The Canadian dollar continues to sparkle, and recorded a fifth straight winning week. USD/CAD closed the week at 1.2416, its lowest weekly close since June 2015. This week’s key event is Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

Canada’s GDP expanded 0.6% in May, easily beating the estimate of 0.6%. In the US, Advance GDP posted a strong gain in 2.6% in the second quarter, above the estimate of 2.5%. Political risk continues to rise, as Trump’s failure to pass a healthcare bill weighed on the US dollar.

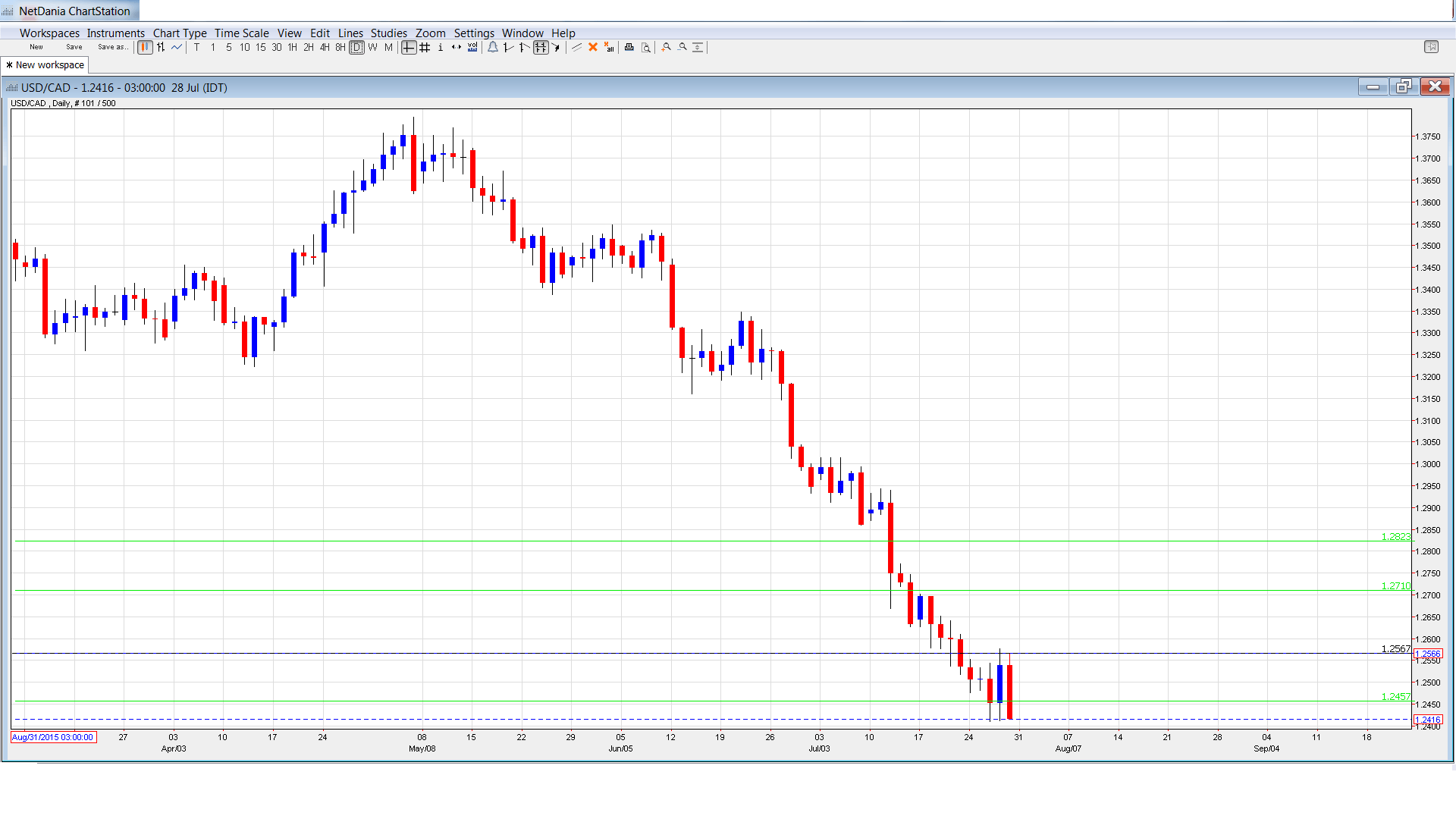

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- RMPI: Monday, 8:30. The indicator edged up to 1.0% in April, easily beating the estimate of 0.5%. This marked a 4-month high. The forecast for the May report stands at 0.5%.

- Manufacturing PMI: Tuesday, 9:30.

- Employment Change: Friday, 8:30.

- Trade Balance: Friday, 8:30.

- Ivey PMI: Friday, 10:00. GDP is released each month. In April, GDP slowed to 0.2%, matching the estimate. This was the weakest gain since February. Another gain of 0.2% is expected in May.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.2532 and dropped to a low of 1.2410. The pair touched a high of 1.2577, testing resistance at 1.2563 (discussed last week). USD/CAD lost ground on Friday, closing the week at 1.2416.

Technical lines, from top to bottom

We start with resistance at 1.2823.

1.2710 is next.

1.2563 was tested as the pair posted gains late in the week before retracting.

1.2457 is an immediate resistance line.

1.2351 has been a cushion since May 2015.

1.2218 is next.

1.2126 is the final support line for now.

I am bearish on USD/CAD

The US dollar is under pressure, with mixed numbers in Q2 and worries that the Fed might not raise rates in December. The Canadian economy has been improving, and the recent rate hike by the BoC has made the Canadian dollar more attractive.

Our latest podcast is titled Draghi Dud and the Petrol Pendulum

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.