- Trade Balance: Wednesday, 12:30. Canada usually posts trade deficits, so the surplus of C$1.4 billion in January was a surprise, as the forecast stood at -C$1.4 billion. Another surplus is expected in February, with an estimate of C$1.3 billion.

- Ivey PMI: Wednesday, 14:00. The PMI pointed to sharp growth in January, jumping from 48.8 to 60.0. Another strong report is projected for March, with an estimate of 62.5.

- Employment Report: Friday, 12:30. After an impressive gain of 259.2 thousand new jobs in February, job creation is expected to slow to 90.0 thousand in March. The unemployment rate is expected to fall from 8.2% to 8.0%.

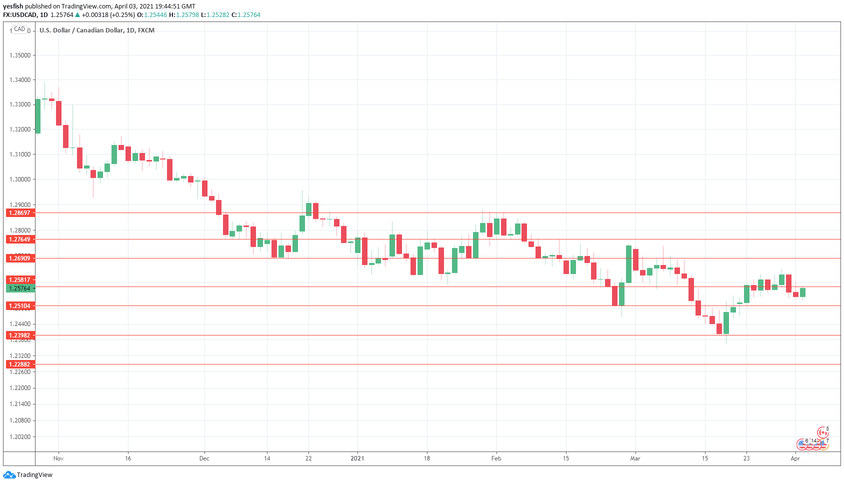

Technical lines from top to bottom:

We start with resistance at 1.2869 (mentioned last week).

1.2764 is next.

1.2690 switched to resistance in mid-March, when CAD started a strong rally.

1.2581 an immediate resistance line.

1.2510 is the first support level.

1.2398 has held since mid-March.

1.2288 is the final support level for now.

.

I am neutral on USD/CAD

The US economy continues to show strong signs of recovery. This could raise risk sentiment, which would make minor currencies like the Canadian dollar more attractive.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!