The Canadian dollar bounced back last week, gaining 260 points. USD/CAD closed just above the 1.30 line. This week’s key event is Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In the US, Janet Yellen sent the US dollar on its heels, seeing the glass half empty and certainly playing down rate hike expectations. The NFP beat expectations but this didn’t bolster the greenback. In Canada, GDP was unexpectedly strong, posting a gain of 0.6%.

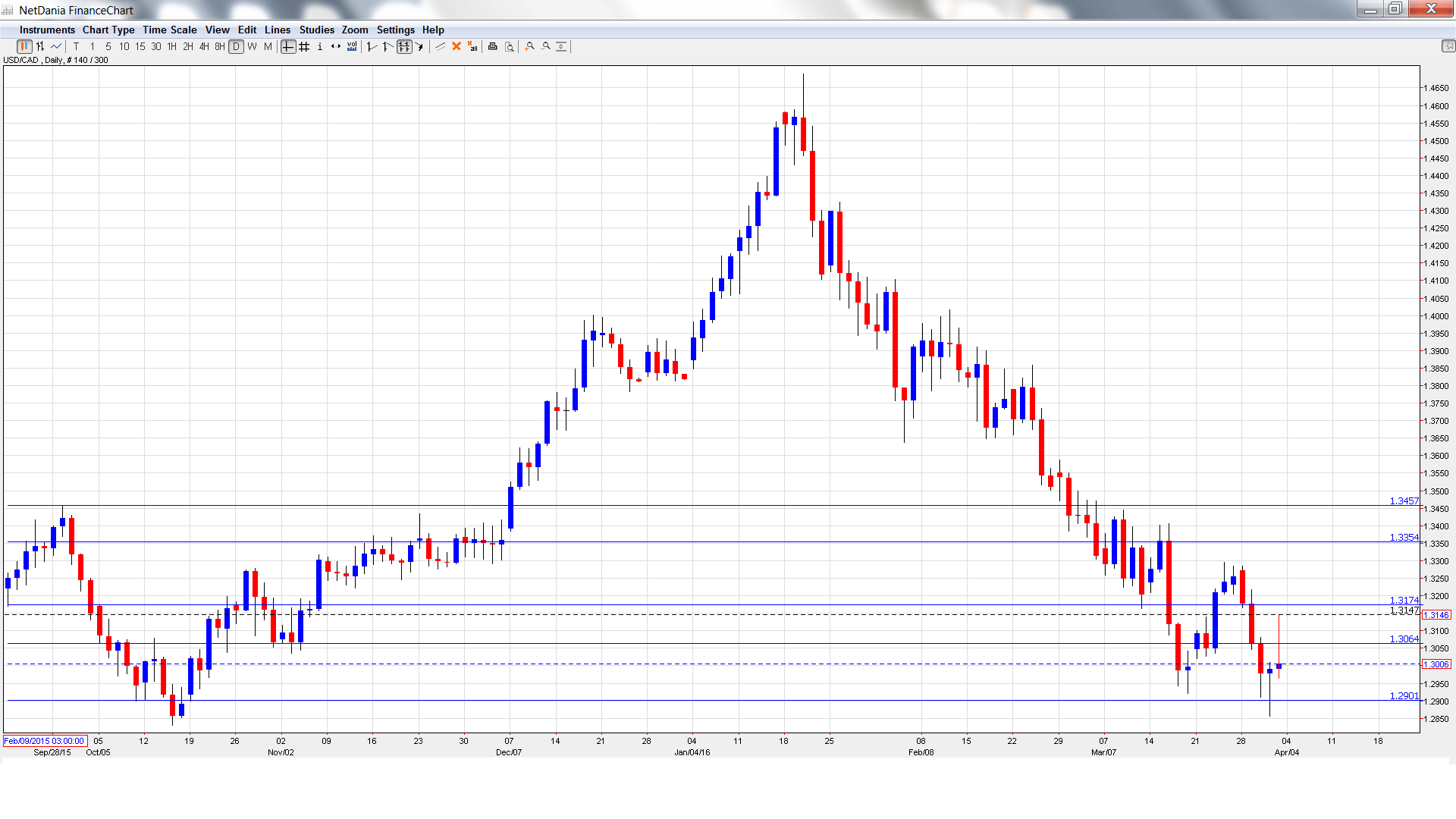

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- BOC Governor Stephen Poloz Speaks: Monday, 14:00. Poloz will speak at an event in Ottawa. The markets will be looking hints regarding the BOC’s future monetary policy.

- Trade Balance: Tuesday, 12:30. Canada’s continues to post trade deficits, with the January reading coming in at C$-0.7 billion. This was better than the forecast of C$-1.0 billon. The markets are expecting a surplus in the February report, with the estimate standing at C$0.9 billion. Will the indicator match or beat this rosy prediction?

- BOC Senior Deputy Governor Carolyn Wilkins Speaks: Tuesday, 19:00. A speech that is more hawkish than expected is bullish for the Canadian dollar.

- Ivey PMI: Wednesday, 14:00. This index has been showing some volatility, and dropped sharply to 53.4 points in February, below expectations. The markets are expecting an improvement in March, with the estimate standing at 55.6 points.

- Building Permits: Thursday, 12:30. Building Permits continues to alternate between gains and declines, and posted a sharp drop of 9.8% in January, much weaker than the forecast of -2.2%. The indicator is expected to improve in February, with an estimate of 2.3%.

- Housing Starts: Friday, 12:15. This indicator provides a snapshot of the strength of the housing sector. The February release jumped to 213 thousand, well above the estimate of 181 thousand. The estimate for the March report is 215 thousand.

- Employment Change: Friday, 12:30. This key indicator has struggled, posting 3 declines in the past 4 releases. The February reading of -2.3 thousand was well short of the estimate of 10.2 thousand. The unemployment rate edged higher to 7.3% in February, its highest level since October 2012.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3272 and quickly touched a high of 1.3284. The pair then reversed directions, dropping all the way to a low of 1.2855, testing support at 1.2900 (discussed last week). USD/CAD closed the week at 1.3006.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

With USD/CAD posting sharp losses, we start at lower levels:

1.3457 has held firm since the first week in March.

1.3353 is the next line of resistance.

13174 was a cap in October 2015.

1.3064 has switched to a resistance role. It is a weak line.

The round number of 1.2900 is providing support. This line was a cushion in October.

1.2780 is the next support level.

1.2646 is the final support line for now.

I am neutral on USD/CAD

With Janet Yellen serving notice that the Fed is not planning to raise rates shortly, sentiment on the US dollar could sour. Still, the US economy continues to outperform the Canadian economy.

In our latest podcast we explain why the doves do NOT cry.

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.