- Foreign Securities Purchases: Tuesday, 12:30. This indicator is directly linked to currency demand as foreigners must purchase Canadian dollars in order to buy Canadian securities. In January, purchases slipped to C$6.20 billion, well short of the forecast of C$9.45 billion. The downward trend is expected to continue, with an estimate of C$5.21 billion.

- BoC Senior Deputy Governor Carolyn Wilkins Speech: Tuesday, 16:45. Wilkins will speak at an event in Toronto. A speech which is more bullish than expected is bullish for the Canadian dollar.

- BoC Senior Deputy Governor Carolyn Wilkins Speech: Wednesday, 17:00. Wilkins will participate in a panel sponsored by the IMF. The markets will be looking for clues regarding the BoC’s future monetary policy.

- CPI: Friday, 12:30. This is the key event of the week. CPI dropped to 0.2% in February, down from 0.9% a month earlier. Still, this matched the forecast. The estimate for March stands at 0.4%.

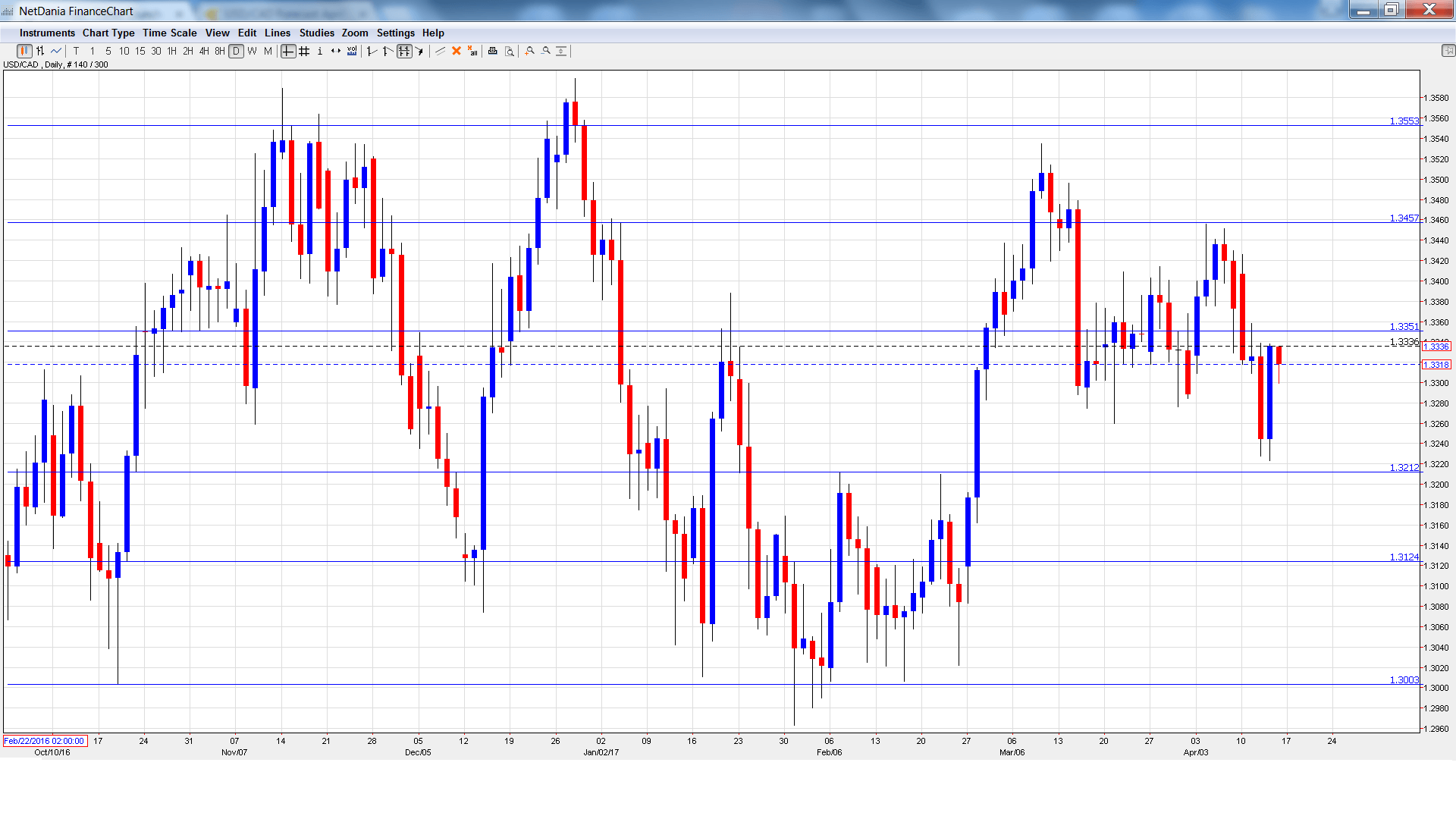

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3407 and quickly climbed to a high of 1.3426. The pair dropped to a low of 1.3223 late in the week, as resistance held at 1.3212 (discussed last week). USD/CAD closed the week at 1.3318.

Technical lines, from top to bottom

We start with resistance at 1.3757.

1.3648 was an important support level in February.

1.3551 is the next line of resistance.

1.3457 was a high point in September 2015.

1.3351 has switched to a resistance role following losses by USD/CAD. It is a weak line and could see more action early in the week.

1.3212 is providing support. It was a cap in the second quarter of 2016.

1.3124 is the next support level.

1.3003 is protecting the symbolic 1.30 level.

1.2908 is the final support level for now.

I am bullish on USD/CAD

The Fed minutes were slightly hawkish and the markets are expecting another rate hike in June. With the BoC saying that it is neutral towards a rate move, monetary divergence favors the US dollar.

Our latest podcast is titled Brexit Bad and “Clean Coal”

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.