Better than expected investment data from the US: durable goods orders jumped by 4.8%, far better than 1.5% predicted and with an upwards revision. More importantly, core orders rose by 1%, five times the early expectations, and also here, they came on top of an upwards revision. Excluding defense and air, orders rose by 0.4%, marginally better than 0.3% predicted.

Jobless claims came out at 251K ,within expectations and following a downwards revised 233K last week, a multi-decade low.

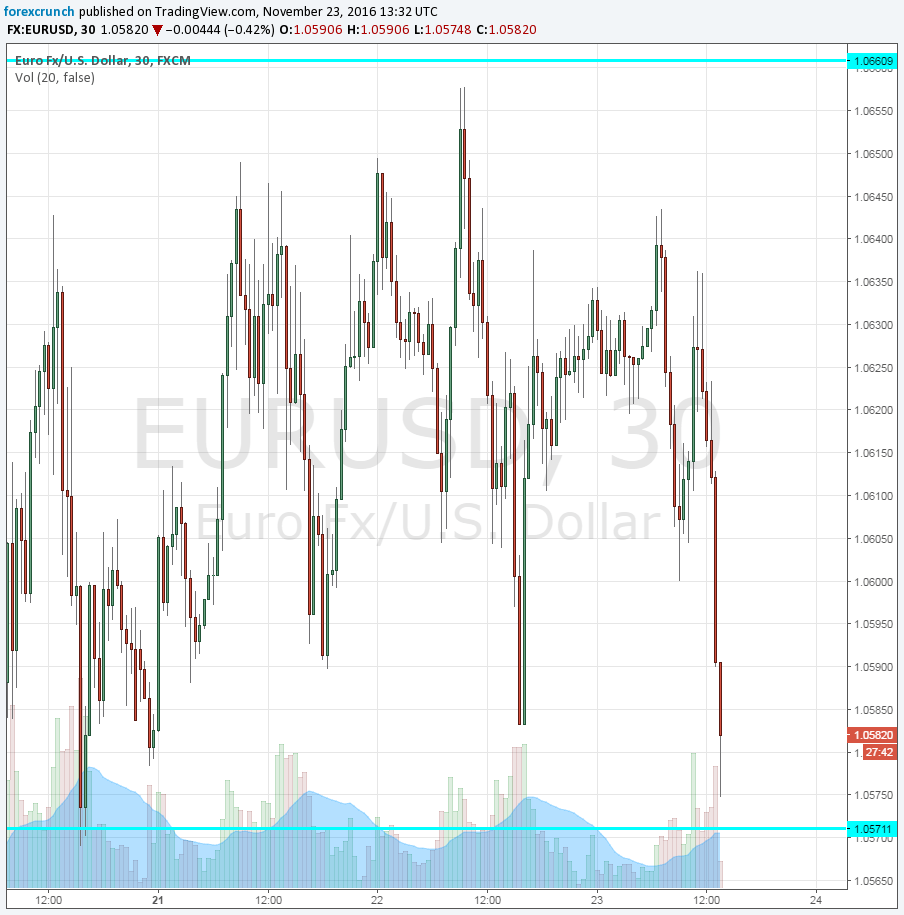

The US is reacting positively. EUR/USD is down to 1.0580, just above its recent cycle low of 1.0570. Further support awaits at 1.0520 and 1.0460. Some see EUR/USD heading towards parity. Update: the pair reaches a new low at 1.0561.

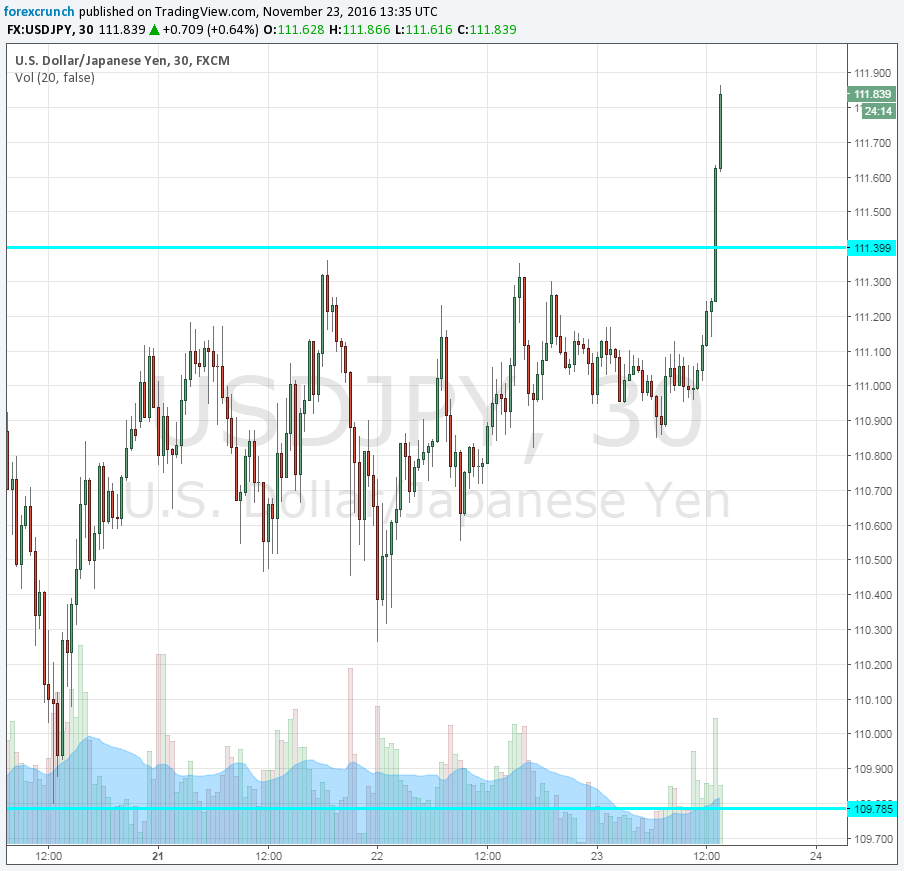

Also USD/JPY makes a big leap upwards: the pair is at 11.80, a new cycle high. It paused for a short time under resistance at 111.40, due to the earthquake.

The pound, which wobbled on the Autumn Statement by Chancellor Hammond, is being hammered as well, falling to 1.2367.

USD/CAD is approaching 1.35. The slide of the Canadian dollar is also a result of a stall in the rise of oil prices.

AUD/USD is approaching support at 0.7375. NZD/USD is at 0.702, getting closer to the edge.

US durable goods orders were expected to rise by 1.5% after a slide of 0.3% beforehand. Core orders carried expectations of +0.2% after +0.1%. Jobless claims were projected to bounce back to 250K from 235K.

The USD was strengthening ahead of the publication.

More: After the Donald, the dollar takes a Thanksgiving break [Video] – the greenback resumes its rise now.