Weaker than expected growth in the manufacturing sector. That is the message from the manufacturing PMI for February. This is the first out of three PMIs released by Markit. The next one is construction, released tomorrow, and the last one is services, the most important one, released on Friday.

The British pound has been suffering from fresh talk about a second Scottish independence referendum, a ramification of Britain’s decision to leave the European Union. GBP/USD is also lower due to the renewed strength of the US dollar. The greenback ignored Trump and rallied on the Fed. The President of the New York Fed, Bill Dudley, said that there is a compelling case to raise rates.

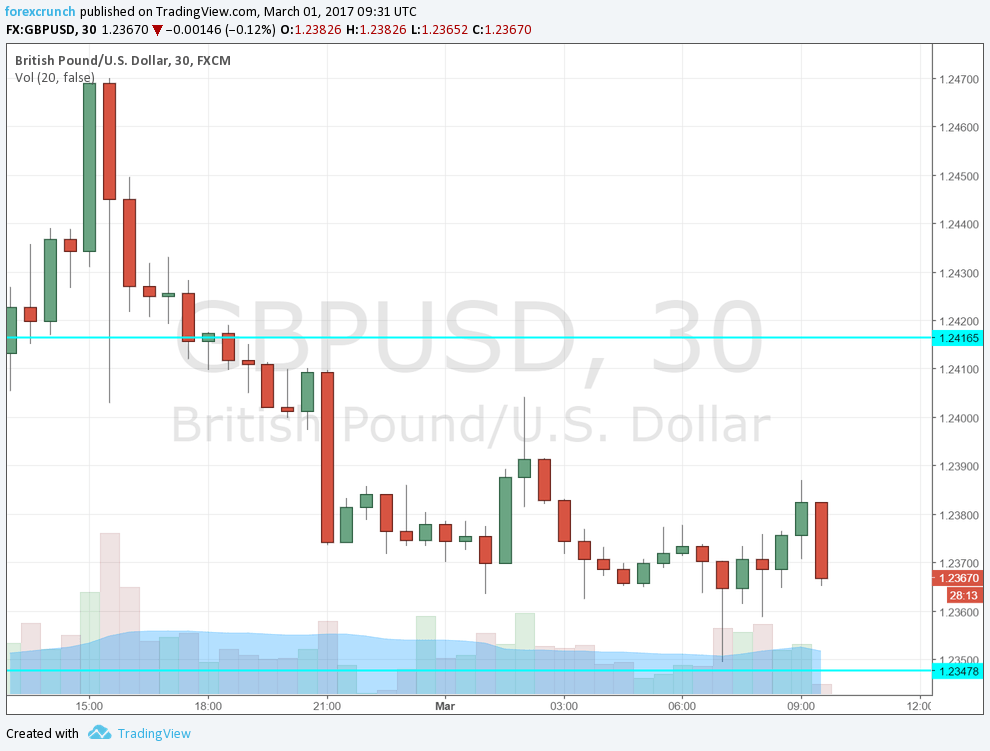

GBP/USD erases its recovery attempt and slips some 20 pips back down to 1.2365. Support awaits at 1.2350. Resistance is at 1.2415.

More: GBP/USD: Towards 1.30 Or 1.10?: The Game Theory Of A UK-EU Transition Deal – BofA Merrill

Markit’s UK manufacturing purchasing managers’ index was expected to remain steady, ticking down from 55.9 to 55.6 points, reflecting solid growth.

GBP/USD was trading around 1.2384 ahead of the publication, down mostly due to the dollar’s strength.