The Canadian dollar was unchanged over the course of the week, closing at 1.34 line. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The US Non-Farm Payrolls were upbeat and wage growth improving to 0.3%, above the estimate of 0.2%. The Fed refrained from raising rates last week, but the policy statement was slightly hawkish, as the Fed gave the economy a solid report card. In Canada, GDP dipped to 0.2% in August, matching the forecast. Canadian employment change posted an excellent gain of 43.9 thousand, crushing the estimate of -10.0 thousand.

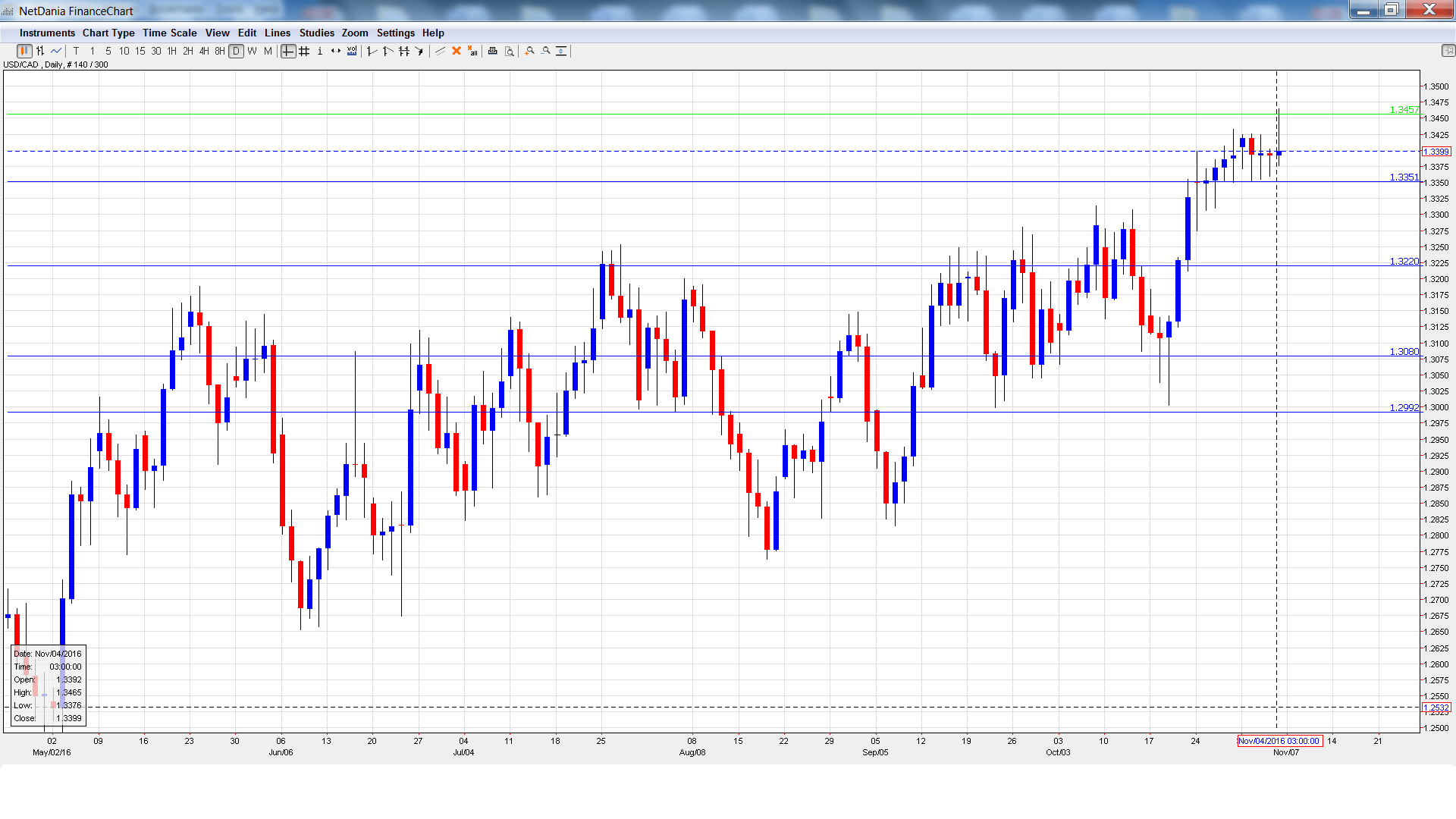

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Housing Starts: Tuesday, 12:15. Housing Starts provides a snapshot of the level of the activity in the housing sector. The indicator jumped to 221 thousand in September, crushing the estimate of 194 thousand. The estimate for October stands at 195 thousand.

- Building Permits: Tuesday, 12:30. Building Permits tends to show strong movement, making accurate forecasts a tricky task. In August, the indicator jumped 10.4%, well above the estimate of 1.1%. This was the highest gain since February.

- BOC Deputy Governor Lawrence Schembri Speaks: Tuesday, 15:20. Schembri will speak at an event in Halifax. A speech which is more hawkish than expected is bullish for the Canadian dollar.

- NHPI: Thursday, 12:30. This housing inflation index dipped to 0.2% in August, within expectations. Another gain of 0.2% is expected in the September report.

- BoC Governor Stephen Poloz Speaks: Friday, 14:50. Poloz will deliver remarks at a bank conference in Santiago, Chile. Analysts will be looking for hints regarding the BoC’s future monetary policy.

USD/CAD opened the week at 1.3405 and dropped to a low of 1.3351. USD/CAD then reversed directions and climbed to a high of 1.3465 as resistance held at 1.3457 (discussed last week). The pair closed the week at 1.3399.

Live chart of USD/CAD:

Technical lines, from top to bottom

We begin with resistance at 1.3813. This line was a cushion in January and February.

1.3672 is next.

1.3551 has provided resistance since March.

1.3457 was a cap in September 2015. It held firm in resistance last week.

1.3351 is a weak support line. This line held in support as the pair lost ground early in the week.

1.3219 was a cap in April.

1.3081 is the next support line.

1.2990 has held firm since early September. It is the final support level for now.

I remain bullish on USD/CAD

The US economy continues to move in the right direction, buoyed a very strong labor market. With the Fed expected to raise rates in December, market sentiment is positive towards the US dollar.

More:

- How to trade the US elections with currencies

- US elections: updates on 21 brokers

- US elections and forex – all the updates in one place

And the video:

Our latest podcast is titled Bold in oil and talking up the currency

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.