- On Thursday, the safe-haven yen closed below 115.00.

- The Fed is cautious about interest rates and the balance sheet in its January minutes.

- The US Treasury rates have fallen following Ukraine’s crisis that weakened the dollar.

The USD/JPY weekly forecast remains neutral as the risk sentiment is unclear. Meanwhile, the Fed’s rate hike plan is also not obvious.

The Russian president has spoken the most about USD/JPY this week. In addition, Russia’s intentions in Ukraine and the news flow regarding the military and diplomatic situation have been major catalysts for USD/JPY movements.

–Are you interested in learning more about STP brokers? Check our detailed guide-

A report of a change to the artillery on Wednesday triggered safe-haven flows in the yen that continued on Thursday, causing USD/JPY to close at 114.91, its lowest level in two weeks. Next week, a meeting between Secretary of State Anthony Blinken and Russian Foreign Minister Sergei Lavrov has pushed USD/JPY above 115.00. However, the standoff is still widespread and could impact markets.

Treasury rates fell as US securities were favored by the markets. After closing higher than the previous two days, the yield on the 10-year bond dropped below 2% on Thursday and Friday. In early Friday trading, two-year bond yields declined by 1.5%.

In its meeting minutes for January, the Federal Reserve acknowledged its public relations efforts. There are 73 references to inflation in the text, which is a record, though we do not know how many of the more than 70 participants spoke.

Retail sales in January came in at 3.8%, nearly double the 2% forecast, although December totals were downgraded to -2.5% from -1.9%. The result temporarily allayed the Fed’s concern that consumer spending, which accounts for 70% of US economic activity, would be cut by a decade-long decline. If US consumption continues to decline, the Fed’s rate hike campaign will be difficult or impossible.

After a general decline of 0.5% in the fourth quarter, US household consumption has recovered for now. The economy grew 6.9% in the fourth quarter of last year; however, the Federal Reserve Bank of Atlanta’s GDP estimate for the first three months of 2022 is currently just 1.3%. Tight labor markets, resulting in an average of more than 10.5 million unemployed in seven months, are likely to spur consumption growth even as wages lose ground to inflation.

This marks a slight improvement over December’s 9.8% rise. US producer prices rose 9.7% y/y in January, well above the 9.1% forecast. Core prices rose 7.9%, 8.3% over forecasts, and 8.5% over the previous month.

Japan’s fourth-quarter q/q GDP was 1.3%, lower than a forecast of 1.4%, but up from a 0.7% contraction in the third quarter. Global GDP increased by 5.4% in 2018, compared with an expected 5.8% and a previous decline of 2.7%. In January, consumer prices in the United States increased by 0.5% y/y while the core index fell by 1.1%.

Because of political and military tensions in Ukraine, the USD/JPY is weakening in two ways. First, the dollar is still favored over most other currencies in this pair due to safe-haven flows, but the yen is more favored over most other currencies due to safe-haven flows. A second factor weakening the dollar is the safe-haven buying of US Treasury bonds.

As long as the Ukrainian crisis is not resolved, the USD/JPY will be influenced by these prevailing influences for some time to come.

