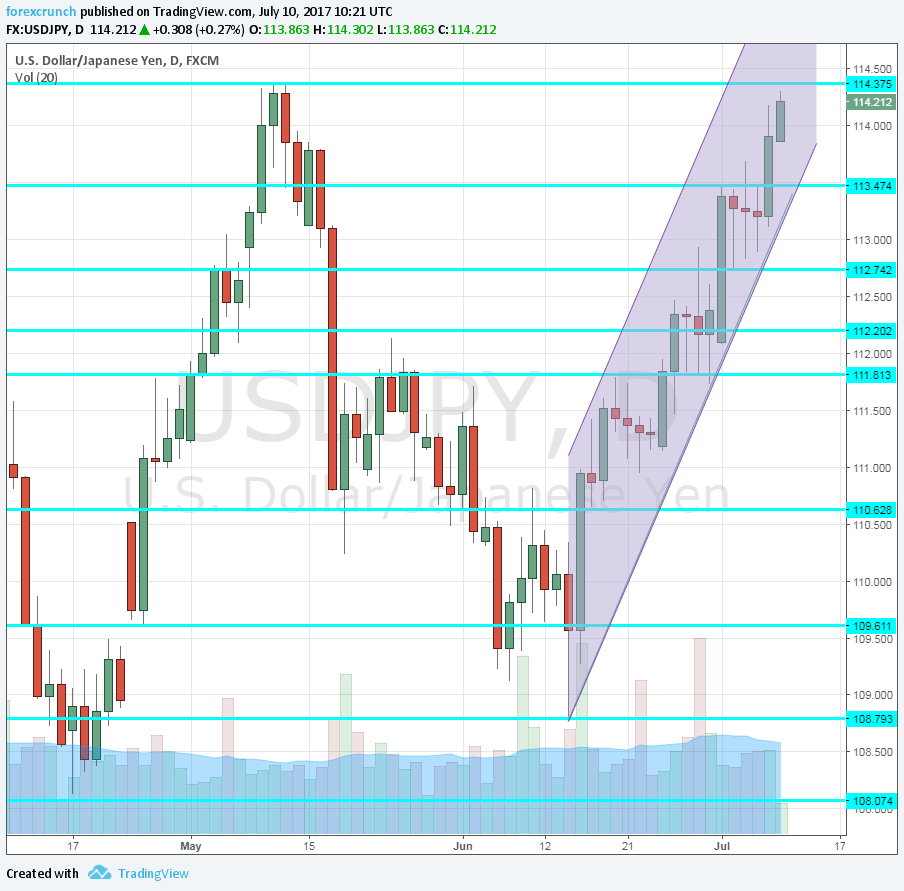

Dollar/yen continues its upwards move. After a short pause that followed the mixed Non-Farm Payrolls, the pair continues riding the tiger along the upwards support line and hits a major barrier.

114.37 is the cycle high. The level was reached in May and the pair could not advance from there. Two months later, USD/JPY hit a high of 114.30, very close to that peak. After the initial rush, we had a small retracement, but the battle continues.

One of the most recent drivers of the pair to the upside is a speech from BOJ Governor Kuroda. He said that the Bank will continue buying as many bonds as needed until the 2% inflation target is achieved.

Make or break?

The next level to watch is the round 115 number. While it did not work as technical resistance nor support, it is certainly a psychological barrier.

Above 115, we find 115.35, which already had a role in the past. Further above, 116 is a veteran line, serving as strong support in 2016.

At the current levels, 113.50 is the first line of support, in the case of a big bounce. It is followed by 112.75, that separated ranges.