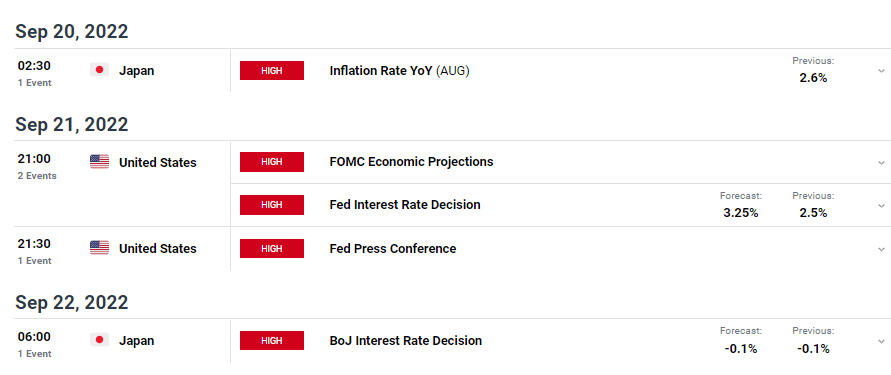

- US inflation came in higher than expected in August.

- Markets expect the Fed to deliver a 75bps rate hike.

- Inflation in Japan is starting to rise.

The USD/JPY weekly forecast is bullish as dollar strength continues, with the Federal Reserve raising rates by 75bps. The BoJ, on the other hand, is expected to maintain low rates and keep the yen down.

–Are you interested to learn more about Forex demo accounts? Check our detailed guide-

Ups and downs of USD/JPY

The pair rose sharply on Tuesday after US consumer prices unexpectedly increased in August, and underlying inflation accelerated amid rising rent and healthcare expenses. This provides the Federal Reserve grounds for raising interest rates by another 75 basis points on Wednesday.

Inflation has likely not peaked due to a robust labor market and high wage growth, which will keep the Fed on an aggressive monetary policy course for some time.

Next week’s key events for USD/JPY

The BoJ may soon go further and state that strong price increases will become faster than anticipated for the remainder of this year, fueled partly by the yen’s decline to 24-year lows. The central bank no longer implies that strong price increases will be temporary.

The implication is that the nation’s ultra-easy monetary policy, which keeps both short- and long-term interest rates close to zero, may not last as long as forecasters believe. Consumers’ expectations for inflation are also rising, and price increases in a nation with a deflation history affect goods that are not directly impacted by rising fuel prices.

“The Fed is all but sure to hike rates aggressively next week, likely by 75 basis points while pushing back strongly against talk of a near-term pause in the tightening cycle,” said Sal Guatieri, a senior economist at BMO Capital Markets in Toronto.

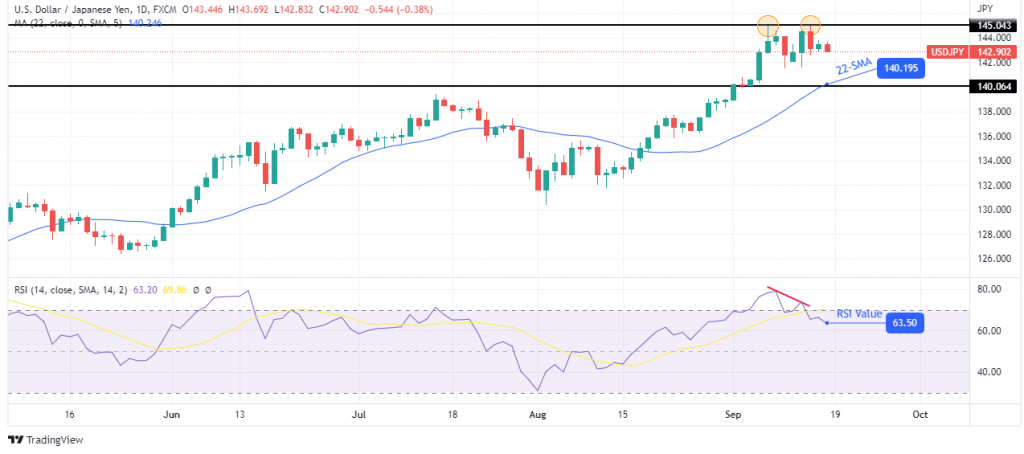

USD/JPY weekly technical forecast: Pullbacks limited above 140.00

Looking at the daily chart, we see the price pulling back toward the 22-SMA in an uptrend. The RSI is trading above 50, favoring bullish momentum. The price found solid resistance at 145.043, at which point sellers took over. The RSI made a bearish divergence showing exhaustion in the move up.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

However, this bearish move has little future below the 140.064 support level, coinciding with the 22-SMA to make a strong support zone. If the price gets to this support zone, it will likely bounce back up to retest the 145.043 resistance level and possibly break above.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.