- USD/JPY weekly forecast is neutral.

- US CPI slowed in August that gave a reason to the Fed to postpone tapering.

- A slight increase was also noted in government bond yields.

- The Fed’s Jerome Powell says that a $120 billion monthly cut to bond purchases is likely to occur by year’s end.

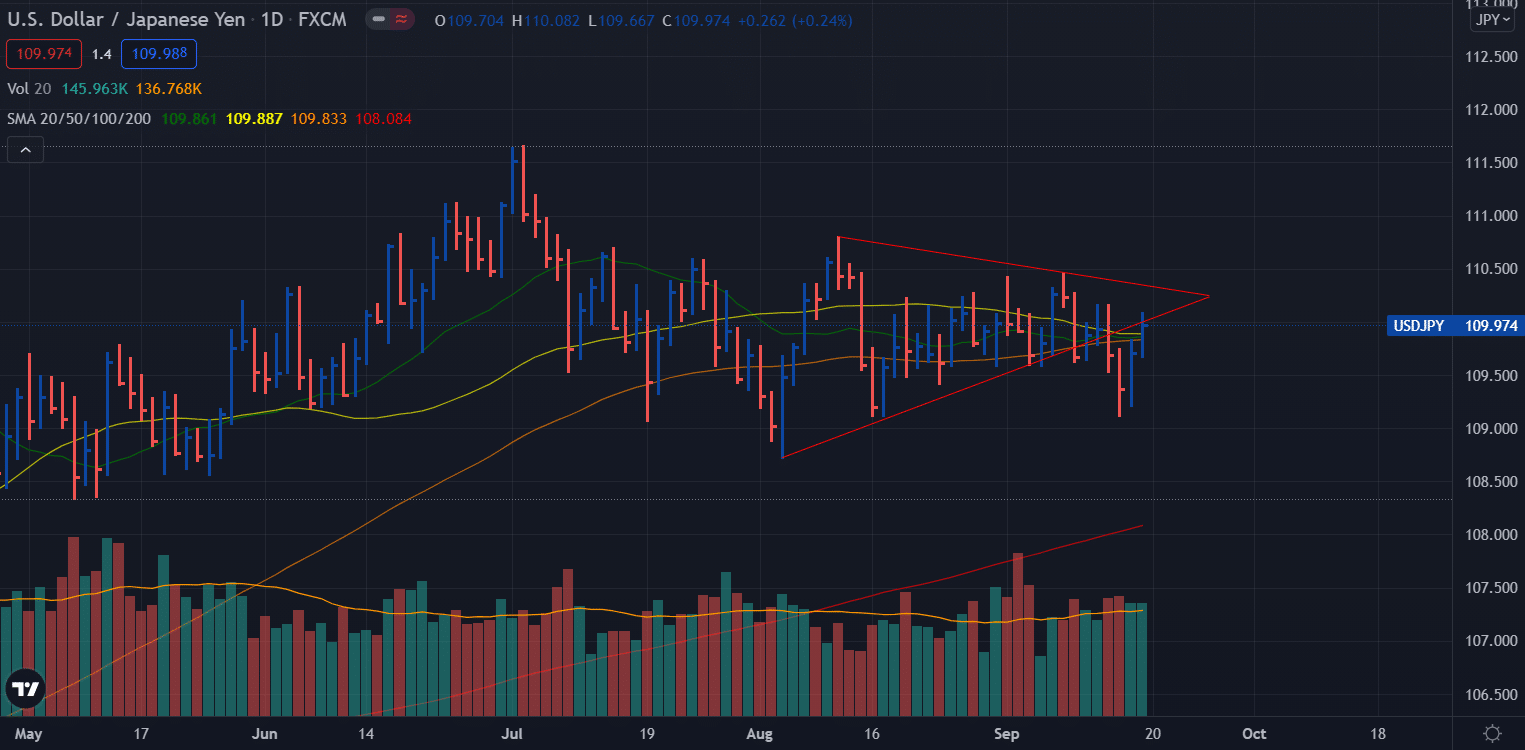

The weekly forecast for the USD/JPY pair is neutral as the net positive change for the week is only ten pips. Moving into the next week, the FOMC press conference is the key market mover.

