- Canada’s annual inflation rate dropped more than anticipated to 3.1%.

- Money markets have almost completely factored in a BoC rate cut by April.

- Speculators have boosted their bearish bets on the Canadian dollar.

Wednesday’s USD/CAD price analysis painted a bullish picture, influenced by data on Tuesday revealing a decrease in Canada’s inflation. Moreover, investors were absorbing minutes from the recent Federal Reserve meeting.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

In October, Canada’s annual inflation rate dropped more than anticipated to 3.1%. Meanwhile, core inflation measures reached their lowest points in approximately two years. Simon Harvey from Monex Europe and Monex Canada stated, “This aligns with our belief that the BoC, having led the Fed in the hiking cycle, will once again lead in the 2024 easing cycle, with a probable cut as early as April.”

Furthermore, recent weeks have seen markets gradually align with this perspective. Consequently, the Canadian dollar has lagged behind the G10 rally caused by the weaker dollar. Additionally, money markets have almost completely factored in a BoC rate cut by April and anticipate three cuts next year.

The upcoming BoC rate decision will be on December 6. Moreover, it will come after the release of third-quarter GDP data, anticipated to reveal a slight contraction in the Canadian economy.

Elsewhere, data from the US Commodity Futures Trading Commission showed that speculators have increased their bearish bets on the Canadian dollar to the highest level since June 2017.

Meanwhile, the US dollar recovered from recent declines against a basket of major currencies. This recovery came as Federal Reserve officials, in their last meeting, agreed to adopt a cautious approach to future rate hikes.

USD/CAD key events today

- US core durable goods orders

- US initial jobless claims

- US crude oil inventories

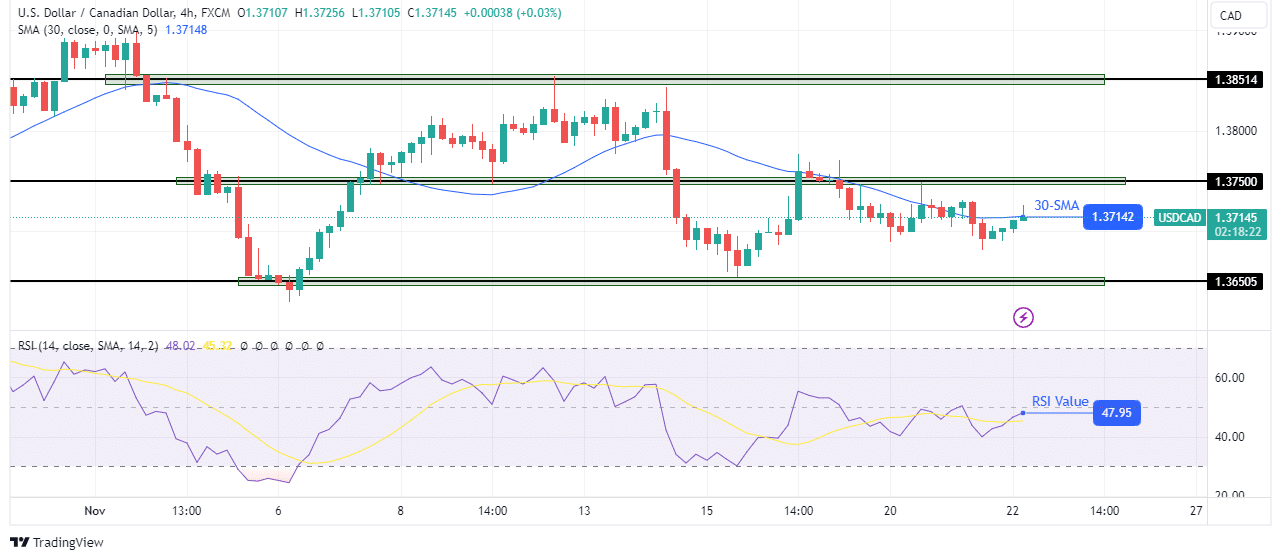

USD/CAD technical price analysis: Bulls struggle against 30-SMA resistance

On the charts, the USD/CAD price is facing the 30-SMA resistance and has struggled to break above for some time. Bears have held control since the price broke below the SMA and the 1.3750 key level. However, they have failed to make lower lows as bulls try to regain control.

–Are you interested to learn more about crypto signals? Check our detailed guide-

The price has retested the 30-SMA several times and might eventually break above. Still, bulls must also break above 1.3750 to confirm a bullish takeover. However, at the moment, bears are still ahead, and the RSI supports bearish momentum below 50. If bears hold control, the price will retest the 1.3650 support level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.