The US dollar was seen trading lower against many other major currencies, including the Swiss franc. The market sentiment was recently tilted in the favour of sellers. The USDCHF pair breached an important support area, which might lead to more losses in the pair in the near term. There is an significant release lined up later today i.e. the US existing home sales data will be published. The market is expecting a 1% gain, which if misses the forecast might dent the US dollar further moving ahead. The Chinese GDP data released during the Asian session also acted as a catalyst for the US dollar.

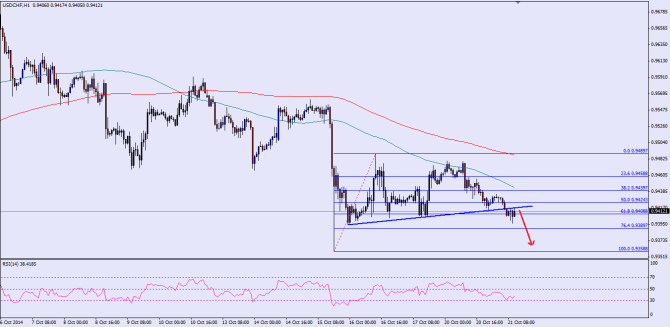

There was a critical bullish trend line formed on the hourly chart of the USDCHF pair, which was broken by the US dollar sellers recently. This particular break has opened the doors for further downside acceleration in the short term. Currently, the pair is trading around the 61.8% fib retracement level of the last leg from the 0.9358 low to 0.9489 high. There is a high probability that the pair might continue heading lower if it fails to recover above the broken support area which could act as a resistance moving ahead. If the pair continues lower, then a retest of the last low of 0.9358 would be possible. We need to see how the US dollar sellers react once the pair corrects higher.

If they manage to take the pair higher again, then the next level of selling interest would be around the 100 hourly moving average.

Overall, one might consider selling rallies as long as the pair is trading below the 100 MA.

————————————-

Posted By Simon Ji of IKOFX