-Are you looking for the best CFD broker? Check our detailed guide-

The USD/JPY pair ended the week higher despite some conflicting US economic data during the week. The pair started the week at 109.87, marked the weekly highs near 110.20 area where it found some strong selling and drifted to the weekly lows on Wednesday just above 109.00 area. However, the price found some mid-week reversal and turned higher, closing the week 10 pips above the weekly opening price.

As the US consumer price rise slowed in August, the Federal Reserve found a reason to postpone reducing bond purchases. As a result, after the consumer price index was released on Tuesday, the USD/JPY fell to a weekly low on Wednesday.

On Thursday, it was forecast that retail sales for August would decline for the second consecutive month. Within a month, Michigan’s consumer sentiment dropped to its lowest level in ten years. Despite limited automobile sales, consumers had the busiest month since January. On Friday, the USD/JPY pair reversed as expected, trading at 109.98, just a few pips above Monday’s open.

A slight increase was also noted in government bond yields. Through Friday, the yield on the 10-year note rose 3 basis points to 1.370% after opening the week at 1.340%, falling 1.279% on Tuesday’s CPI data.

It was not that surprising to see data from Japan. The industrial production in July fell compared to the previous month, but it was higher than a year ago. Likewise, imports were higher in August despite weaker exports.

The Fed’s Jerome Powell says that a $120 billion monthly cut to bond purchases is likely to occur by year’s end. His announcement came after the Nonfarm Payrolls (NFP) announced that over a million new jobs had been created in June and July. The month ahead should be strong as well. However, the disappointment in August, when the consensus forecast didn’t exceed 500,000, has shaken firm confidence that the Fed will announce its tapering plan at its meeting in September.

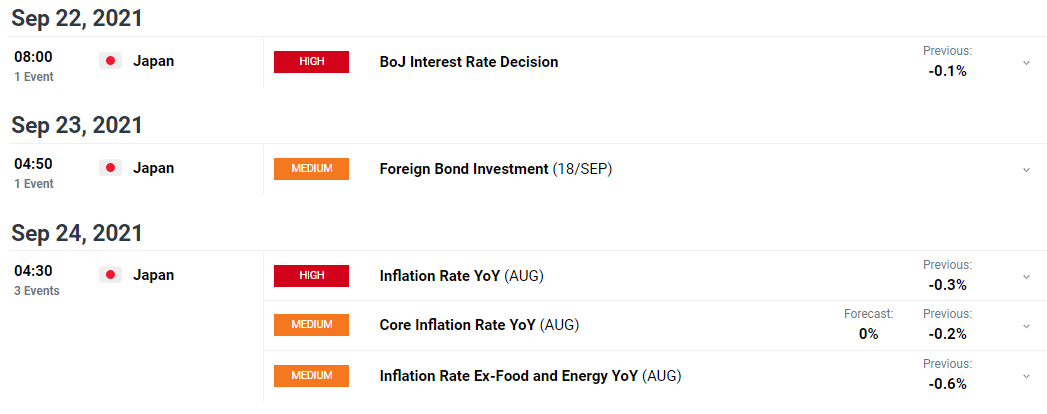

Key data events from Japan next week

The economic calendar is relatively light next week for the Japanese Yen. However, the BoJ interest rate decision on Wednesday and inflation rate data on Friday.

