Dollar/CAD continued moving.higher as the loonie exposed its weakness The upcoming week culminates on Friday with top-tier figures from inflation and retail sales. Here are the highlights and an updated technical analysis for USD/CAD.

Canadian data was actually positive: housing starts are up to 222K and building permits jumped by 2.5%. Nevertheless, the Canadian dollar failed to rise. The markets are eager on selling the C$. Another reason to sell the loonie was the crisis around North Korea. The “risk aversion” sentiment hurts commodity currencies such as the Canadian dollar. In the US, the JOLTs report was positive but inflation looks weak.

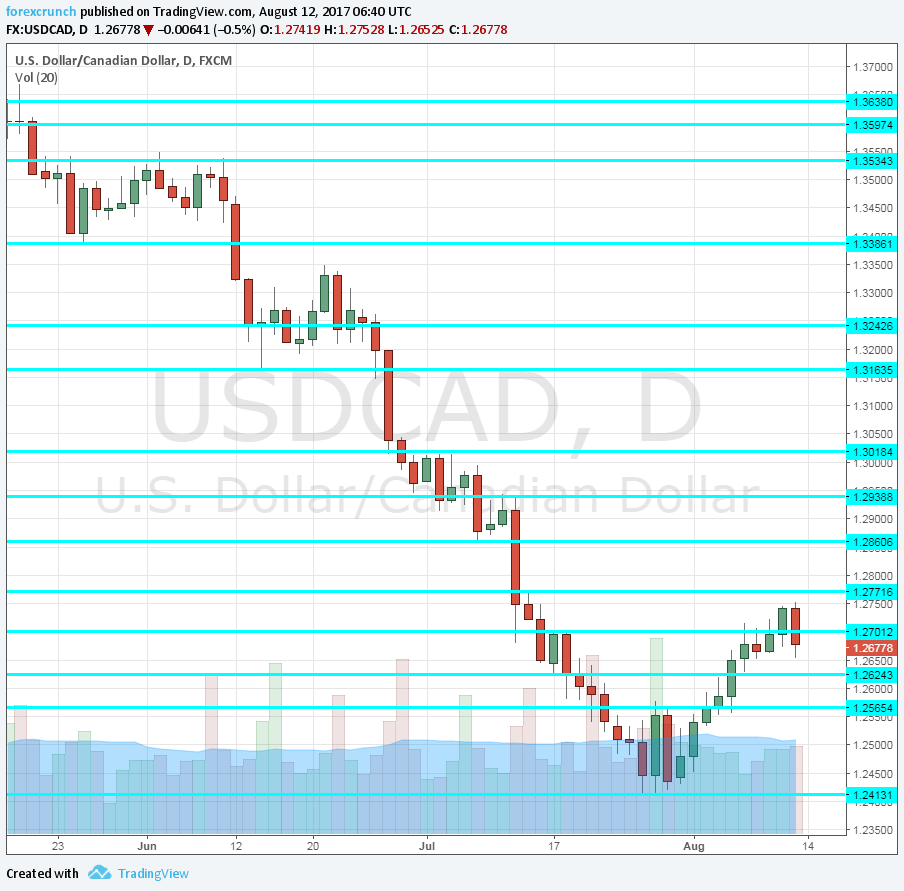

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Foreign Securities Purchases: Wednesday, 12:30. The flow of funds into Canada increased in May, reaching 29.46 billion, nearly triple the previous month. The figure could be lower this time.

- Manufacturing Sales: Thursday, 12:30. The volume of sales in the manufacturing sector has increased at healthy rates in the past three months according to the initial releases, but suffered revisions afterward. After 1.1% in May, we could see a smaller rise in June.

- Inflation data: Friday, 12:30. The Bank of Canada has been optimistic about inflation, but numbers haven’t been so impressive, at least for now. Headline inflation dropped by 0.1% in June, as expected. Measures of core inflation vary: Common CPI is up to 1.4% y/y, up from 1.3% beforehand. The Median CPI is also up, to 1.6% in this case. However, the Trimmed CPI stands at 1.2%, unchanged and lower than the other measures.

* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD consolidated its recovery and then extended its gains, battling and eventually winning the 1.27 level mentioned last week.

Technical lines from top to bottom:

1.30 is towering above. It is followed by 1.2940 which capped the pair in July.

1.2860 was a relatively significant stepping stone on the way down, holding the pair for some time. It is followed by 1.2775, which marked a recovery attempt.

1.27 is a round number and also the top of a short-lived range. 1.2640 was the bottom of that range and a level where the pair reached after bouncing back.

1.2580 is a pivotal line and capped the pair temporarily on its recovery path. 1.2410 is a very strong line, serving as the low for 2017 (so far).

Further down, we find levels last seen in early 2015. These levels are 1.22 and 1.20.

I am neutral on USD/CAD

While the greenback come back is probably over, the Canadian dollar has its own weaknesses, as clearly seen now. These weaknesses will likely balance other.

Our latest podcast is titled As good as it gets? – US economy edition

Follow us on Sticher or iTunes

Safe trading!