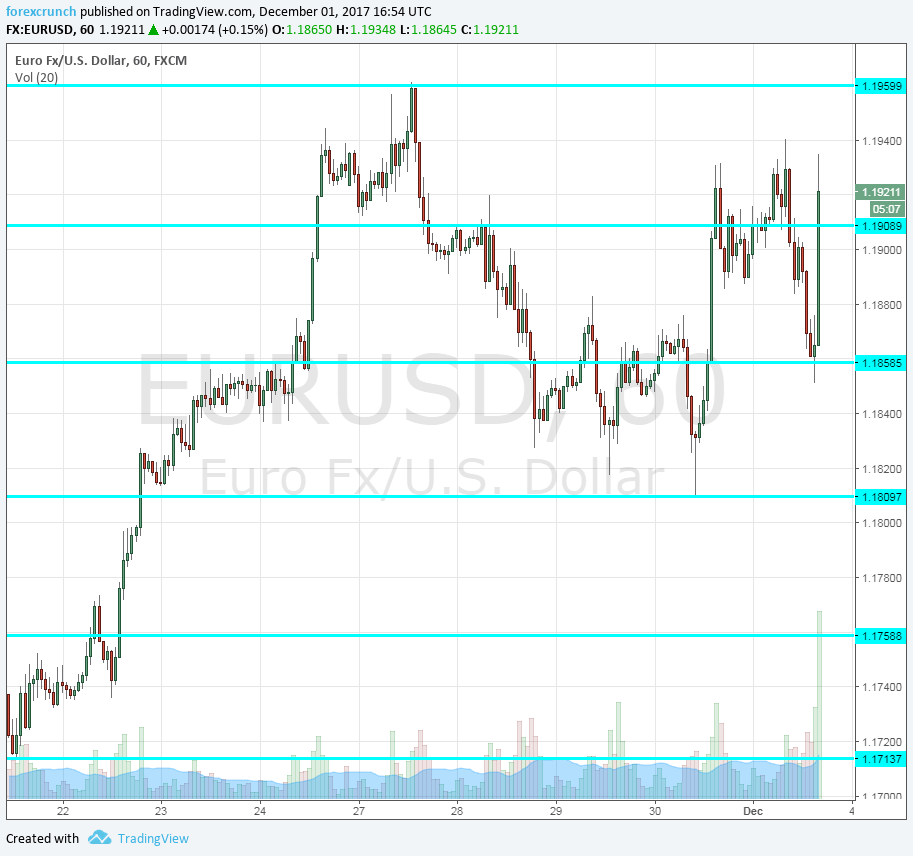

EUR/USD is now trading around 1.1920 after having already reached 1.1940. The 1.1910 level has been high support before the pair tried to reach higher levels: 1.1960, which was the peak early in the week before things turned against the pair.

The next level is clearly 1.20, and it is then followed by the 2017-high of 1.2090. Above 1.2090, we are back to levels last seen in 2014, with 1.22 serving as a potential cap.

Support awaits at 1.1810, followed by 1.1760 and 1.720. More: EUR/USD: ‘Primed For Another Look At Higher Levels‘ – NAB

Here are the recent moves on the euro/dollar chart: