- Recently, the USD/JPY hit an intraday high near a weekly low and is consolidating its biggest daily losses.

- In anticipation of the Fed, yields and shares start the key week on an upbeat note.

- US Markit PMIs for January are expected to move intraday, while the FOMC meeting on Wednesday is the main event of the week.

The USD/JPY price analysis shows positive momentum as the pair reached an intraday high near 113.90, up 0.16% early on Monday morning.

–Are you interested to learn more about ETF brokers? Check our detailed guide-

Traders are preparing for Wednesday’s meeting of the Federal Open Market Committee (FOMC) as the yen pair rises for the first time in four days, following the rise in US Treasury yields.

The preliminary manufacturing PMI for January from Jibun Bank rose to 54.6 from 54.3, hitting a four-year high. However, in December, the Jibun Bank Services PMI dropped from 52.1 to 46.6. According to Japanese media outlet Kyodo News, Prime Minister Fumio Kishida’s government will likely declare more prefectures under quasi-emergency due to COVID-19 as the number of cases continues to rise.

The 10-year Treasury yield rose 3.6 basis points (bps) to 1.783% at the same time, breaking a three-day decline as traders await dovish Fed policy at a key meeting this week amid rising inflation.

The US data for the past week has been mostly mixed, but recent Fed statements have been hawkish, suggesting that the Federal Reserve is preparing for a rate hike on Wednesday. Omicron-related inflation concerns and supply chain damage contributed to the bullish bias. In addition, US President Joe Biden and the chief executive of the International Monetary Fund, Kristalina Georgieva, both expressed support for the Fed’s hawkish stance, which in turn fueled fears of a Fed rate hike.

In addition, growing concerns over a Russian invasion of Ukraine are supporting US Treasury yields and USD/JPY rates. Moreover, moderate demand for S&P 500 futures supports the pair’s recovery, even as the Nikkei 225 is down 0.80% on the day at press time.

The preliminary US Markit PMI data for January will be crucial in determining the direction of intraday trading. However, Wednesday’s FOMC report and Thursday’s US fourth-quarter GDP will provide a clearer picture.

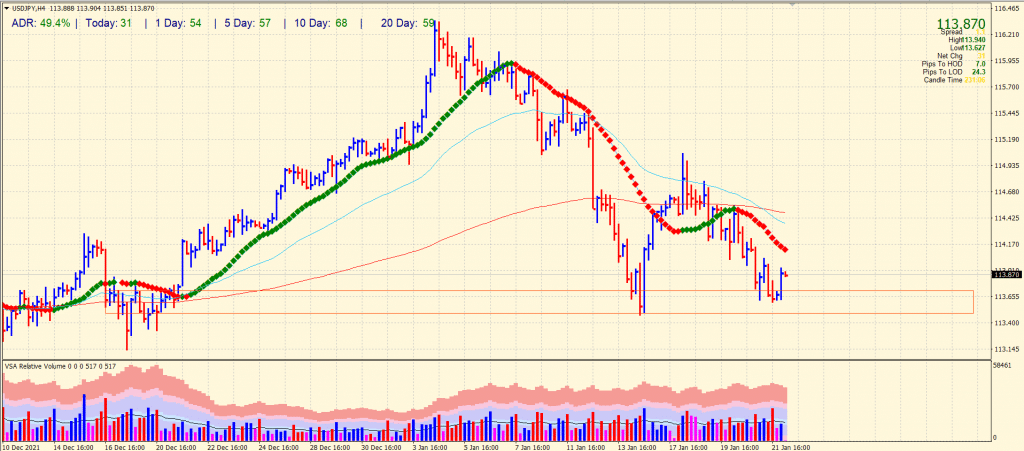

USD/JPY price technical analysis: Bulls emerging around 114.00

The USD/JPY price found support in the order block zone, resulting in a bounce towards the 114.00 area. The pair may find some solid resistance around the 20-period SMA on the 4-hour chart coinciding with the horizontal level at 114.20 area.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

The average daily range hits nearly 50%, which shows a high volatility day. However, the volume data is not sufficient to support any bias at the moment. Meanwhile, the bearish crossover of 50-period and 200-period SMAs may keep pressure on the pair.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.