The Canadian dollar continues to gain ground and posted another winning session. USD/CAD dropped 150 points last week, closing at 1.2681. This week’s key event is GDP. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The oil summit in Qatar, which failed to produce an agreement, resulted in volatility for the Canadian dollar. The currency initially lost ground after the meeting but rebounded with strong gains. In the US, jobless claims sparkled, but manufacturing and housing reports missed expectations.

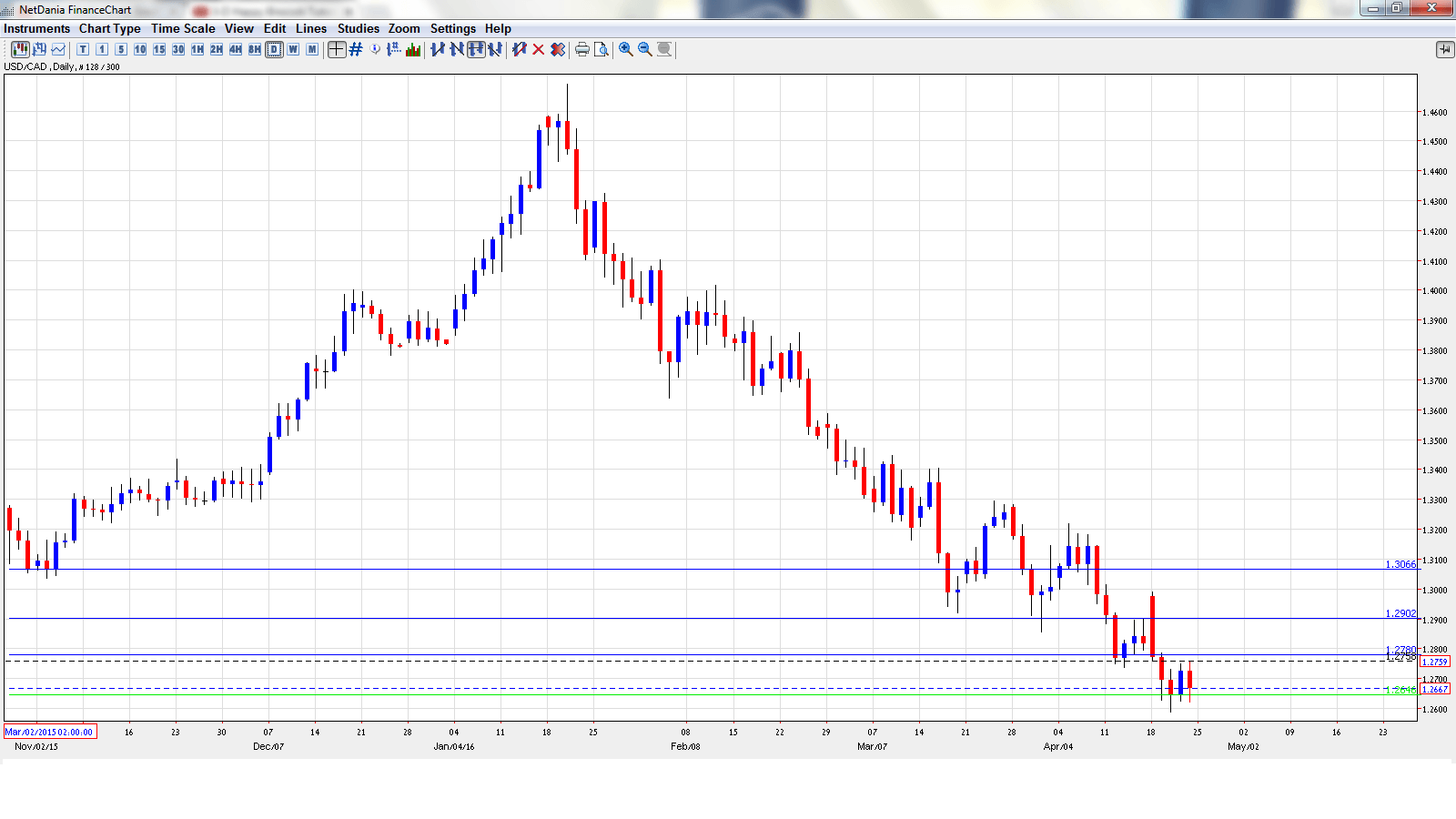

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- BOC Governor Stephen Poloz Speaks: Tuesday, 12:55. Poloz will deliver remarks at a financial meeting in New York. The markets will be looking for hints as to the BOC’s future plans regarding interest rate policy.

- GDP: Friday, 12:30. Canada releases GDP reports on a monthly basis. In January, GDP climbed, posting a strong gain of 0.6%. its highest gain since July 2013. Will the indicator post another strong gain in February?

- RMPI: Friday, 12:30. This manufacturing index has struggled, posting four consecutive declines. The index came in at -2.6% in February, well off the forecast of -0.8%.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.2937 and quickly touched a high of 1.2992, as resistance held at 1.3062 (discussed last week). The pair then reversed directions and dropped to a low of 1.2589. USD/CAD closed the week at 1.2681.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

With the pair posting sharp losses, we start at lower levels:

1.3064 is an immediate resistance line.

The round number of 1.2900 was a cushion in October. It switched to a resistance role last week.

1.2780 is the next resistance level.

1.2646 was tested last week. This line has provided support since late June 2015.

1.2538 is the next support level.

1.2410 has held firm in support since June 2015.

1.2215 is the final support level for now.

I am neutral on USD/CAD

The Canadian dollar piggybacked on stronger oil prices last week, following the Doha summit. However, the loonie rally could stall if oil prices don’t continue to climb. The markets are not expecting the Fed to make any moves next week, but a June hike is a serious possibility if the US economy continues to expand.

In our latest podcast we ask: is China out of the woods?

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.