Dollar/yen was on the back foot as fear gripped financial markets. The sell-off in stocks saw the greenback and the US dollar both gain ground, but the Japanese currency emerged as the winner.

USD/JPY fundamental movers

Stock sell-off, mixed data

Global stock markets dropped sharply and set the tone for currencies as well. A mix of concerns about the Fed’s rate hikes, Trump’s tariffs, a slowdown in emerging markets, Brexit, and Italy’s stand-off with the EU all weighed. Towards the end of the week, unimpressive earning by some big companies also hurt stocks.

US data was mixed, with GDP advancing by 3.5% but this consisted of an increase in inventories and a fall in exports, not the right kind of growth. Other figures such as housing and durable goods orders were mixed.

NFP buildup, BOJ decision, and a politics taking center stage

The turn of the month features a busy calendar. The Fed’s favorite inflation figure is published on Monday. The Core PCE Price Index is projected to remain at 2%, the central bank’s target. Later in the week, the ADP NFP and the ISM Manufacturing PMI stand out as hints towards the all-important jobs report on Friday. A return to gains of around 200K jobs is on the cards, while wages are projected to rise at a slower pace.

The Bank of Japan makes its rate decision early on Wednesday. They are not expected to change their policy, leaving the interest rate at -0.1% (negative) and buying 10-year bonds.

In addition, the US Mid-Term Elections are getting closer. Democrats are still favorites to regain the House while Republicans are set to retain the Senate. Opinion polls will have an increasing role in shaping politics.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

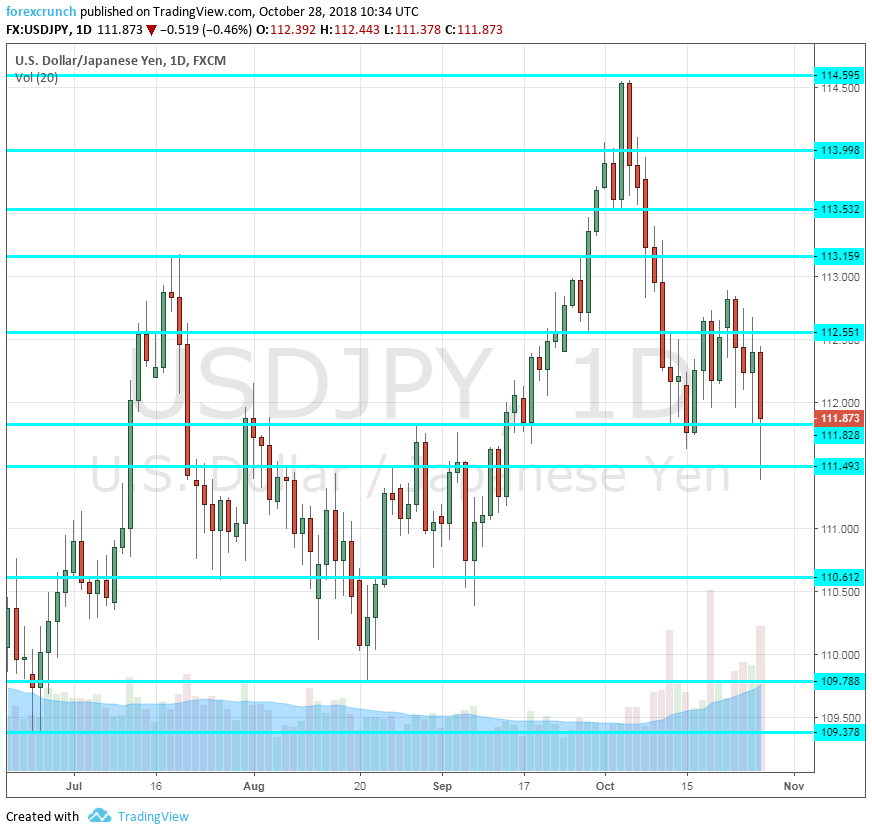

115.55 was a high point in the first half of 2017 and is an upside target. 114.60 was the high point in early October and serves as resistance.

114 is a round number and was a stepping stone on the way down. 113.50 supported USD/JPY when it traded on high ground.

113.15 was a swing high back in July. 112.55 served as support in September and resistance in October, making it a significant level.

111.80 was the low point after the fall in mid-October. 111.50 capped the pair in August.

110.60 was a swing low in late July and then again in late August. 109.70 was a swing low in late August and provides extra support below the round 110 level.

Close by, 109.35 was a cushion in mid-July. 108.70 was a cushion early in the summer and 108.10 a swing low in late May.

Lower, we find 107.50 capped the pair in early April and is a strong line.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bearish on USD/JPY

The relief in stock markets looks temporary. The Japanese yen may continue riding higher with fears. In addition, unimpressive US data could weigh on the greenback against the Japanese currency.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!