The CB Consumer Confidence misses expectations with a score of 11.8, less than 113 forecast. In addition, the previous number was downgraded from 113.7 to 113.3 points. This is still a high score but the winning streak is cut short.

The US dollar was already sliding ahead of the publication, and this release sends EUR/UDS to 1.08 and beyond.

USD/JPY is also making big moves: 112.30 is the level at the time of writing, under the 112.50 support line. The breakout still awaits a confirmation.

More: How Far Can The Dollar Fall S/T? What Is The Trade? – SocGen

Among the components, we find a rise in the “Present Situation” from 126.1 to 129.7 but a drop in “Expectations” from 106.4 to 99.8.

The Conference Board’s consumer confidence measure for January was expected to tick down from 113.7 to 112.6 points. After the release in December, Trump took credit for the higher values.

The US dollar has been on the back foot on the ongoing crisis from Trump’s Muslim Ban and the general disillusionment from his actions.

Trump’s most recent headlines were related to the pharma industry. He promised to cut regulations and also took advantage of the opportunity to blame other countries for devaluing their currencies. Earlier, his adviser David Navarro said Germany is manipulating the euro.

Earlier, the Chicago PMI disappointed with a drop from 54.6 to 50.3 points, lower than 55.1 points predicted. The S&P Case-Shiller House Price Index showed an annual rise of 5.3% instead of 5% expected.

EUR/USD has specifically enjoyed strong data from the euro-zone. Inflation jumped to 1.8% y/y, growth beat with 0.5% q/q and the unemployment rate fell to 9.6%, an ongoing improvement, albeit from a higher level.

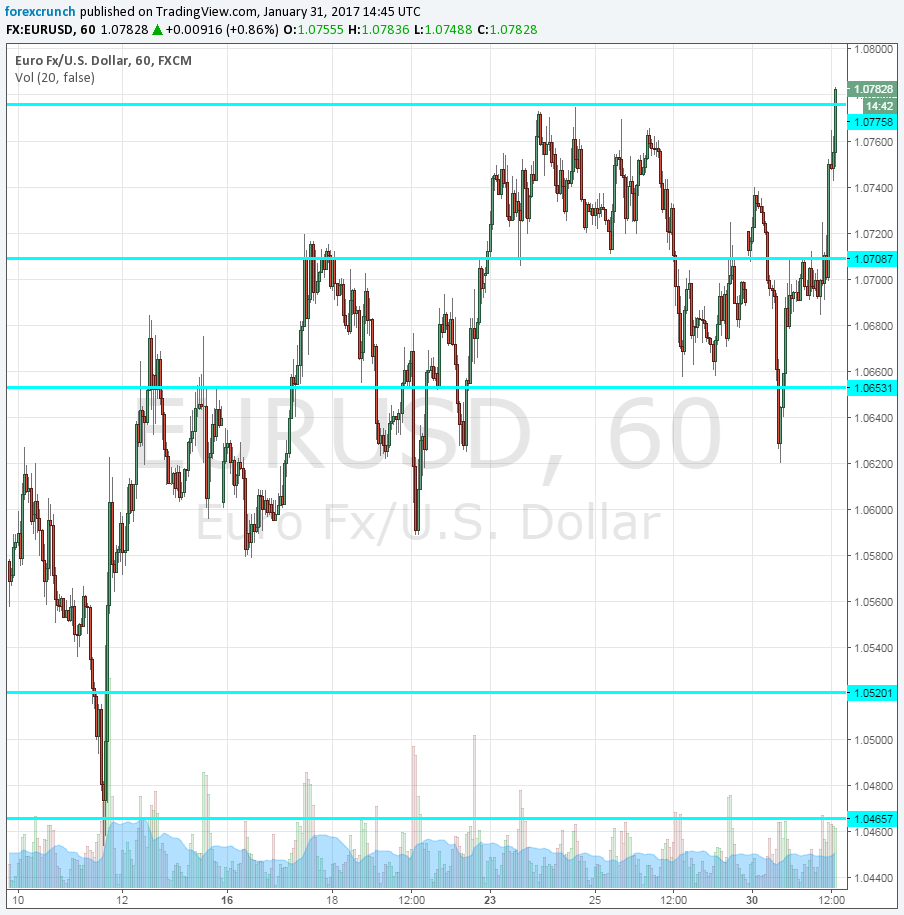

EUR/USD was flirting with resistance at 1.0780. This was a recent peak. The next line of resistance is at 1.0870.

More: EUR/USD: Poor Performance Of Shorts To Stay For Some More Weeks – Barclays