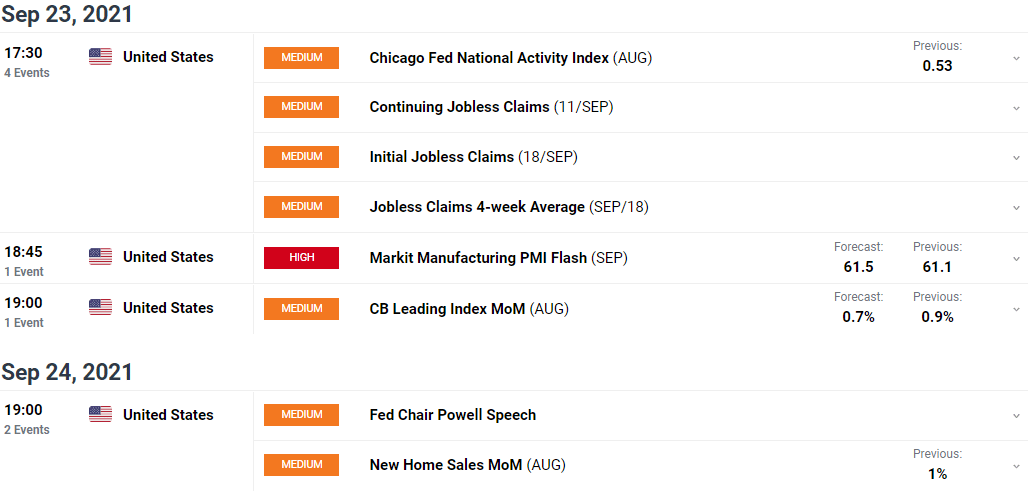

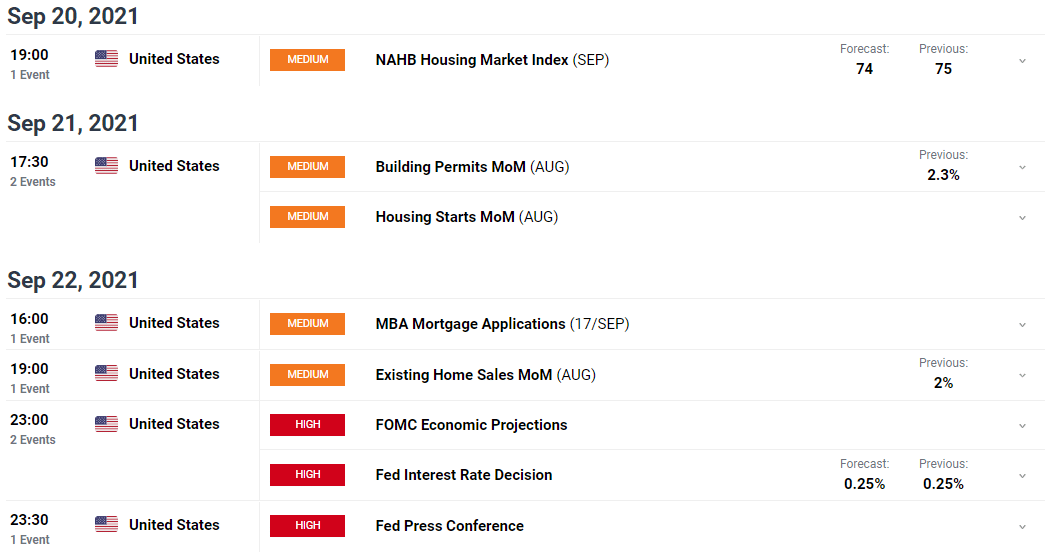

Key data events from the US next week

The week’s major event is the FOMC interest rate decision, followed by the press conference on Wednesday. Investors will likely look for clues of rate hikes and tapering from the press conference. The next important event is Market Flash PMI data on Thursday.

-Are you looking for forex robots? Check our detailed guide-

USD/JPY weekly technical forecast: Broken trendline to resist

The USD/JPY price remains rangebound on the daily chart. Although the price managed to close the week positively above key SMAs, the ascending trendline may provide some resistance. Technically, the upside can be considered a retest of broken trendline that may further see a follow-up selling.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.