Inflation in the UK slides to 3% y/y as expected. Month over month, this is an advance of 0.4%.. Other figures were mixed: core inflation dropped from 2.7% to 2.5%, more than forecasts. PPI also fell short of expectations with a marginal rise of 0.1% while PPI Output came out ahead of projections with 0.4%. All in all, there were no big surprises here.

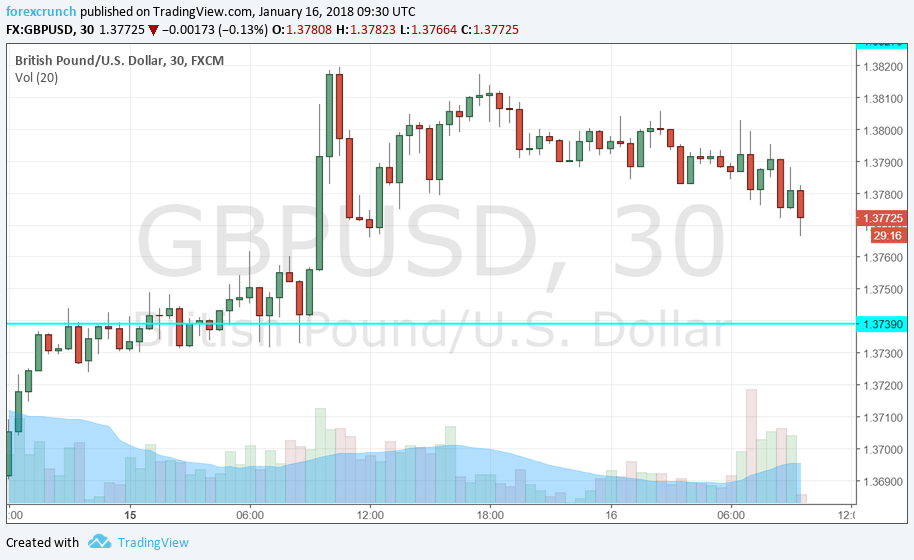

GBP/USD slips from around 1.3780 to 1.3762, extending the correction. Update: after the initial slide, Sterling stabilizes as the news was generally not a shocker.

The UK was expected to report annual inflation of 3% in December after 3.1% in November, a minor slide.

GBP/USD slipped off 1.38 ahead of the publication, as the US dollar was making attempts to recover. The greenback suffered from a massive sell-off that accelerated on Friday despite an OK inflation report from the US.

Even the pound, with all the worries about Brexit and clear signs of a slowing economy, benefitted. Pound/dollar reached the highest levels since before the EU Referendum on June 23rd 2016.

More: GBP/USD: Staying Structurally Bullish Targeting A Break Above 1.40