The loonie enjoyed some gains against the greenback, but these eventually met a wall. The rate decision and inflation data are the main events this week. Here’s an outlook for the Canadian events and an updated technical analysis for USD/CAD.

Last week, positive housing data with new housing starts increasing unexpectedly to 200,200 units in December from 186,000 inthe previous month with a rise in multiple urban starts. Meantime new housing price index also increased above predictions gaining 0.3%. However the total value of building permits dropped by 3.6%, mostly inOntario. Will the housing sector continue to thrive ?

Updates: The report about the US trying to stop Israel from attacking Iran continues to push oil high, and USD/CAD lower. The pair is struggling with the 1.02 line. The Bank of Canada leaves interest rates unchanged, as expected. After dropping below the 1.0143 line on Saudi Arabia’s $100 oil target and strong Chinese GDP, the pair is struggling with this line again. USD/CAD dropped under 1.0143 once again. Will it succeed this time? The BOC report is closely watched. USD/CAD parity is getting closer as European optimism pushes the dollar lower.

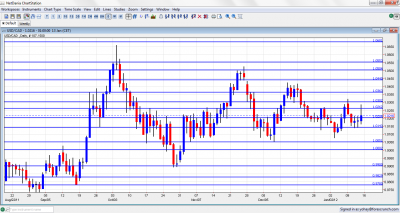

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- New Motor Vehicle Sales: Monday, 13:30. The number of new cars and trucks sold in Canada increased by 3.3% in October from 1.5% rise in September. The reading was higher than the 1.8% increase predicted. Growth in sales was demonstrated in all 10 provinces. Another rose of 2.1% is expected now.

- Foreign Securities Purchases: Tuesday, 13:30. Foreign purchases of Canadian securities dropped sharply in October to C$2.03 billion from C$7.35 billion in September. Money market purchases declined to C$615 million from C$7.24 billion in September and investment in commercial shares plunged to C$196 million in October.2.1% A climb to C$6.97 billion is expected now.

- Rate decision: Tuesday, 14:00. The Bank of Canada maintained its overnight interest rate at 1% in line with predictions and did not mention any rate cuts possibilities despite the grim outlook of the European debt crisis. The BOC statement was upbeat regarding the current conditions and the near future inCanada and theUS but cautioned about the downside risk from the EU debt crisis. No change is forecasted.

- Manufacturing Sales: Thursday, 13:30. Canadian manufacturing sales dropped in October by 0.8% for the first time in three months. The major decline was in energy products and increase was registered in Automobile sales and electronic products. Those reporting sales increases included motor vehicle parts, which were up 6.2 %. A rise of 0.9% is predicted now.

- Inflation data: Friday, 12:00.Canada’s monthly rate of inflation rose by 0.1% in November, after an increase of 0.2% in the previous month. The rise was below the 0.2% increase predicted. Meanwhile Core prices also rose by 0.1% after 0.3% increase in October, worse than the 0.2% rise expected. These low readings places Canada as the country with the lowest interest rates in the world. Headline inflation is expected to drop by -0.1% while Core inflation is predicted to decline -0.2%.

- Wholesale Sales: Friday, 13:30. Canadian wholesale sales increased more than predicted in October rising 0.9% to C$49.2 billion after 0.58% increase registered in September amid strong machinery and food sales. Economists expected a small increase of 0.25%. Another rise of 1.2% is predicted now.

* All times are GMT.

USD/CAD Technical Analysis

Dollar/CAD kicked off the week with a nice slide downwards, until it met the 1.0143 line (mentioned last week). This line served as a double bottom, and the pair eventually bounced higher and closed at 1.0216.

Technical lines, from top to bottom:

1.0677 is a long standing resistance line, tested several times in the past. 1.0550 is a minor line on the way up – a line which can slow the pair. 1.0500 is another minor line of resistance. It was a pivotal around the same time and was a point of resistance before the pair fell.

1.0430 provided support when the pair was trading at higher ground during November and was tested successfully also in December, making it stronger. 1.0360 capped the pair in September and October and also provided support. It is weaker now.

The round number of 1.03 was the peak of a move upwards seen in November 2010 and has found new strength after working as a cap in January 2011. It is key resistance now. 1.0263 is the peak of surges during October, November and December, but was shattered after the move higher. The break above this line still needs to be confirmed.

The round figure of 1.02 was a cushion when the pair dropped in November, and also the 2009 trough. It is weaker now but remains pivotal. 1.0143 was a swing low in September and worked as resistance in the past. It capped a small recovery attempt in November.

1.0050 worked as support in November, was a swing low in December and had the opposite role back in 2010. It worked as a great cushion for the pair in November.

The very round number of USD/CAD parity is a clear line of course, and it will be closely watched on a potential downfall. Under parity, the round number of 0.99 provided support on a fall during October and also served as resistance back in June.

0.9830 provided support for the pair during September. 0.9780, where the current run began is the next and important support line.

I am bullish on USD/CAD.

The situation in Europe is deteriorating at a faster pace, and this certainly helps the US dollar. Also fresh worrying American signs have a weakening effect on the Canadian dollar. Another external influence is the tensions around Iran, tensions which push oil prices higher together with the loonie. But all in all, the Canadian dollar is under pressure. In Canada, the rate decision will like send a concerned message.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.