- In November, the United States’ inflation rate reached 6.8%, its highest level in four decades.

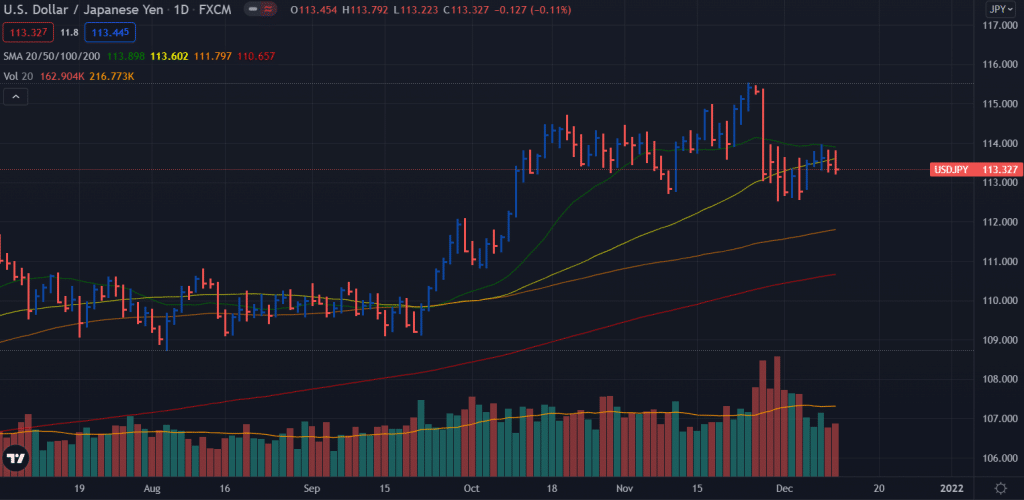

- After climbing to 113.00 on Monday, the USD/JPY stopped.

- The yield on US Treasury bonds is rising, but it is still below recent highs.

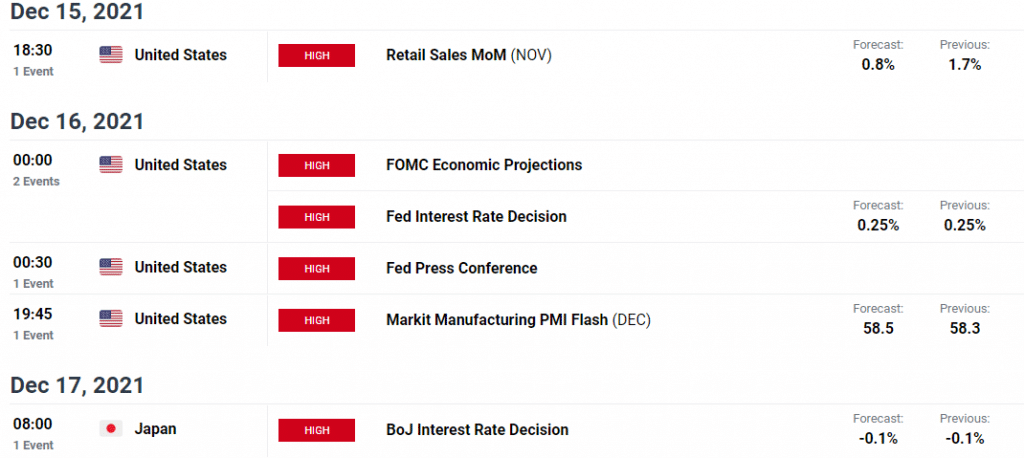

- It is expected that the Fed will raise rates at its December 15th meeting, which is a coordination meeting.

The weekly forecast for the USD/JPY remains mixed as the fundamental scenario is bullish bias, while technically, the retracement seems due after a bull run.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

US credit markets and the Federal Reserve System hold USD/JPY hostage. US inflation cannot be contained in the short term unless US Treasury bonds rise. The Federal Reserve does not need to raise interest rates, as the credit market will do all the work, but nearly two years of pandemic panic have forced traders to buy Treasury bonds at every unknown round of the virus. One prime example was the panic at Omicron two weeks ago.

In contrast, the Bank of Japan is moving in the opposite direction. Prime Minister Fumio Kishida has pledged fiscal and monetary policies to stimulate the Japanese economy. A new budget for additional government spending will be proposed, and the Bank of Japan may increase purchases on the credit market. Japanese 10-year government bonds yielded 0.056% last week and 0.051% last week, largely flat.

Despite peaking at 1.764% on March 31, the US government bond yields have risen multiple times this year. The Fed may be willing to encourage higher Treasury and trading rates, but credit traders want proof, not rhetoric, after many false starts.

Japanese data were mixed. Household spending declined from -1.9% to -0.6% in October, but it remains the third consecutive decline and the fourth over the past six months. In October, the rise in wages was 0.2%, which is within the forecast range of 0.7% and in line with September. Eco Watchers’ study, which tracks regional economic trends, performed better than expected at the current scale, but the outlook was poor. Producer prices rose by 0.6% month-over-month and 9% year-over-year in November, faster-than-expected. Japan is facing a deflationary environment.

Likewise, American data was different. In October, the trade deficit improved, and the number of initial jobless claims fell to 184,000, the lowest level in 52 years. In November, consumer inflation is expected to reach 6.8% in the headline, a 39-year record, and 4.9% in the core, also a three-year record, following 6.2% and 4.6% in October. After a 1.2% CPI increase in November last year, inflation jumped 5.6% last month, the fastest in 69 years.

After the consumer price index was released on Friday, the dollar fell slightly, and inflation in the United States did not worsen after the easing of market conditions.

Key dates/events for USD/JPY

The US Federal Reserve and Bank of Japan (BOJ), which meet on Wednesday and Thursday, will hold back and order markets. Expect quiet trading after the Fed announces and tightens rates at 2:00 pm ET. US interest rate hikes are almost certainly due to rising consumer prices and concerns expressed by the Fed itself.

Due to the differences in concerns and interest rate policies between the Federal Reserve and the Bank of Japan, the USD/JPY pair is expected to rise. The Fed’s willingness to take inflation seriously will determine how quickly and how far this goes. The markets will find out on Wednesday.

USD/JPY weekly technical forecast: Key SMAs to support bears

The USD/JPY price fell below the 20-day and 50-day SMAs while the volume is inclining. Such a condition usually forecasts a bearish scenario. On the downside, the 111.80 – 112.00 band may provide strong support amid the 100-day moving average and the round number effect.

–Are you interested to learn more about Forex demo accounts? Check our detailed guide-

On the upside, 114.00 remains a stiff resistance to break ahead of swing highs at 114.75 and 115.50. The path of least resistance lies on the downside.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.