- The USD/JPY quickly regained its weekly lows and defended the 114.00 level.

- A positive risk tone undermined JPY’s safety and helped the pair recover.

- The renewed rise in US bond yields has been a tailwind for the US dollar in recent weeks.

The USD/JPY price was near a daily high just below the mid-114.000 level during the European session. However, the price is slowly paring gains.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

Several factors contributed to buying near the 114.00 level or earlier this Thursday’s weekly low. With risk appetite rising, the Japanese yen has been undermined as a safe haven, thereby bolstering USD/JPY. US Treasury yields were also being targeted by bulls, which supported the US dollar.

In recent days, US bond yields rose as expectations that the Fed would raise rates in March to curb persistently high inflation continued to rise. In addition, last week’s US CPI data showed the CPI rose to its highest level since 1982, while the core CPI rose at its fastest pace since 1991.

In turn, benchmark 10-year Treasury yields rose to their highest level since January 2020 on Wednesday. Furthermore, the two-year US debt, which is highly sensitive to rate hike expectations, topped 1.0% for the first time since February 2020. Thus, the focus will be on the January 25-26 FOMC meeting.

Traders should be cautious before aiming for further gains, given that the fundamental backdrop favors bulls, but the lack of strong subsequent buying should also be considered. In addition to the Philadelphia Fed manufacturing index and weekly initial jobless claims, investors watch existing home sales for fresh signs of momentum.

The yield on US bonds, along with the dynamics of the US dollar, will affect the price of the dollar. This will allow traders to be guided by a broader market risk appetite for some short-term USD/JPY opportunities.

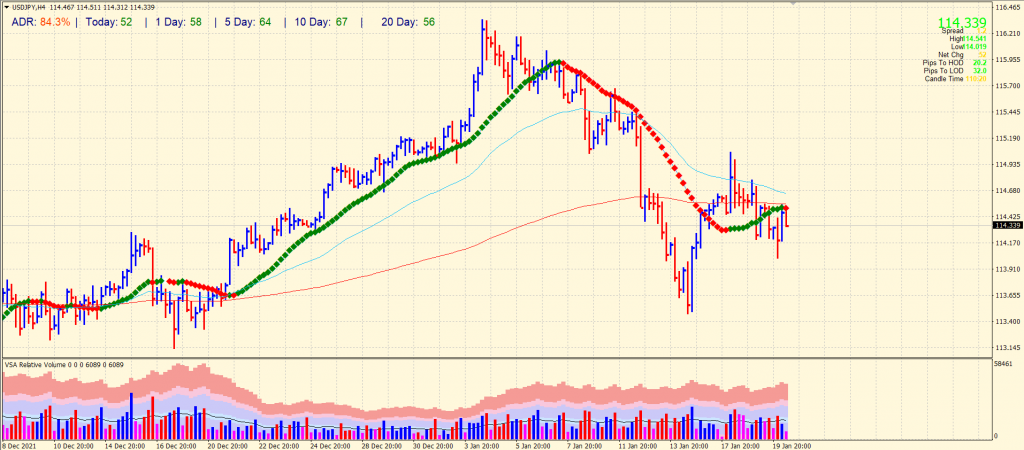

USD/JPY price technical analysis: Price staying above 114.00

The USD/JPY price halts rallies around the 20-period SMA on the 4-hour chart. The pair has seen an average daily range of 84% so far, which indicates very high volatility. Currently, the price is consolidating, providing no clear direction. However, the overall bias remains bearish despite the recent gains. Alternatively, if the price manages to go above 20 and 200 period SMAs, we may see a surge up to the 115.00 mark.

–Are you interested to learn more about forex brokers? Check our detailed guide-

On the downside, the USD/JPY pair may slip below the 114.00 area and test the swing lows at 113.46.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.