The Canadian dollar rebounded nicely last week, as USD/CAD dropped 240 points. The pair closed the week at 1.2941. This week’s key events are Manufacturing Sales, Core CPI and Core Retail Sales. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The Canadian dollar jumped after an IEA report stated that the oil market would tighten in the third and fourth quarters. As well, OPEC announced that members would meet in later September, with the aim of curbing output in order to stabilize oil prices. In the US, soft retail sales and wholesale prices pushed the greenback lower.

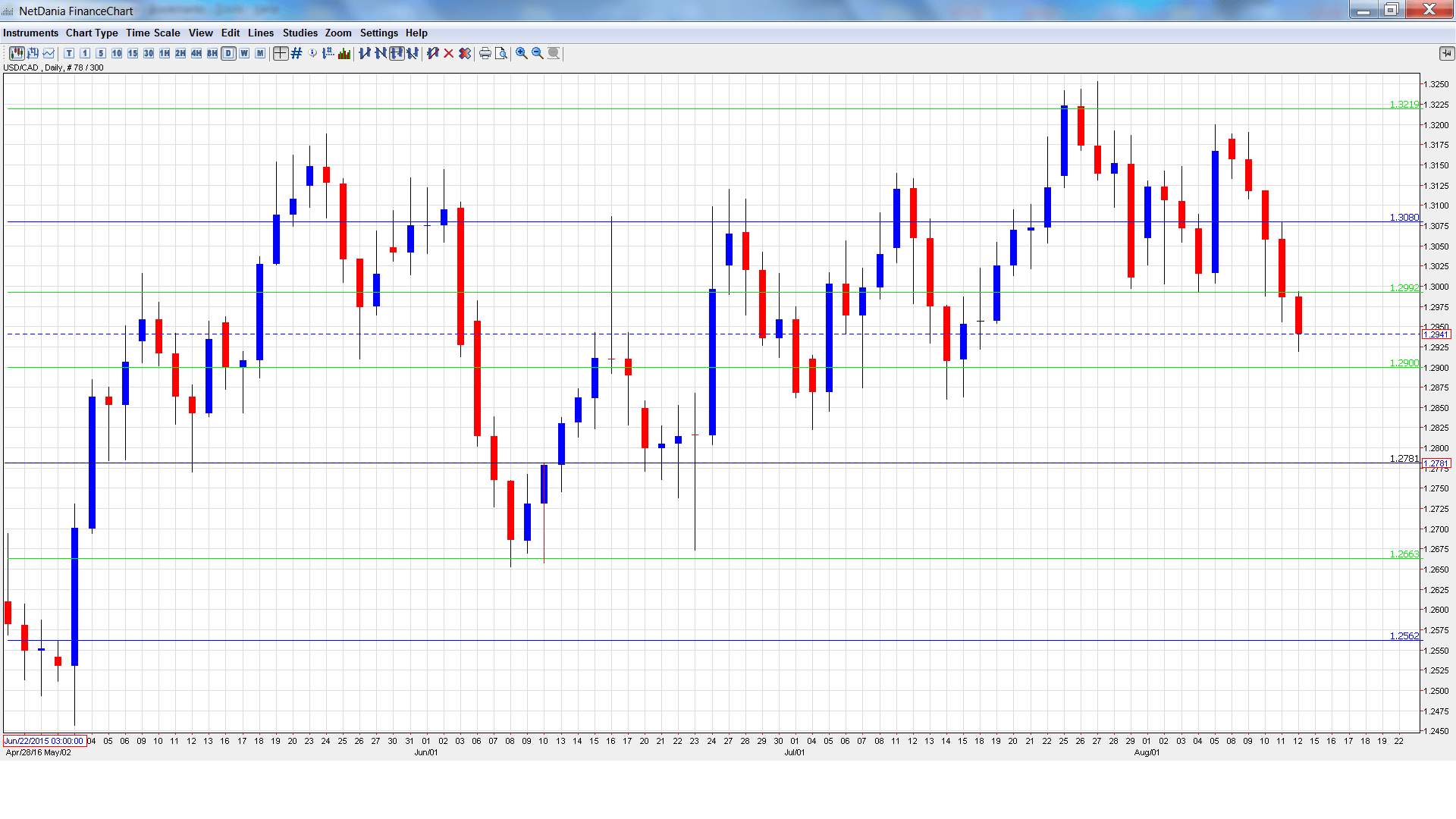

USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Manufacturing Sales: Tuesday, 12:30. This key event kicks off the week. The indicator has looked weak, posting three declines in the past four months. The May report showed a declined of 1.0%, weaker than the estimate of -0.8%. The markets are expecting a strong rebound in June, with an estimate of 0.8%.

- Foreign Securities Purchases: Thursday, 12:30. This event is closely linked to currency demand, as foreigners must purchase Canadian dollars in order to buy Canadian securities. The indicator dropped to C$14.73 billion in May, missing expectations.

- Core CPI: Friday, 12:30. Core CPI excludes the most volatile items which comprise CPI. The index dropped to a flat 0.0% in June, after five straight gains. This figure matched the forecast. Another reading of 0.0% is expected in the July release.

- Core Retail Sales: Friday, 12:30. Core Retail Sales exclude automobile sales, which tend to be volatile. The indicator dropped to 0.9% in May, but this easily beat the forecast of 0.3%. The June estimate stands at 0.4%. Will the indicator repeat and beat the prediction?

- CPI: Friday, 12:30. CPI dipped to 0.2% in June, matching the estimate. However, this marked the weakest gain in four months. The downward trend is expected to continue in the July report, with an estimate of 0.0%.

- Retail Sales: Friday, 12:30. Retail Sales is the primary gauge of consumer spending. The indicator posted a weak gain of 0.2% in May, sharply lower than the 0.9% gain recorded a month earlier. The markets are expecting better news in June, with a forecast of 0.8%.

USD/CAD opened the week at 1.3182 and quickly touched a high of 1.3190. It was all downhill from there, as the pair dropped all the way to 1.2919, as support remained firm at 1.2900 (discussed last week). The pair closed the week at 1.2941.

Live chart of USD/CAD:

Technical lines, from top to bottom

We begin with resistance at 1.3353.

1.3219 was a cap in April.

1.3081 has strengthened in resistance following sharp losses by USD/CAD.

1.2990 is an immediate resistance line.

1.2900 held firm in support. It could be tested early next week if the Canadian dollar rally continues.

1.2780 has provided support since late June.

1.2663 is next.

1.2562 was a cap in July 2015. It is the final support line for now.

I am bearish on USD/CAD

The Canadian economy is not in great shape, but the Canadian dollar posted sharp gains last week, piggybacking on stronger oil prices. With a September rate likely off the table in the US, investors may look elsewhere to park their funds ,which could boost the Canadian currency.

Our latest podcast is titled Carney King of Governors, Small in Japan

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.