The Canadian dollar dropped close to 100 points last week, as USD/CAD closed the week at 1.2868. The upcoming week has only two events. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The Canadian dollar received a boost from stronger oil prices, as the markets expect the global oil glut to decrease in the third and fourth quarters. Late in the week, soft retail sales and inflation numbers trimmed these gains. In the US, the Fed’s minutes showed that only a small minority favors a rate hike, while the vast majority wants to continue to wait, notably because of low inflation levels.

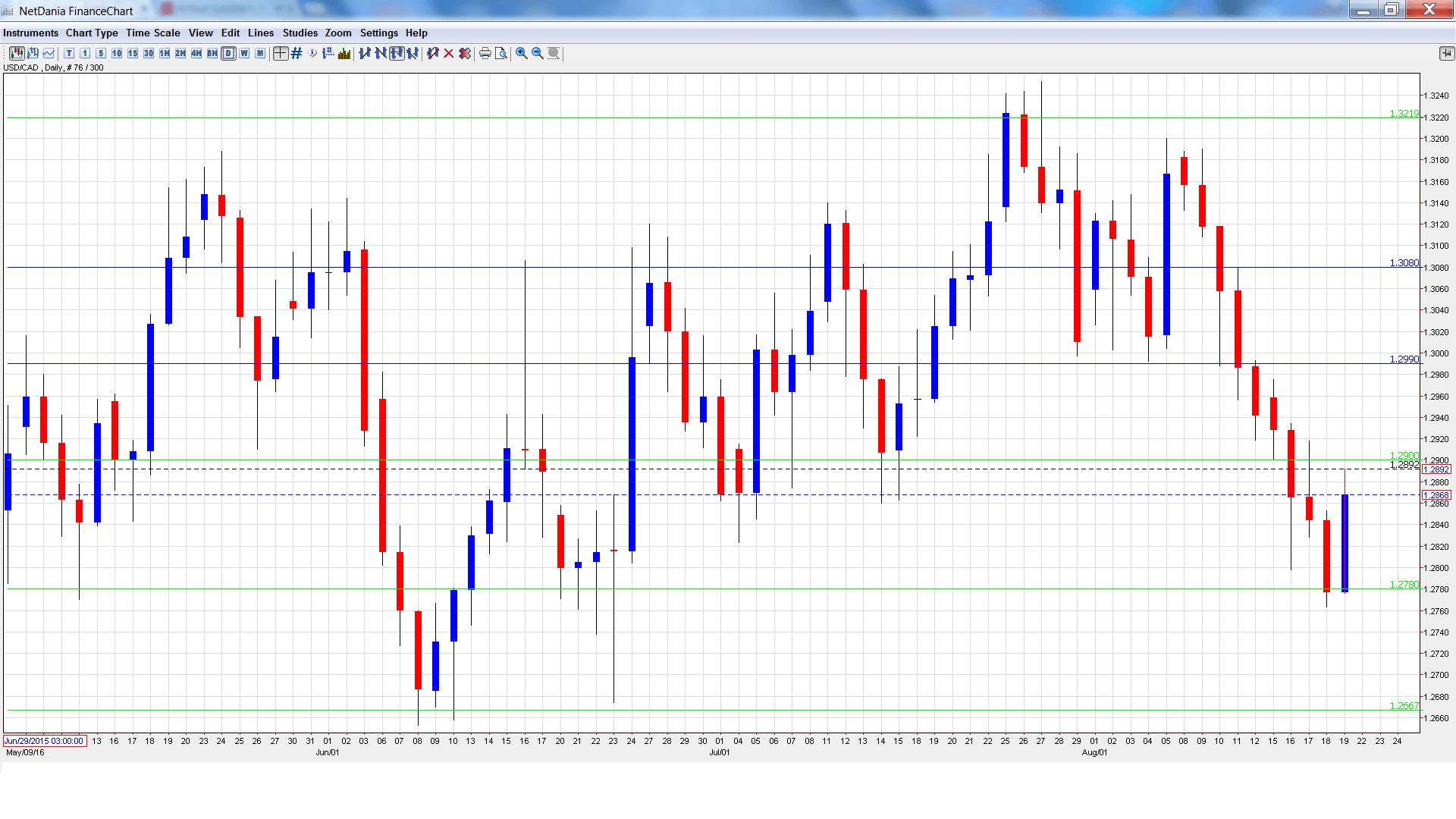

USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Wholesale Sales: Monday, 12:30. This important consumer indicator impressed in May, posting a strong gain of 1.8%. This easily beat the forecast of 0.2%. The estimate for the June stands at 0.5%.

- Corporate Profits: Thursday, 12:30. Corporate Profits has been struggling, managing just one gain in 2016. In the second quarter, the indicator posted a sharp gain of 4.6%. Will we see an improvement in the third quarter?

USD/CAD opened the week at 1.2958 and quickly touched a high of 1.2975. The pair then reversed directions and dropped to a low of 1.2763, testing support at 1.2780 (discussed last week). The pair rebounded on Friday, closing the week at 1.2868.

Live chart of USD/CAD:

Technical lines, from top to bottom

We start with resistance at 1.3353.

1.3219 was a cap in April.

1.3081 is next.

1.2990 has strengthened is resistance following strong losses by USD/CAD.

1.2900 has switched to a resistance role.

1.2780 was tested in support as the pair dropped below this line before rebounding late in the week.

1.2663 is next.

1.2562 was a cap in July 2015.

1.2459 is the final support line for now.

I am bullish on USD/CAD

The US economy remains stronger than its Canadian counterpart, despite some soft US numbers of late. Although a September hike is very unlikely, there is a reasonable chance of a December move, so any strong US releases will raise speculation about a hike and could send the greenback to higher levels.

Our latest podcast is all about the Fed’s forecast failures.

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.