Are markets in over-hype mod? Or is this indeed a huge event?

The team at Bank of America Merrill Lynch discuss:

Here is their view, courtesy of eFXnews:

We enter the last full trading week before Christmas with two major central bank meetings ahead of us: the FOMC and the BoJ’s MPB.

We – like the market – do not expect any fireworks from the BoJ. And, with the market ~95% priced for a Fed hike, the FOMC should be uneventful as well.

However, along with the actual rate decision, the FOMC will deliver its latest SEPs, which along with Yellen’s press conference, will determine whether the Fed can successfully pull off a dovish hike

The bar for a dovish hike in FX is high, while rates will also pay close attention to the Nov CPI print.

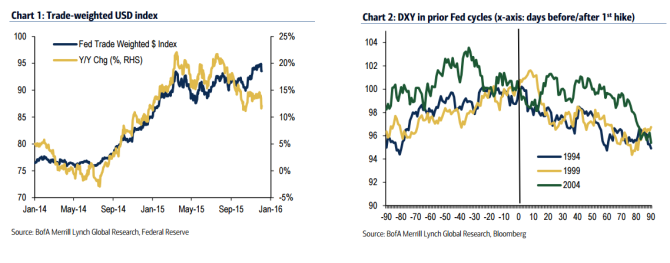

Together, we will see the USD supported in the wake of the statement, but historical experience makes us cautious about how long the rally can last. In particular, the USD has typically rallied into the first Fed hike only to sell off in the months after. This is largely because the market has fully priced the start of cycle, and expectations for other central bank tightening builds.

With the market still positioned long USD, despite the washout post-ECB, the bar remains high for a further near-term rally, in our view, particularly if equities come under pressure. The latter risk seems more elevated in the wake of the post-ECB and OPEC market volatility. In a risk off situation, being short higher beta commodity currencies still makes sense, though we would avoid funding currencies like EUR, JPY, and CHF.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.