USD/CAD posted small losses on the week, closing at 1.3170. This week’s highlight is GDP. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

All eyes were on the Fed last week. As expected, the rates were left unchanged. The Fed broadly hinted that a December hike is a strong possibility. Canadian retail sales and CPI numbers were weaker than expected and the greenback took advantage, posting strong gains late in the week.

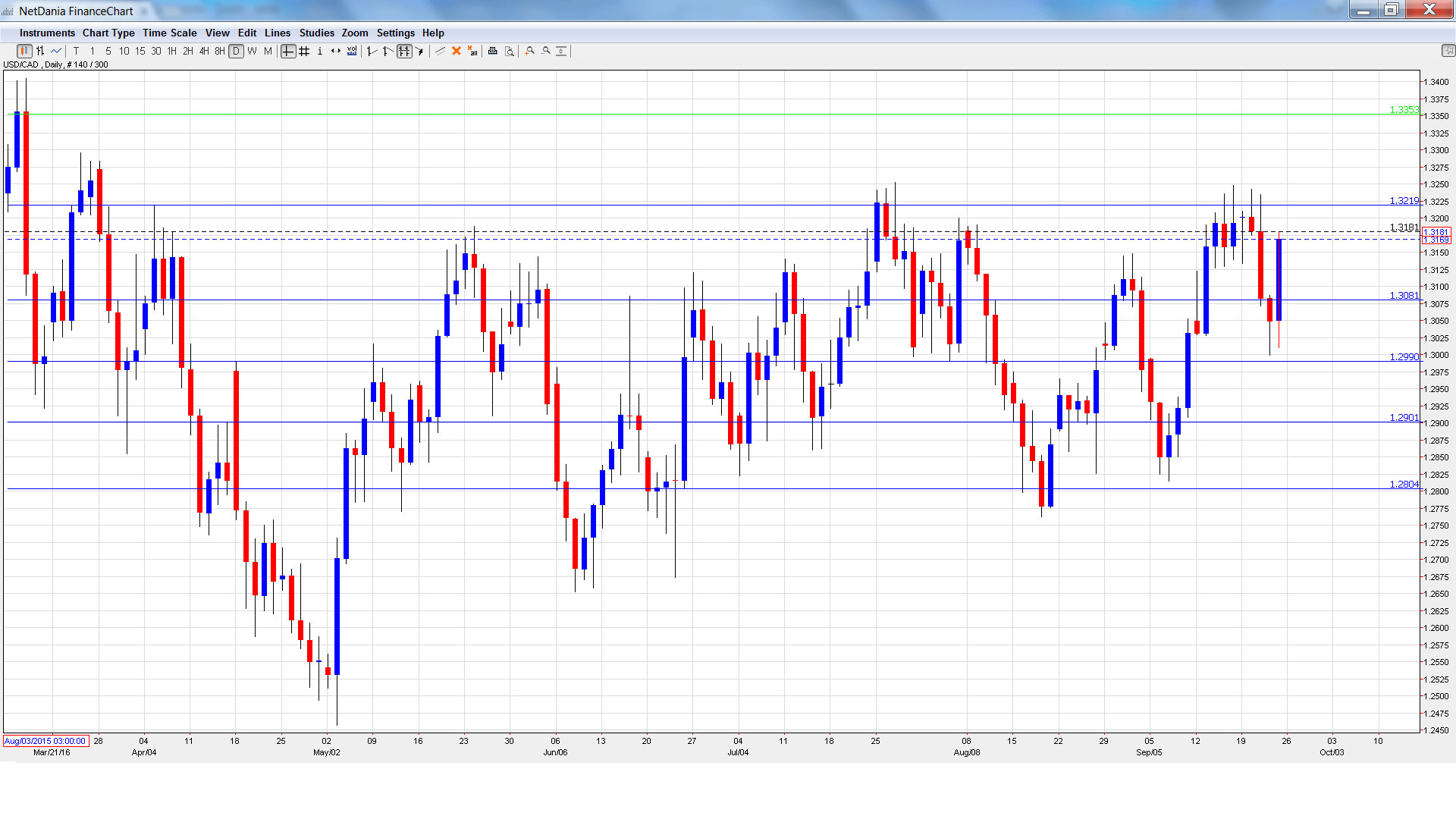

USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- BoC Governor Stephen Poloz Speaks: Monday, 19:10. Poloz will deliver remarks at Western Washington University. A speech which is more hawkish than expected is bullish for the Canadian dollar.

- GDP: Friday, 8:30. Canada releases GDP on a monthly basis and this key indicator should be treated as a market-mover. In June, GDP expanded 0.6%, above the forecast of 0.4%.

- RMPI: Friday, 12:30. This inflation index measures prices of raw materials purchased by manufacturers. The indicator declined 2.7% in July, below expectations and its first decline in five months.

USD/CAD opened the week at 1.3200 and touched a high of 1.3243 early in the week. USD/CAD then dropped sharply, falling to 1.2999, as support held at 1.2990 (discussed last week). The pair then rebounded sharply at the end of the week, closing at 1.3169.

Live chart of USD/CAD:

Technical lines, from top to bottom

1.3551 has provided resistance since March 2016.

1.3457 was a cap in September 2015.

1.3353 is next.

1.3219 was a cap in April. It is currently an immediate resistance line.

1.3081 is providing support.

1.2990 held in support as the pair dropped to 1.2999 before rebounding late in the week.

The round number of 1.2900 is next.

1.2804 was an important cushion after the Brexit vote in late June. It is the final support line for now.

I remain bullish on USD/CAD

The Fed didn’t raise rates but its “hawkish hold” stance is bullish for the US dollar. Canada’s economy continues to show weakness, as underscored by disappointing retail sales and CPI numbers last week,

Our latest podcast is titled Bold BOJ vs. Fearful Fed

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.