USD/CAD was up sharply last week, gaining 160 points. The pair closed the week at 1.3115. There are only two events on this week’s schedule. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The Fed meeting minutes were surprisingly hawkish, putting a June rate hike firmly on the table. The US dollar posted strong gains and pushed the Canadian dollar down sharply. US employment and housing numbers were solid. In Canada, retail sales and inflation numbers were soft.

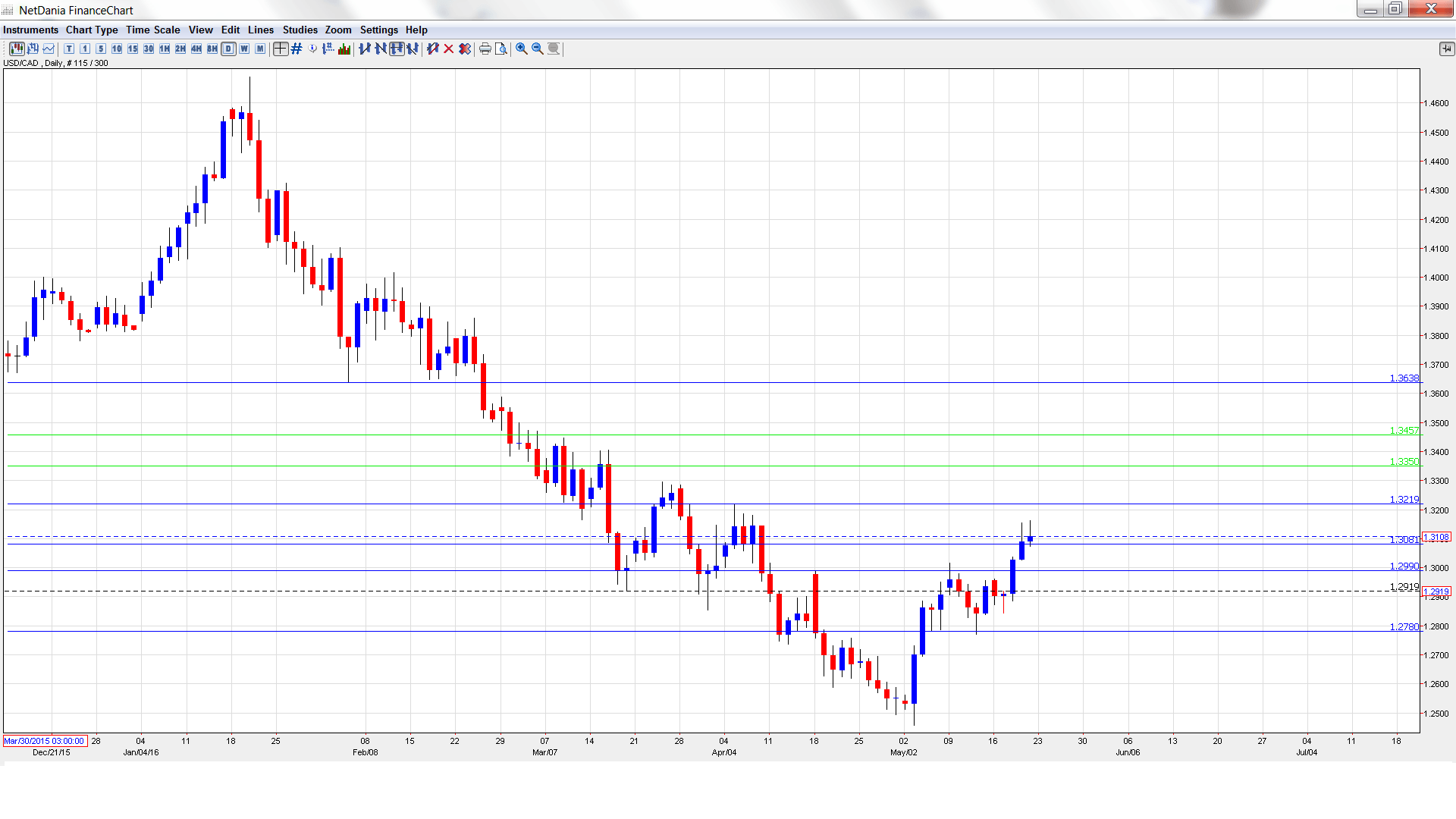

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Overnight Rate: Wednesday, 14:30. The BoC has held interest rates at 0.50% since July 2015. The markets are expecting the rate to remain the same, but will be combing through the rate statement, looking for clues regarding the BoC’s future monetary policy.

- Corporate Profits: Thursday, 12:30. Corporate Profits have struggled, posting four declines in the past five quarters. In Q4, the indicator posted a decline of 3.1%. Will we see a rebound in the Q1 report?

USD/CAD Technical Analysis

USD/CAD opened the week at 1.2946 and touched a high of 1.3161. The pair then reversed directions and dropped to a low of 1.2836, a support held firm at 1.2780 (discussed last week). USD/CAD closed the week at 1.3115.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

With USD/CAD posting strong gains last week, we start at higher levels:

1.3638 has held firm since late February.

1.3457 is the next resistance line.

1.3353 has provided resistance since mid-March.

1.3219 was a cap in April.

1.3081 has switched to a support role following strong gains by USD/CAD. It is a weak line.

1.2990 has held firm since mid-April.

The round number of 1.2900 is next.

1.2780 is the final support level for now.

I am bullish on USD/CAD

The Fed gave another boost to the dollar last week and anticipation about a June hike will continue to weigh on the struggling loonie. US numbers are stronger than Canada’s, which also favors the greenback.

In our latest podcast we examine the road to a June hike (or not)

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.