For a second straight week, the Canadian dollar dropped 200 points against the US currency, with USD/CAD closing at 1.3540. This marked the pair’s highest weekly close since mid-February. There are no Canadian events this week. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The US economy continues to expand at a brisk clip, as third quarter growth beat expectations with an excellent reading of 3.5%. However, durable goods orders were mixed. Consumer confidence also looked sharp, rising for a second straight month. In Canada, CPI indicators posted declines, but retail sales were unexpectedly strong.

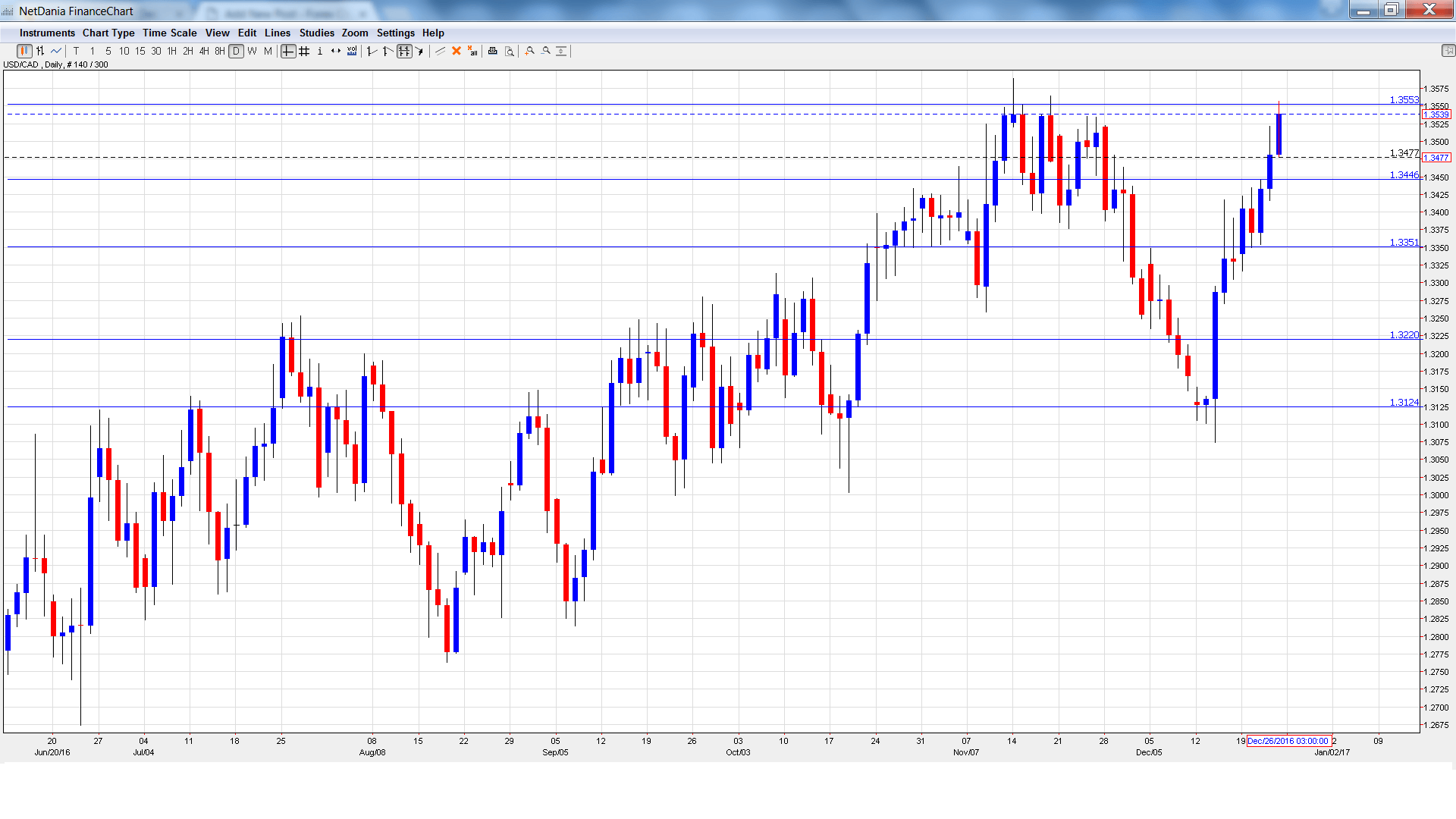

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

Live chart of USD/CAD:

Technical lines, from top to bottom

With USD/CAD continuing to post sharp gains, we start from higher levels:

1.3911 was last tested in February.

1.3813 provided a cushion in December 2015 and January 2016.

1.3648 was an important support level in February.

1.3551 was tested in resistance and is currently a weak line. It could see action early in the week.

1.3433 was the high point in October.

1.3351 has switched to support following strong gains by USD/CAD.

1.3219 has strengthened in support.

1.3124 is the final support level for now.

I am bearish on USD/CAD

The Canadian dollar has sagged badly since mid-December and the slide could continue. With no Canadian events this week, the loonie could lose ground if US numbers meet expectations.

Our latest podcast is titled What will move markets in 2017

Follow us on Sticher or iTunes

Further reading:

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.