The Canadian dollar rebounded last week, gaining 110 points. USD/CAD closed the week just above the 1.34 line. There are three key events on Friday, led by Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In the US, consumer confidence jumped, as consumers continue to feel optimistic about the economy as we enter 2017. On the labor front, unemployment claims dropped, beating expectations. There were no Canadian events last week. Oil prices will be watched as the OPEC Accord is being implemented.

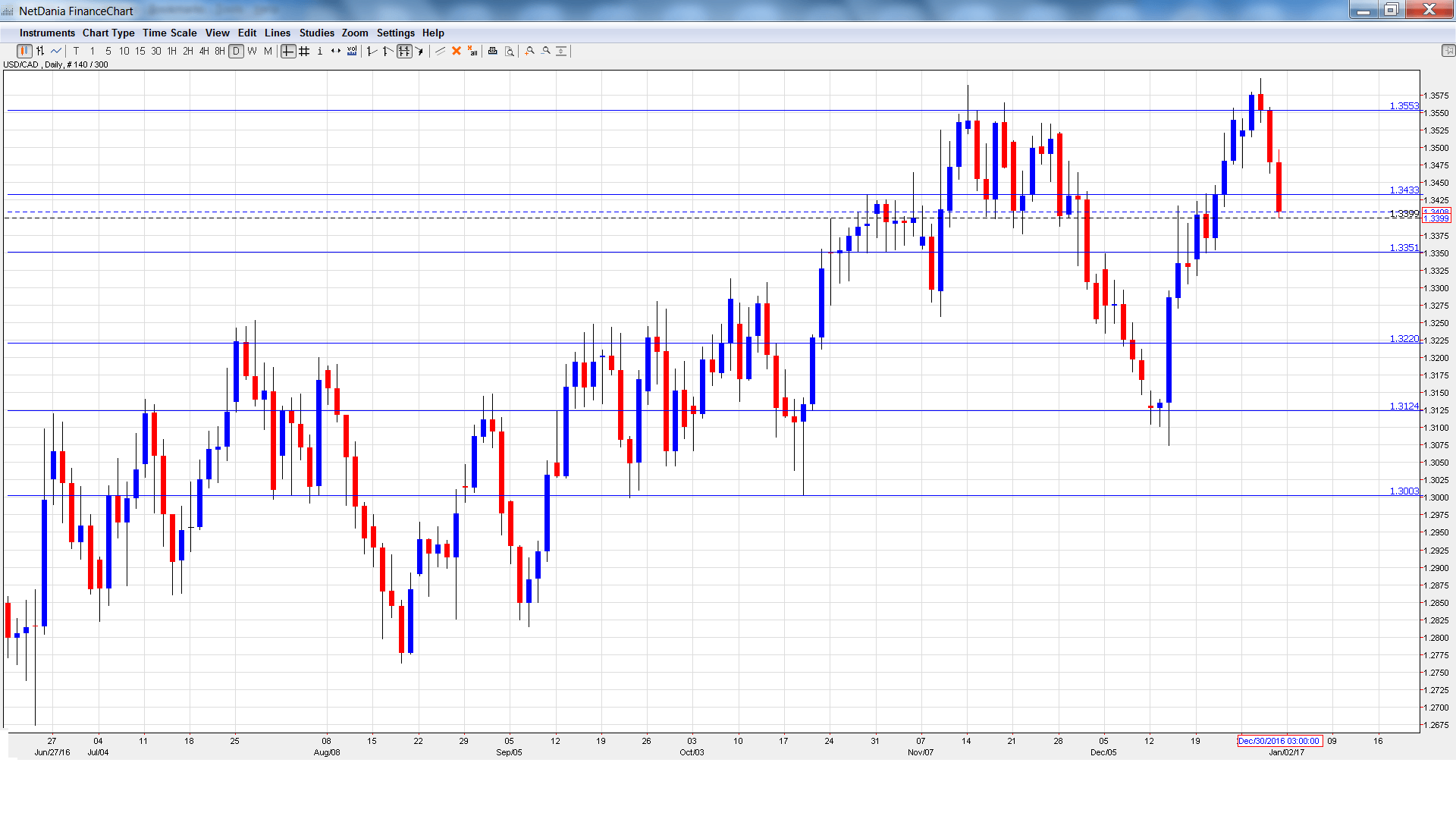

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- RBC Manufacturing PMI: Tuesday, 14:30. The PMI rose slightly to 51.5 points in October, as the manufacturing sector remains stagnant. This figure was a slight improvement from the previous reading of 51.5.

- RMPI: Thursday, 13:30. This inflation indicator surged in October with a strong gain of 3.3%. This edged above the forecast of 3.2%. The markets are expecting a downturn in the November report, with an estimate of -1.5%.

- Employment Change: Friday, 13:30. Employment Change is one of the most important indicators, so traders should treat it as a market-mover. In November, the indicator came in at +10.7 thousand, easily beating the forecast of -16.5 thousand. The markets are braced for a decline of -5.6 thousand in the December report. The unemployment rate dipped to 6.8% in October and is expected to edge up to 6.9% in November.

- Trade Balance: Friday 13:30. Canada’s trade deficit narrowed substantially in September to C$1.1 billion. This was lower than the forecast of a deficit of C$2.1 billion. In October, the deficit is expected rise to C$1.6 billion.

* All times are GMT

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3516 and climbed to a high of 1.3599. The pair then dropped sharply and dropped to a low of 1.3399, as support held firm at 1.3351 (discussed last week). USD/CAD closed the week at 1.3408.

Live chart of USD/CAD:

Technical lines, from top to bottom

1.3813 provided a cushion in December 2015 and January 2016.

1.3648 was an important support level in February.

1.3551 was tested in resistance for a second straight week as the pair moved higher before retracting.

1.3433 was the high point in October.

1.3351 held steady in support last week.

1.3219 has provided support since mid-December.

1.3124 is next.

1.3003 is protecting the symbolic 1.30 level. It is the final support level for now.

I am bearish on USD/CAD

With the Trump presidency just a few weeks away, the markets are expecting US growth to continue, which could mean more rate hikes from the Federal Reserve. So, the US dollar could start 2017 with broad gains.

Our latest podcast is titled What will move markets in 2017

Follow us on Sticher or iTunes

Further reading:

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.