- A bleak US corporate earnings season is fueling recession worries.

- Traders are on guard ahead of a flurry of central bank meetings next week.

- BOJ policymakers cautioned that it would take some time before wages increase sustainably.

Today’s USD/JPY forecast is bearish. On Thursday, the dollar sagged near an eight-month low versus its peers as a bleak US corporate earnings season fueled recession concerns and traders remained on guard ahead of a flurry of central bank meetings the next week.

–Are you interested to learn more about Forex apps? Check our detailed guide-

Investors have reduced their estimates for how long the Federal Reserve will need to raise interest rates aggressively. This is due to disappointing profits and outlook from US corporates and a spate of tech sector layoffs. These factors have increased concerns about an economic downturn in the United States.

Next week, the Fed’s policy-making committee will begin a two-day meeting, and the markets have priced in an interest rate increase of 25 basis points, a reduction from the 50 and 75 basis point increases the Fed made last year.

A report of policymakers’ opinions at the Bank of Japan (BOJ) meeting in January revealed that several of them cautioned that it would take some time before wages increase sustainably.

The BOJ maintained its ultra-low interest rates at that meeting, but it strengthened a tool for monetary policy to stop the 10-year bond yield from exceeding its new 0.5% cap. Its decision went against market expectations for more monetary policy adjustments.

Masato Kanda, Japan’s top financial diplomat, told Reuters that sharp one-sided currency movements cannot be tolerated and reiterated Tokyo’s resolve to intervene in the foreign exchange market to stop any speculative or large yen movements.

USD/JPY key events today

The US will release many economic data today, including core durable goods orders, GDP data, initial jobless claims, and new home sales data. These will show the state of the US economy amid rising interest rates.

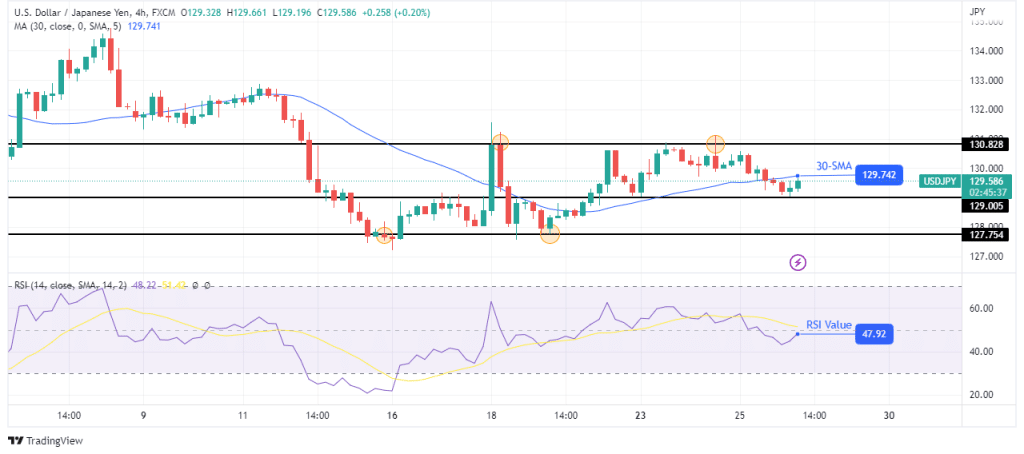

USD/JPY technical forecast: Bearish bias stronger below the 30-SMA

The 4-hour chart shows USD/JPY trading slightly below the 30-SMA after failing to break above the 130.82 resistance level. Bears have managed to take over by pushing the price below the 30-SMA and the RSI below 50.

–Are you interested to learn more about STP brokers? Check our detailed guide-

However, the price is trading near a strong support level of 129.00. If bears fail to break below this level, the bullish move might resume. A break below the support could mean retesting the 127.75 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.