USD/JPY was almost unchanged over the week, closing at 122.67. The upcoming week is very quiet, with just 3 events. Here is an outlook on the major events moving the yen and an updated technical analysis for USD/JPY.

The Fed minutes showed caution towards a rate hike and were dovish in general. The minutes also mentioned Greece, as the current Eurozone crisis is clearly on the mind of the Fed. In Japan, Core Machinery Orders posted a 0.6% gain, much better than expected. The yen enjoyed safe haven flows that were the result of the Greek crisis, yet optimism towards the end of the week enabled the pair to rise.

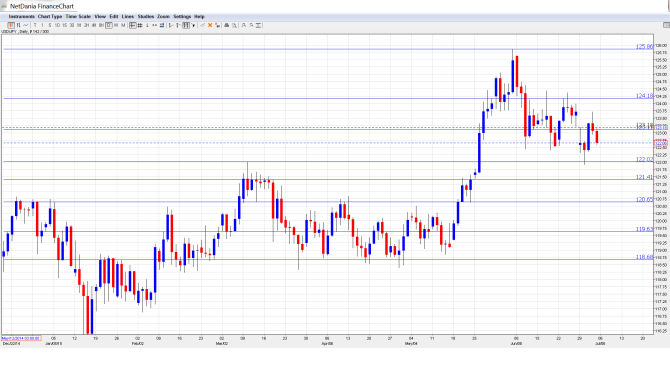

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY graph with support and resistance lines on it:

- Revised Industrial Production: Monday, 4:30. The indicator posted a strong gain of 1.2% in April, within expectations. The markets are braced for a sharp downturn in the May report, with an estimate of -2.1%.

- Monetary Policy Statement: Wednesday, Tentative. With the Japanese economy still struggling, the BOJ is not expected to change its radical easing program. The policy statement will be followed by a press conference.

- BOJ Monthly Report: Thursday, 5:00. This report contains statistical data and an analysis of current economic conditions. As a minor report, it is unlikely to have much effect on the movement of USD/JPY.

* All times are GMT

USD/JPY Technical Analysis

USD/JPY opened the week at 122.42. The pair quickly touched a high of 122.93, and then dropped to 1.2041, testing support at 1.2065 (discussed last week). USD/JPY then rebounded and closed the week at 1.2267.

Live chart of USD/JPY: [do action=”tradingviews” pair=”USDJPY” interval=”60″/]

Technical lines from top to bottom:

We start with resistance at 1.2774.

1.2659 has remained intact since May 2002.

1.2586 continues to be a strong resistance line.

124.16 was in important cap in late June.

123.18 is the next line of resistance.

122.01 continues to be busy in July. It is currently providing intermediate support.

121.39 is the next support level.

120.65 was tested as the pair posted sharp losses in mid-week before recovering. This line is protecting the symbolic 120 level.

119.65 was a key support line in April.

118.68 is the final support line for now.

I am bullish on USD/JPY

Worries about Greece were expressed in the Fed minutes. If the Greek crisis is resolved, there are less hurdles for the Fed to hike in September. In Japan, the economy continues to struggle despite the BOJ’s radical easing program. With no major Japanese events this week, US key releases will have a magnified effect on the movement of the pair this week.

In our latest podcast we clarify Greece and also China, oil, AUD and more:

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.