The Canadian dollar continues to sag, losing 80 points last week. USD/CAD closed the week at 1.3464. This marked the pair’s highest weekly close in 2017. This week’s key event is Manufacturing Sales. Here is an outlook on the major market- movers and an updated technical analysis for USD/CAD.

The US labor picture remains rosy, and a sparking nonfarm payrolls report has virtually ensured a rate hike coming next week. Still, wage growth disappointed, falling short of the forecast. Canadian employment numbers were sharp, as employment change and the unemployment rate both beat the forecasts and pared the Canadian dollar’s losses last week.

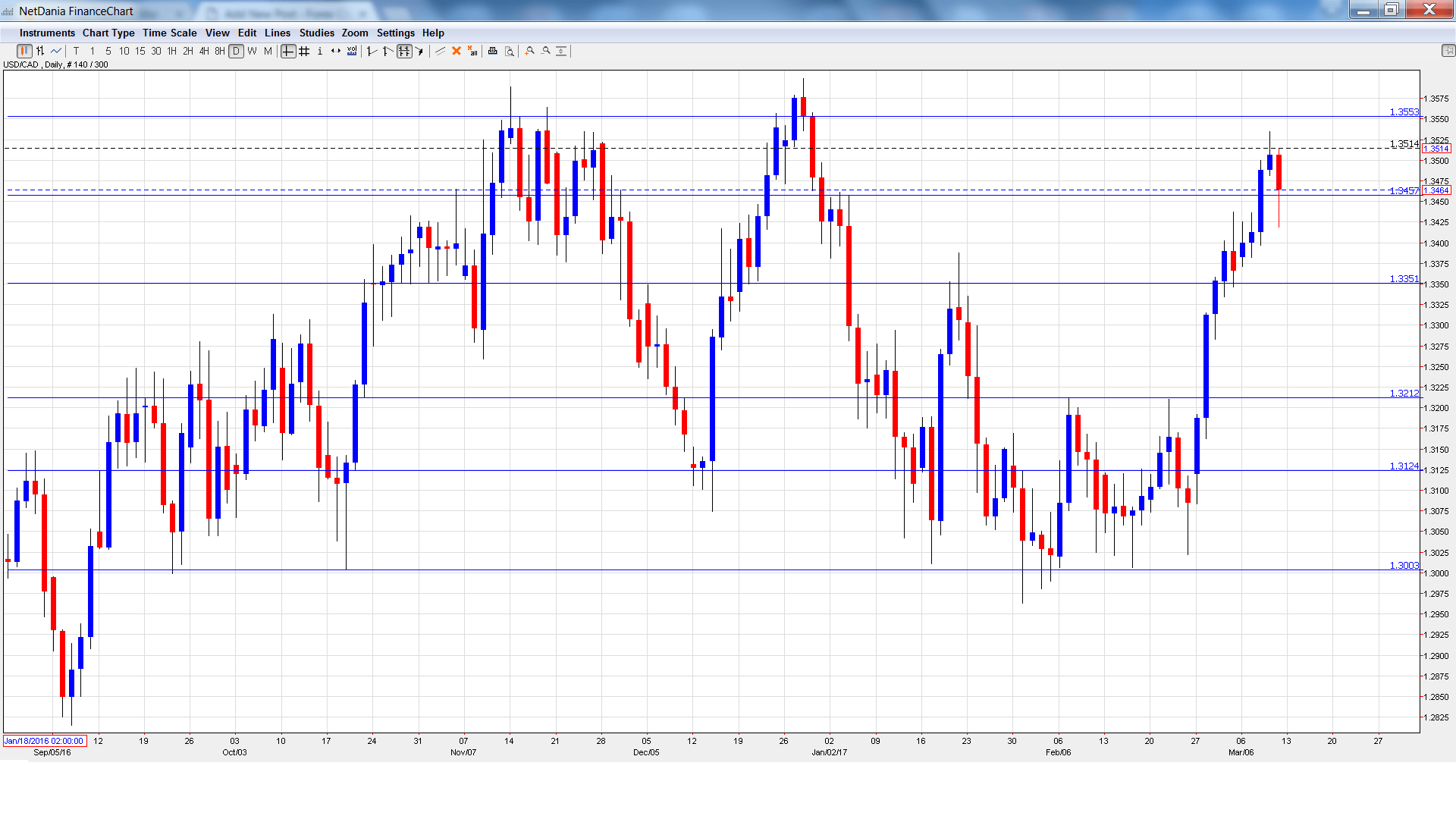

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Foreign Securities Purchases: Thursday, 13:30. The indicator swelled to C$10.23 billion in December, but this fell short of the forecast of C$11.59 billion. The markets are expecting a downturn in January, with an estimate of C$9.45 billion.

- Manufacturing Sales: Tuesday, 00:30. This key indicator should be treated as a market-mover. In December, the indicator improved to 2.3%, beating the forecast of 1.4%. Will the upswing continue in the January report?

* All times are GMT

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3382 and dropped to a low of 1.3371. The pair then reversed directions and climbed to a high of 1.3535, as resistance held at 1.3551 (discussed last week). USD/CAD weakened late in the week and closed at 1.3464.

Live chart of USD/CAD:

Technical lines, from top to bottom

1.3782 has held in resistance since the start of February.

1.3648 was an important support level in February.

1.3551 is the next line of resistance.

1.3457 was a high point in September 2015. The pair closed the week just above this line.

1.3351 is the next line of support.

1.3212 was a cap in the second quarter of 2016.

1.3124 is the next support level.

1.3003 is protecting the symbolic 1.30 level. It is the final support level for now.

I am bullish on USD/CAD

A rate hike in the US next week is all but assured, but the move should still reinvigorate the markets and boost the US dollar, especially against minor currencies like the Canadian dollar.

Our latest podcast is titled Fed fever and crashing crude in the Ides of March

Follow us on Sticher or iTunes

“‹

Safe trading!

Further reading:

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.