A winning streak of three better-than-expected PMIs from the UK. The services sector is also seen as growing at an accelerated pace with Markit’s services PMI beating expectations with 55.8 points.

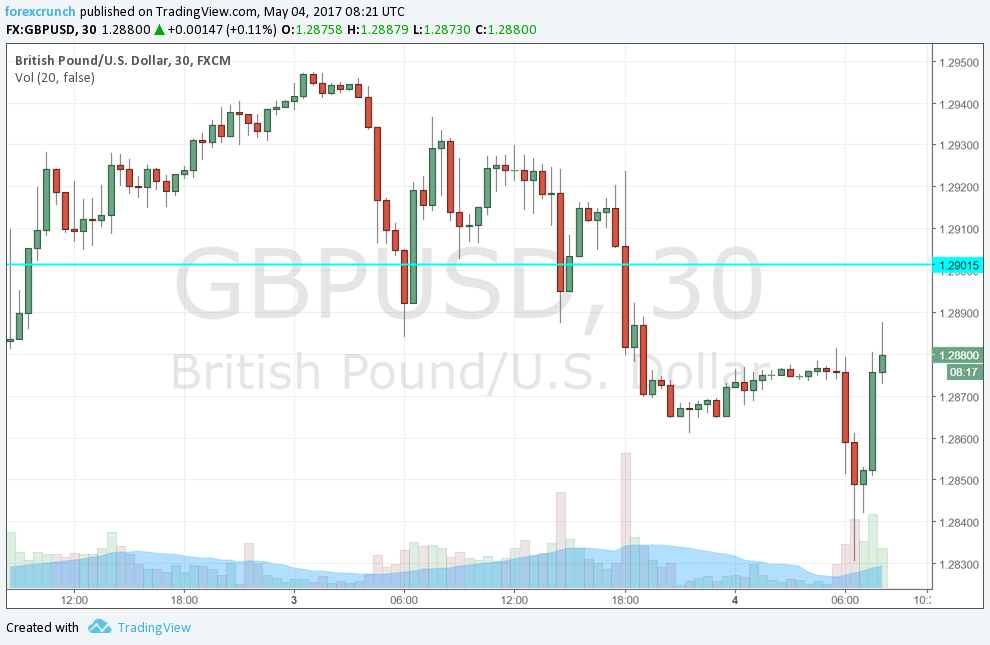

The pound was already bouncing ahead of the publication, leading the normal suspicion about a leak. In the aftermath, cable extended the gains but failed to breach 1.29 at the time of writing.

Other UK figures were more or less in line with expectations. Net lending to individuals stands at 4.7 billion, a bit beyond 4.5 billion predicted. Mortgage approvals are at 67K, bang on expectations.

The UK services PMI was expected to slip from 55 points in March to 54.5 in April. The services sector is 79% of the UK economy, making this last in a series of three PMIs the most important one of all.

GBP/USD was trading around 1.2880, recovering from the lows it had experienced after the Fed decision. The US Federal Reserve left interest rates unchanged but seemed to brush off any worries about the US economy.

The previous PMIs were both positive: manufacturing jumped to 57.3 while construction advanced to 53.1 points.

We are now exactly five weeks away from the UK general elections on June 8th. The surprise announcement about the snap elections sent cable shooting higher on hopes for a softer Brexit. PM Theresa May and her European colleague had a “disaster” dinner and she emerged as a “bloody tough lady” out of it. This serves her campaign.

Here is how the recent moves on pound/dollar look like. 1.2905 is the immediate level of resistance, followed by 1.2965. Support awaits at 1.2770.

More: Elliott Wave Analysis: GBPUSD and EURUSD