The Canadian dollar showed some movement last week but closed the week unchanged. USD/CAD closed the week at 1.2934. This week’s highlights are Retail Sales and CPI reports. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In the US, strong key numbers on Friday helped the US dollar recover against its Canadian counterpart. Retail Sales beat expectations and consumer confidence numbers surged higher. In Canada, a housing inflation report posted a small gain, within expectations.

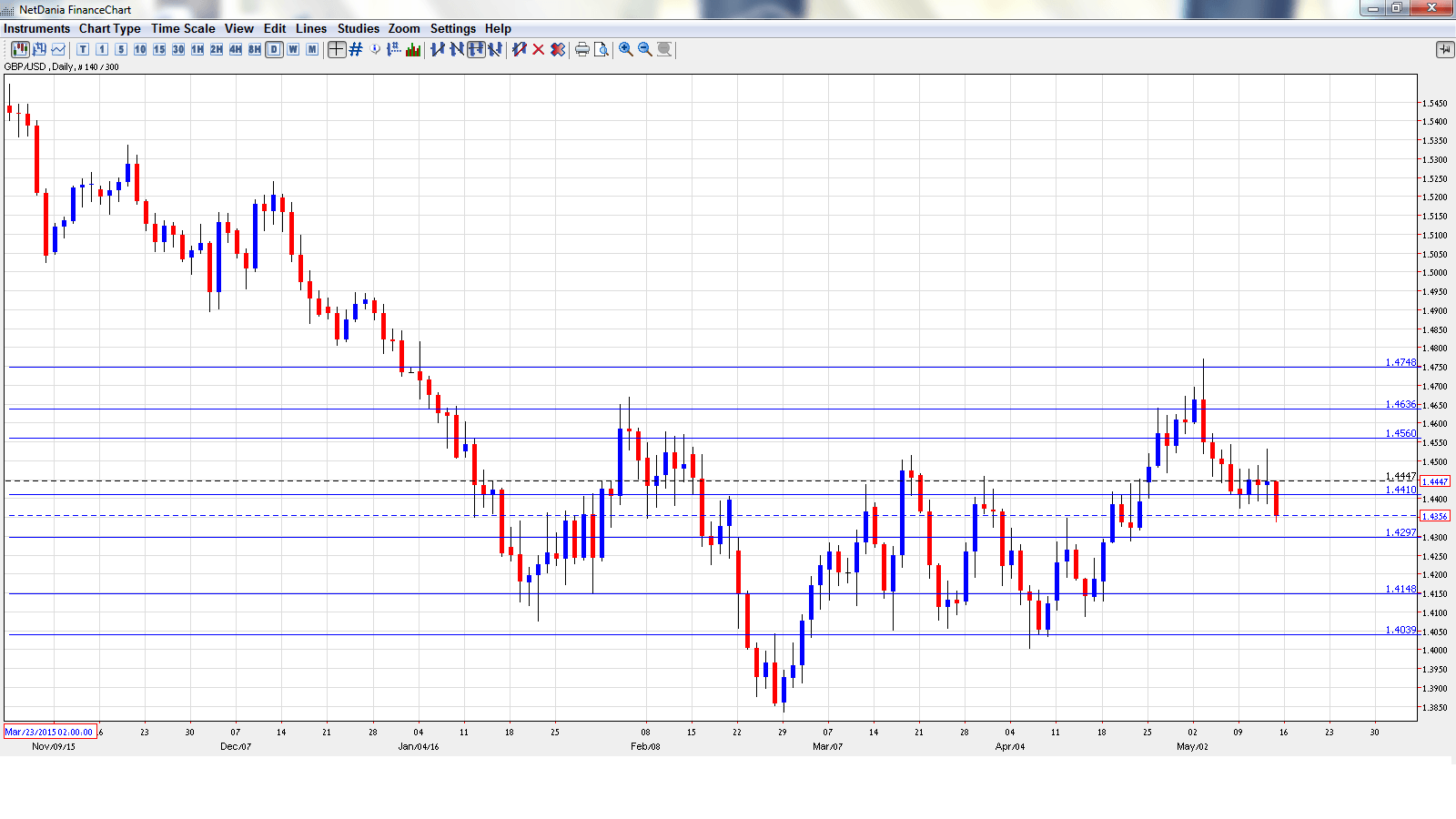

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- BOC Review: Monday, 14:30. This report is published on a semi-annual basis. As a minor event, it is unlikely to have much impact on the direction of USD/CAD.

- Manufacturing Sales: Tuesday, 12:30. This is the first key event of the week. The indicator sagged badly in February, posting a sharp loss of 3.3%, worse than expected. Another decline is expected in March, with an estimate of -0.7%.

- Foreign Securities Purchases: Wednesday, 12:30. The indicator has posted strong gains in the past two months and improved to C$15.94 billion in February. This easily beat the estimate. The estimate for the March report stands at C$10.35 billion.

- Wholesale Sales: Thursday, 12:30. As a leading indicator of consumer spending, this indicator is closely monitored by analysts. The indicator posted a sharp decline of 2.2% in February, its worst reading since January 2015. The markets are expecting a turnaround in the March release, with an estimate of 0.5%.

- Core CPI: Friday, 12:30. Core CPI excludes the most volatile items included in CPI. The index has been improving in recent months and posted strong gain of 0.7% in March. A small gain of 0.2% is expected in the April report.

- Core Retail Sales: Friday, 12:30. Core Retail excludes automobile sales, which are volatile and included in the Retail Sales report. The indicator posted a small gain of 0.2% in February. The markets are expecting a downturn in March, with an estimate of -0.4%.

- CPI: Friday, 12:30. In March, CPI surprise with a strong gain of 0.6%, beating the estimate of 0.3%. The estimate for April stands at 0.4%.

- Retail Sales: Friday, 12:30. The indicator slipped to 0.4% in February, compared to a strong 2.1% gain in January. The markets are braced for a decline of 0.7% in the April report.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.2931 and quickly touched a high of 1.3016. The pair then reversed directions and dropped to a low of 1.2770, testing resistance at 1.2780 (discussed last week). USD/CAD rebounded at the end of the week, closing at 1.2934.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

1.3353 has provided resistance since mid-March.

1.3219 was a cap in April.

1.3081 is next.

1.2990 has held firm since mid-April.

The round number of 1.2900 remains a weak support line. It could see further action early in the week.

1.2780 is next.

1.2646 is next.

1.2538 is the final support level for now.

I am neutral on USD/CAD

The Canadian dollar held its own last week, despite strong US numbers. The loonie has posted strong gains in 2016, and could make headway if oil prices continue to rise. The Federal Reserve will be closely monitoring economic data as the June policy meeting approaches, so strong US data will increase the likelihood of a rate hike and will bolster the US dollar.

In our latest podcast we examine the upbeat US consumer and oil prices

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.