- USD/JPY did not extend its falls, but its recovery was tepid at best.

- A hectic week kicks off with retail sales and culminates with the NFP.

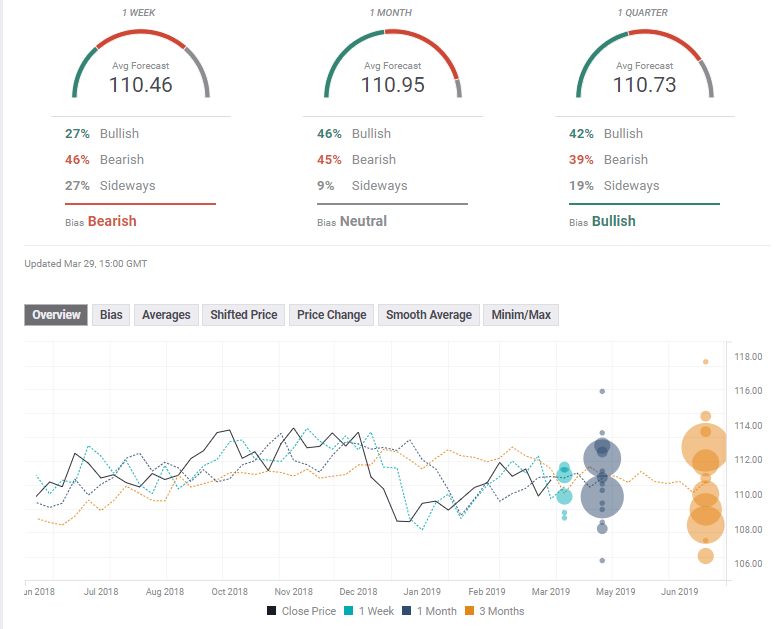

- The technical picture is slightly bearish for the pair and the expert forecast poll shows a short-term bearish bias.

This was the week: Falling yields, trade talks

Global bond yields continued sliding with the benchmark 10-year Treasury yield falling below 2.40%, below the overnight Federal Funds Rate. The yield curve inversion indicates an upcoming recession. The market mood remains damp, and the safe-haven yen saw the demand. However, USD/JPY did not extend its slide.

US data failed to impress with the CB Consumer Confidence retreating to January’s levels when the US government shutdown was in full swing. Most importantly, the US GDP was downgraded to 2.2% annualized. This level may actually be a boon for the greenback, a Goldilocks figure.

On the other hand, the US trade balance finally shrank, albeit due to lower imports, a result of the trade talks.

Top US officials Steven Mnuchin and Robert Lighthizer traveled to Beijing in search of a breakthrough. The world’s largest economies aim to reach a trade deal in the second quarter. The general picture has not changed: China is ready to buy US products but is reluctant to make changes related to Intellectual Property. Enforcement also remains an issue.

Brexit negotiations between UK Parliamentarians did not yield any breakthrough and also weighed on the mood. MPs voted down all eight alternative Brexit paths. PM Theresa May offered her resignation after her Brexit accord passes, but this was not enough and Parliament rejected the accord by a majority of 58 MPs. The default option is that the UK leaves the EU on April 12th without a deal, a shocker to the global economy.

Markets were somewhat relieved that the Mueller Investigation concluded that there was no collusion between the Trump 2016 campaign and Russia. While Mueller did not exonerate the President from allegations of obstruction of justice, the political fight may last for a long time, and political instability is unlikely in the short-term.

Japanese inflation remained low at 1.1% on the essential core figure allowing Bank of Japan Governor Haruhiko Kuroda to repeat his dovish stance.

US events: Was the NFPdisappointment a one-off?

The first week of the month is always a busy one, with a lead to the Non-Farm Payrolls. This time it is even more hectic. Due to the government shutdown, two additional top-tier figures are due this week.

Monday, a usually quiet day, is packed with data. The Retail Sales report for February will likely show modest increases in consumption. After a devastating December that left many economists puzzled, January saw an improvement with 0.2% on the headline, 0.9% on sales excluding cars, and an impressive leap of 1.1% in the Control Group, the “core of the core.” Consumption is key to the US economy. See the Retail Sales Preview.

The first hint towards the Non-Farm Payrolls is also scheduled for Monday. The ISM Manufacturing PMI dropped back down in February to 54.2 points and raised fears of a broader slowdown. A small increase is projected now. The Prices Paid component which reflects inflation expectations, is also watched. See the ISM Manufacturing PMI Preview.

Durable Goods Orders for January are on the docket on Tuesday. Back in January, the Durables Non-defense ex-Transporation number rose by 0.8%, showing that investment is still alive and kicking. Other figures were more moderate. The data feed into Q1 GDP and are also watched closely by the Fed.

Wednesday features two hints towards the NFP. The ADP Non-Farm Payrolls came out at 183K in February, within the averages. However, it did not foresee the disappointing official number. This time, we may see a downward revision of February’s figure and also a more modest amount in March.

The second figure is the ISM Non-Manufacturing PMI. Contrary to the manufacturing measure, the services sector looked upbeat in February, with 59.7 points. A softer outcome may be seen now.

Thursday features only the weekly Initial Jobless Claims, which have returned to normal, leaving the stage for the NFP.

February’s Non-Farm Payrolls badly disappointed on the headline with only 20K. The meager gain in jobs was countered by a jump of 0.4% m/m in wages and acceleration to 3.4% YoY. Also, the unemployment rate remains low at 3.8% with a healthier participation rate of 63.2%.

Most analysts saw February’s number as an anomaly, and the fresh figure for March is expected to show a return to healthy gains in positions, around 200K. Upwards revisions will also be eyed. As long as job gains return to normal, a deceleration in wage growth will not be frowned upon.

Here are the top US events as they appear on the forex calendar:

Japan: Depressed with yields, faces Brexit storms

The Japanese yen will likely continue moving in an inverse correlation to the market mood. Bond yields and the yield curve are closely watched alongside global stock markets. The worse for markets, the better for the yen.

If Britain edges closer to the cliff and near exiting without a deal, the yen could rise, while another Article 50 extension could send it lower.

In Japan, the Tankan surveys for Q1 are released early in the week and are watched by markets. They are expected to drop, alongside other global sentiment indicators. Foreign Investment is also of interest.

Here are the events lined up in Japan:

USD/JPY Technical Analysis

Dollar/yen climbed over the 50-day Simple Moving Average, but Momentum remains to the downside, and the 200 SMA looms above. The Relative Strength Index is stable. The pair previously lost the uptrend support line. All in all, the picture is slightly bearish.

110.25 provides support after separating ranges in the first half of February. 109.60 is the lowest point in March. 109.10 provided support in January, and 108.50 is where the uptrend support began. 107.75 and 107.50 are next.

111.00 is a round number and also capped the pair of late. 111.50 is where the 200 SMA meets the price. 112.15 was the high point in March. 112.60 and 113.15 are next and date to 2018.

USD/JPY Sentiment

The doom and gloom about the global economy are not expected to go anytime soon. It would take an impressive jobs report alongside other healthy US data to change the market mood and push the pair higher. There is more room to the upside than to the downside.

The FXStreet Poll shows a bearish bias in the short term which turns into a neutral one in the medium term and a bullish one in the long run. However, the targets are quite close, all between 110.00 and 111.00. The average targets are slightly higher. It seems that forecasters are cautious, similar to recent moves in USD/JPY.

-636894510489555331.png)