The Canadian dollar made small gains against the US dollar in a choppy week and managed to reconquer parity. Retail sales figures are the highlight of this week. Here’s an outlook for the Canadian events and an updated technical analysis for the Canadian dollar.

Last week Canada’s inflation gauge edged up unexpectedly in January where CPI rose 0.4% after a 0.6% drop in the previous month and Core CPI gained 0.2% following a 0.5% slide in December. Leading Index also came out better with 0.7% increase while expected to climb 0.6%. Let’s see what is in store for us this week.

Updates: USD/CAD enjoyed the higher tensions between the EU and Iran regarding oil trade and kicked off the week with a gap. However, it didn’t manage to break under 0.99, especially as worries about the Greek deal rose. Oil prices continue rising. Nevertheless, this could backfire on the US economy and indirectly on the Canadian one. USD/CAD is capped under parity. Parity couldn’t be conquered as global optimism weakened the US dollar.

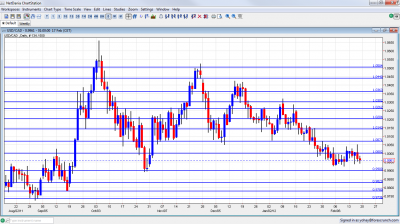

USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Retail sales: Tuesday, 13:30. Canadian retail sales increase more than predicted in November amid stronger gasoline sales. Retail sales climbed 0.3% for the fourth consecutive month. Analysts predicted 0.2% gain. Meanwhile Core sales excluding automobile sector increased 0.3% while expected a 0.2% rise. These figure suggest a modest growth on the Canadian economy. Retail sales are expected to decrease 0.2% while Core sales are predicted to rise 0.3%.

- Wholesale Sales: Tuesday, 13:30. Canadian wholesale sales dropped in November by 0.4% 0.9% increase in the previous month. Wholesalers lowered their stocks due to concerns about future sales. An increase of 0.6% is anticipated.

- Corporate Profits: Thursday, 13:30. Commercial profits for Canadian corporations declined by 0.5% in the third quarter to $64 billion due to strong declines in the financial sector offset by stronger gains in the non-financial sector rising 3.1% to $49.4 billion.

- Mark Carney speaks: Friday, 15:00. Mark Carney head of the BOC is scheduled to give a talk inNew York his words can rock the markets.

* All times are GMT.

USD/CAD Technical Analysis

Dollar/CAD had an extremely choppy week. Parity was the battleground for most of the week, that ended in a victory for the loonie.

Technical lines, from top to bottom:

Most lines haven’t changed since last week. 1.0550 was a minor cap back in September, when the pair traded higher. The round number of 1.05 had the same role during a surge in November.

1.0440 provided support when the pair was trading at higher ground during November and was tested successfully also in December, making it stronger. 1.0360 capped the pair in September and October and also provided support. It is weaker now.

The round number of 1.03 was the peak of a move upwards seen in November 2010 and has found new strength after working as a cap in January 2012. 1.0263 is the peak of surges during October, November and December, but was shattered after the move higher. The break above this line proved to be short lived, and it returned to the previous strength.

The round figure of 1.02 was a cushion when the pair dropped in November, and also the 2009 trough. It is weaker now but remains pivotal. 1.0143 was a swing low in September and worked as resistance several times afterwards. It is a strong line of resistance and should be watched on every move higher. The failure to break it marked the collapse of the pair.

1.0070 was a trough more than once in November, December and January. It worked as a very strong cap also in February 2012.

The very round number of USD/CAD parity is a clear line of course, and was a line of battle that eventually saw the pair fall lower.

Under parity, the round number of 0.99 provided support on a fall during October and also served as resistance back in June. In February 2012, the pair fell short of challenging it. 0.9830 provided support for the pair during September and is a minor line on the way down.

0.9780, where the current run began is the next and important support line. It is closely followed by 0.9736, which provided support during August 2011.

The veteran 0.9667 line worked as support at the beginning of 2011 and then for several months during the spring. It is a very clear and strong line on the chart. 0.9550 worked as support during April and also June and is minor now.

0.9406 was the trough in July 2011 and is the final frontier for now. Below this line, its back to 2007.

I remain neutral on USD/CAD.

The new tensions between Israel and Iran support higher oil prices and this helps the Canadian dollar. Also improved US figures aid the loonie. On the other hand, the crisis in Europe strengthens the greenback. Retail sales should be watched this week.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand Dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.