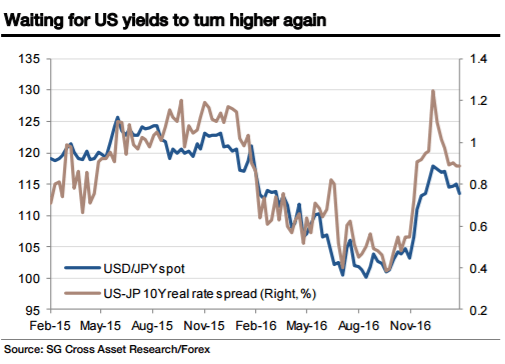

The US dollar is on the back foot, with EUR/USD touching 108 and USD/JPY breaking support.

Here is their view, courtesy of eFXnews:

President Trump’s travel ban – and his associated decision to fire the acting Attorney General – dominates sentiment and remains good for Treasuries, the yen (and gold), but bad for bonds and the dollar. How long will market sentiment to be affected? How far can the dollar and yields fall on this?

I’m not sure serious analysis is possible, and I don’t trust my gut instincts on something as far from the usual state of affairs, but my bias is still that we’ll get back to the Trump economic program, and the implications for Fed policy, before too long. More prosaically, markets will focus on the US jobs data due Friday.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

So how to trade?

We still want to fade this bout of Yen weakness too, with the BoJ holding policy and still anchoring yields. This till leaves me looking fondly at long EUR/JPY as an idea, even if we still think it is 2 1/2 months too early for that trade really.

GBP looks rangebound, with mortgage approvals and the debate on the Brexit bill.

Visually, AUD looks as though it’s topping out but at the same time, Australia looks a haven of calm (or at least, Sydney seems an appealing destination as I sit in Heathrow this morning, on the way to Frankfurt instead!).

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.