Everything is going against USD/CAD. The big mover of the week came from Ottawa. The Bank of Canada not only raised rates but also made hawkish sounds. They are set to hike rates again this year, based on upgraded forecasts.

The dollar side is also making its contribution. The troubles of Trump Junior were joined by Janet Yellen’s nod to lower inflation.

And weak inflation is indeed the name of the game. Both core and headline inflation numbers missed on a monthly basis. Year over year, core CPI remained at 1.7% and headline CPI dropped. In addition, retail sales dropped by every measure, headline, core, and core of the core. A miss on US consumer confidence added fuel to the fire.

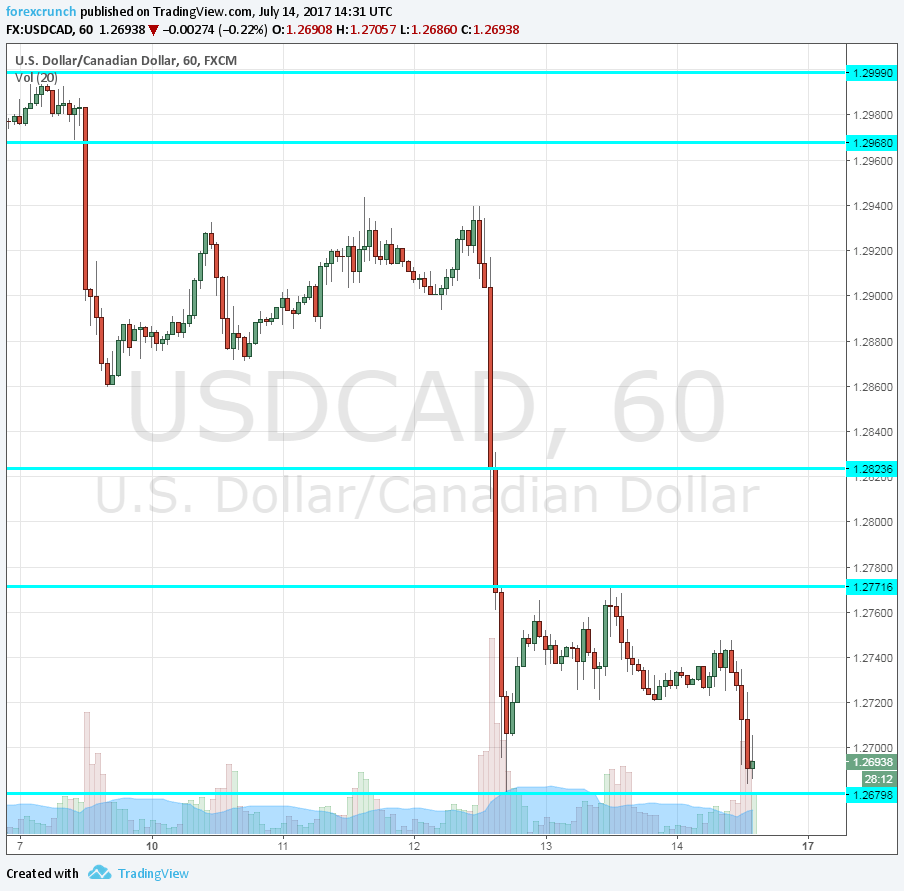

The US dollar dropped and the loonie was there to benefit. USD/CAD reached a bottom of 1.2680 and bounced all the way back up to 1.2771. From there, the pair slid a bit lower before the data came out.

And those poor US figures pushed the pair to challenge the lows. The low is 1.2684, just 4 pips shy of the previous 13-month low.

Double bottom at 1.2680

So, this can be seen as a double-bottom, making 1.2680 a tougher nut to crack.

While the wider trend is clear and can continue running, the pair may be oversold at this point in time.

More: USD/CAD: What’s The Post-BoC Trade? – Nomura