Idea of the Day

The dollar rally last night in the wake of the Fed statement largely reflected the fact that the statement was little changed from the September print, with the key phrase stating that they want to see “more evidence that progress will be sustained”. There was no mention of the government shut-down and debt ceiling debacle; we’ll have to wait until the minutes of the meeting for a sense of how this impacted their thinking. The biggest losses versus the dollar were the CHF and EUR, the most resilient was the AUD, helped by data showing stronger growth in import prices and also building approvals. From here, we have shifted back to watching data and seeing to what extent this underlines or undermines the possibility of Fed tapering at the December meeting, which is unlikely but still possible.

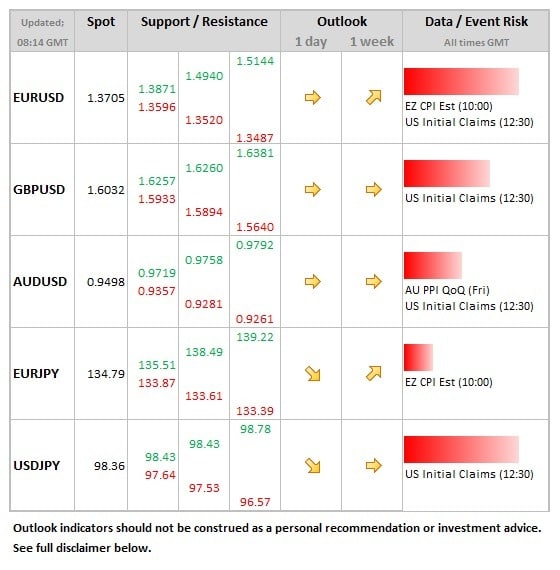

Data/Event Risks

USD: The claims data has been distorted by a number of factors in recent weeks, but are seen moving lower (from 350k to 338k) on this week’s release.

EUR: The first estimate for inflation in the Eurozone should come in softer than the 1.1% market estimate after the weaker than expected data from Germany yesterday. Oil prices have also been lower which will also be supportive of a better number. A lower headline reading could help the softer tone to the euro.

CNY: Manufacturing PMI data is released early Friday, which is seen holding relatively steady at 51.2. The yuan has been softening in recent sessions, but money market rates have been squeezing higher into month end.

Latest FX News

EUR: The euro slipping below the 1.37 level later in the Asia session as the single currency was one of the weaker performers as the dollar firmed after the Fed decision. There have been good reasons why the euro has performed relatively well over the past month, but there is a sense that some of these are starting to fade now.

AUD: Some signs of recovery, helped by much stronger than expected building approvals data, which rose over 14% in September. It will be crucial to see the extent to which the Aussie can form a base at these lower levels in the next couple of days.

NZD: The kiwi was initially higher after the interest rate decision, which saw rates unchanged by the statement reflecting the fact that continued currency strength could push eventual rate increases further into the future. The rise in the currency reflected relief that no real concern was expressed regarding the recent gains of the kiwi, which briefly pushed below the 0.82 level yesterday before recovering during the Asia session.

Further reading:

USD/JPY: The Wave Structure Points Towards 99 And 100

Fed leaves policy unchanged, omits “tighter financial conditions” – dollar stronger