The Canadian dollar had a huge rebound last week, as USD/CAD plunged some 460 points. The pair closed at 1.4117. This week’s highlight is GDP. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In the US, inflation numbers were within expectations, but Unemployment Claims surged to their highest level in 11 months. The Canadian dollar improved after the BOC surprised the markets by not cutting interest rates, and strong retail sales also bolstered the currency. However, inflation numbers remained weak, as Core CPI posted a second straight decline.

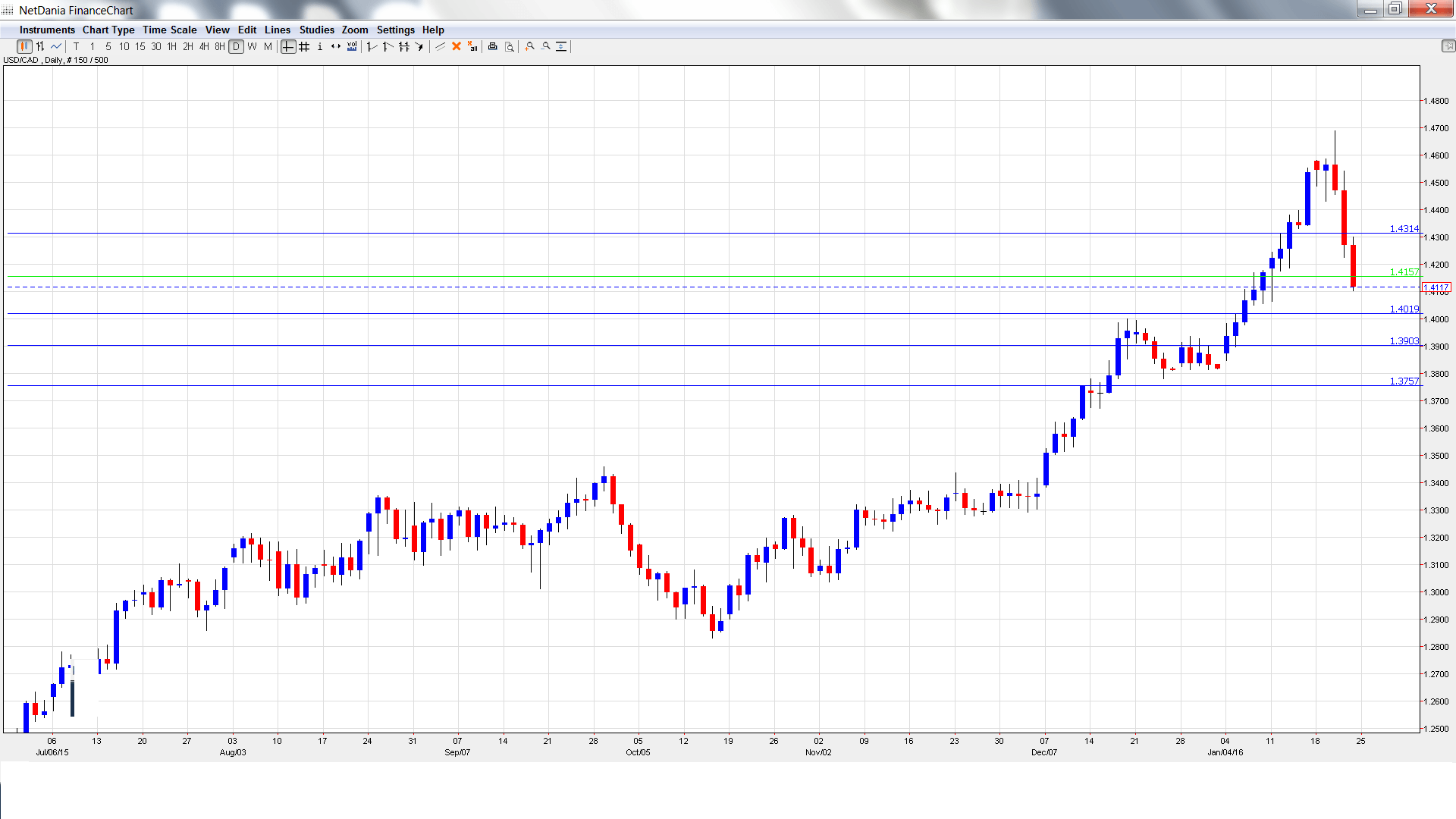

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- GDP: Friday, 8:30. GDP is one of the most important economic indicators, and an unexpected reading can have a sharp impact on the movement of USD/CAD. In October, GDP posted a flat gain of 0.0%, shy of the forecast of 0.2%. Will the indicator push into positive territory in November?

- RMPI: Friday, 8:30. RMPI measures inflation in the manufacturing sector. The index slipped 4.0% in November, weaker than the estimate of -2.3%.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.4579 and climbed to a high of 1.4690. The pair reversed directions and dropped to a low of 1.4103, breaking below support at 1.4159 (discussed last week). USD/CAD closed the week at 1.4117.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

With USD/CAD posting sharp losses last week, we start at lower levels:

1.4480 was an important cushion in April 2000.

1.4310 is the next line of resistance.

1.4159 has switched to a resistance role following sharp losses by the pair.

1.4019 is providing support, just above the psychologically important 1.40 level.

The round number of 1.39 is next.

1.3757 is the final support level for now.

I am neutral on USD/CAD

After huge losses in recent weeks, the Canadian dollar reversed directions. Speculation about a March rate hike in the US has dampened following weak inflation and employment numbers. Still, the US economy continues to outperform the Canadian economy, and investors have not shown much appetite in 2016 for minor currencies like the Canadian dollar.

In our latest podcast we update from the currency war front

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.