When the CB consumer sentiment hit new highs back in December, then President-Elect Donald Trump took credit for it, saying “Thanks Donald”. Will he be wary of the current figures in showing a worsening mood among consumers?

The University of Michigan’s first consumer sentiment report after Trump came into the White House shows a drop from 98.5 to 95.7 points, much lower than 97.9 expected. This is the preliminary release for the month of February.

The Current Conditions number dropped to 111.2 and Expectations fell to 85.7 points. Only inflation expectations actually went up to 2.8%.

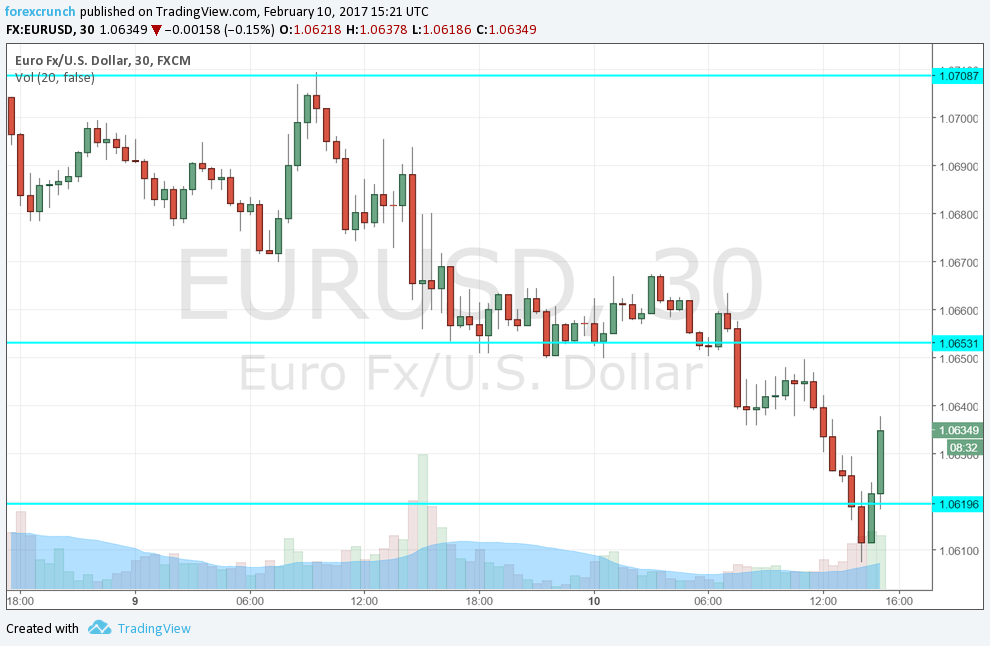

The US dollar also reacted negatively. The drop in EUR/USD reversed and the pair enjoyed a bounce. The world’s most popular currency pair had already come within a touching distance from 1.06 and now trades above 1.0635.

USD/JPY finds support at 113.40 before bouncing. GBP/USD trades around 1.2470.

The US dollar will likely be influenced by the visit of Japanese PM Shinzo Abe in the US. A series of meetings is planned for the two leaders in the White House and also in Florida.

More: EUR/USD: Despite political risks, parity chances are all but gone [Video]