Price rises are taking a break in the UK. Maybe the recent hawkishness of the BOE could be unwound. Headline inflation slows down to 2.6% y/y, significantly lower than expected. Month over month, it is flat against 0.2% predicted.

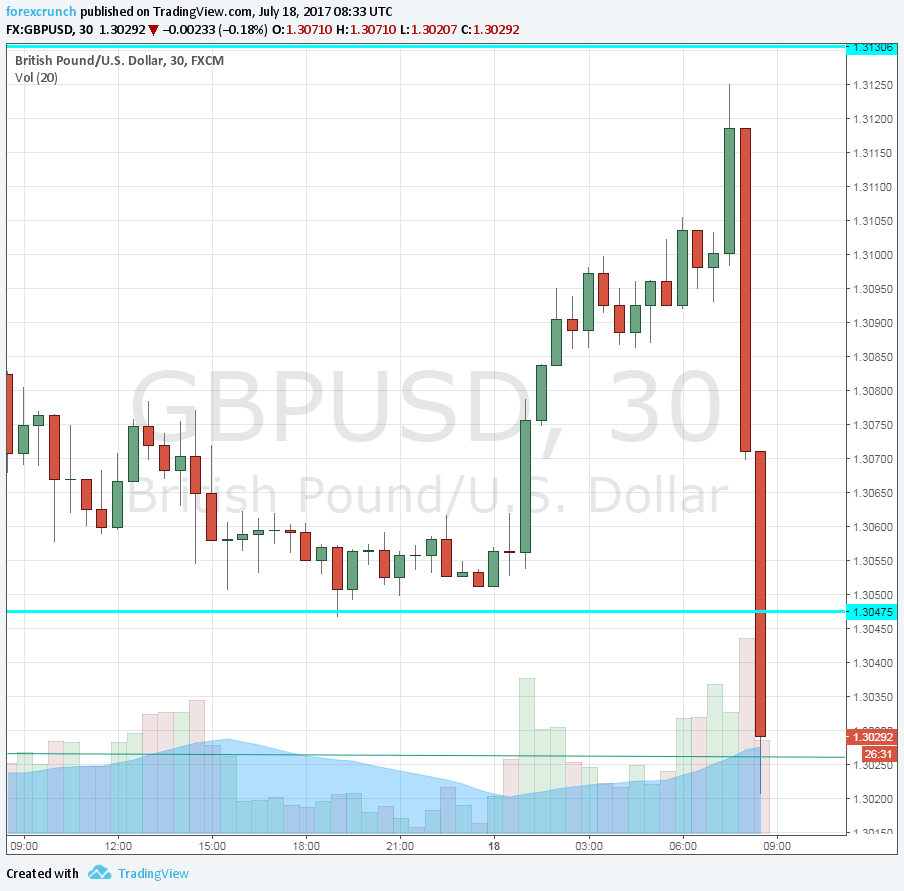

GBP/USD falls all the way to 1.3020. From the highs of the day, this is a fall of around 100 pips. The pair is experiencing a “dead cat bounce” to 1.3030, but the momentum seems to be to the downside.

Core inflation is also slower: 2.4% y/y. PPI Input is down only 0.4%, better than -1% predicted. Core PPI is up 0.2%, also above predictions. However, CPI figures have the upper hand.

Here is how it looks on the 30-minute chart. Note that the drop began before the data came out. Support awaits at 1.2980, just under the round number of 1.30. Further support is at 1.29 and 1.2820. Resistance is at 1.3050 and 1.3130.

High expectations and political woes

The UK was expected to report a rise of 2.9% in consumer prices in June, a repeat of the rise in May. This is significantly above the rise in wages, which stood in May at 1.8%. Core inflation was expected to rise 2.6%. Also, PPI figures are watched.

GBP/USD was slipping from high ground ahead of the publication.Were there rumors or leaks about a poor number?

Earlier, it had risen thanks to the greenback’s weakness on the apparent failure of Trumpcare. Cable traded around 1.31 ahead of the publication.

The Bank of England has a huge dilemma: raise rates to battle rising inflation or keep rates low to help the economy in this period of uncertainty. Governor Mark Carney flip-flopped from opposing raising rates to support such a move.

Resistance awaits at 1.3130, an important line in 2016. The pair had already traded at 1.3125 earlier in the day. Support awaits at 1.3050, the low-level today and also the previous 2017 high, before the most recent move.

In the background, Brexit negotiations continue with positive noises but little progress. In London, there are reports that various MPs in Theresa May’s Conservative Party are plotting against her. Political uncertainty is high both internally and externally.