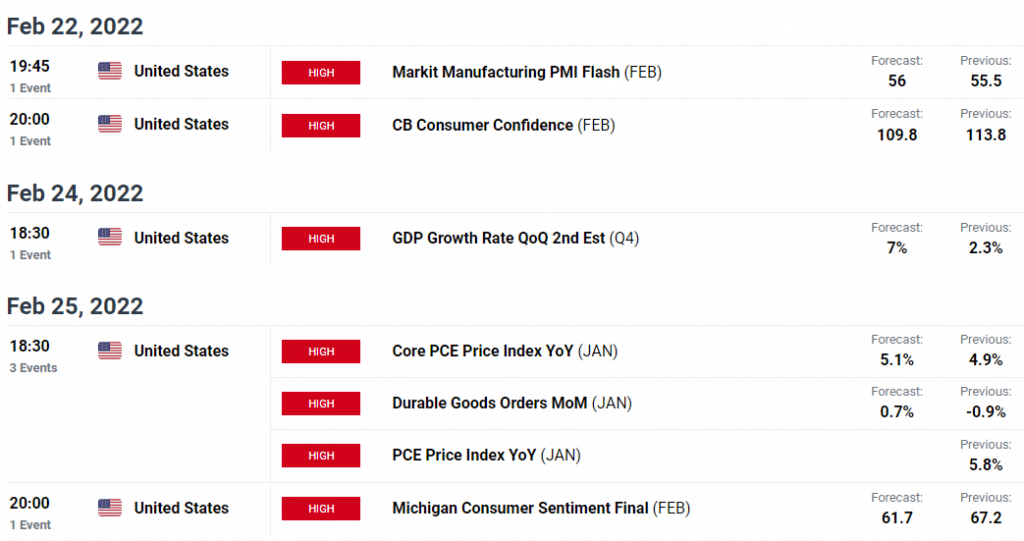

Key data/events for the USD/JPY

The US economy will grow enough to sustain itself this year despite the Fed’s anti-inflation campaign. However, the US recovery is likely more fragile than it appears, and a Russian invasion of Ukraine will push up oil and commodity prices. The destruction of the global economy would make a global and US recession quite possible.

Tokyo’s CPI will be reported in Japan’s economic data for the coming week. In January, a weaker than expected national consumer price index shifted the Tokyo trend downward. Therefore, the BoJ’s policy remains unchanged.

The first GDP revision for the fourth quarter will not be particularly noteworthy in the United States. The January durable goods orders will replicate higher retail sales than expected, but this will not surprise the market.

As a result of the tense and uncertain nature of the global economic and political climate, coupled with the market’s tendency to take defensive actions, the USD/JPY pair faces a neutral outlook, with pronounced weakness vis-à-vis the political tensions in Ukraine.

–Are you interested in learning more about forex robots? Check our detailed guide-

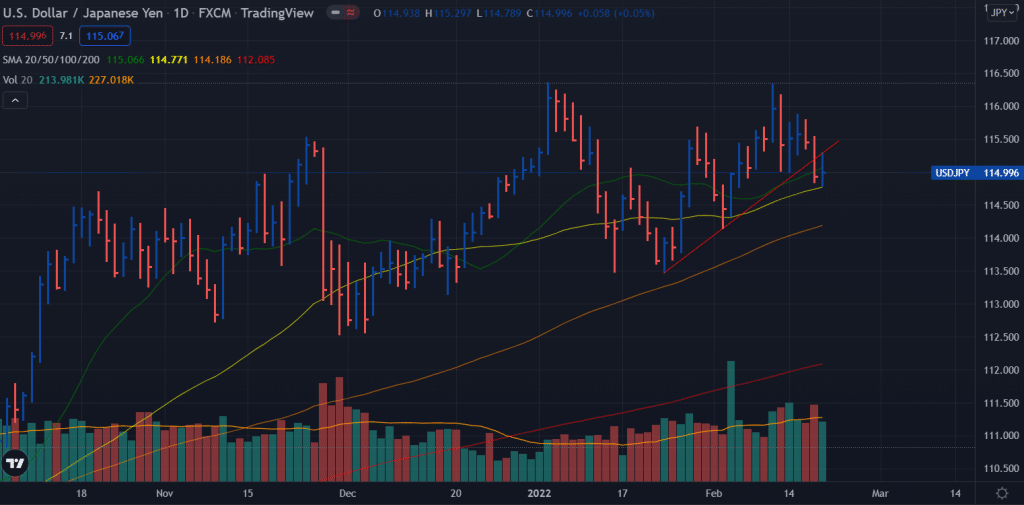

USD/JPY weekly technical forecast: Double top to hamper bulls

The daily chart of the USD/JPY pair shows a bearish bias as the 115.00 mark has been broken. There is a double top at 116.35 area, and the ascending trendline has been broken, retested, and the price is down again. The next support for the pair lies at 114.20 (100-DMA) ahead of swing lows around 113.50. On the upside, the double top at 116.35 will remain the key hurdle for the bulls.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money