The Japanese economy did not grow in Q2 2016. Output remained flat and this was disappointing in comparison to projections of 0.2% growth. In annualized terms, the economy did grow 0.2%, which is around 0.05% q/q. Q1 saw a decent growth rate of 0.5% q/q.

Inflation, which is always escaping the BOJ, is also nowhere to be seen in this report. The GDP Deflator stands at 0.8% in yearly terms, far away from the 2% target. Business spending is down and consumer spending is not going anywhere fast.

The underwhelming numbers come from the preliminary report and could still change in the final read. For now, the basically non-existing growth rate means that the stimulus program published by the government is justified. Yet the reaction to the stimulus package is repeated also here: it is not enough to sell the yen.

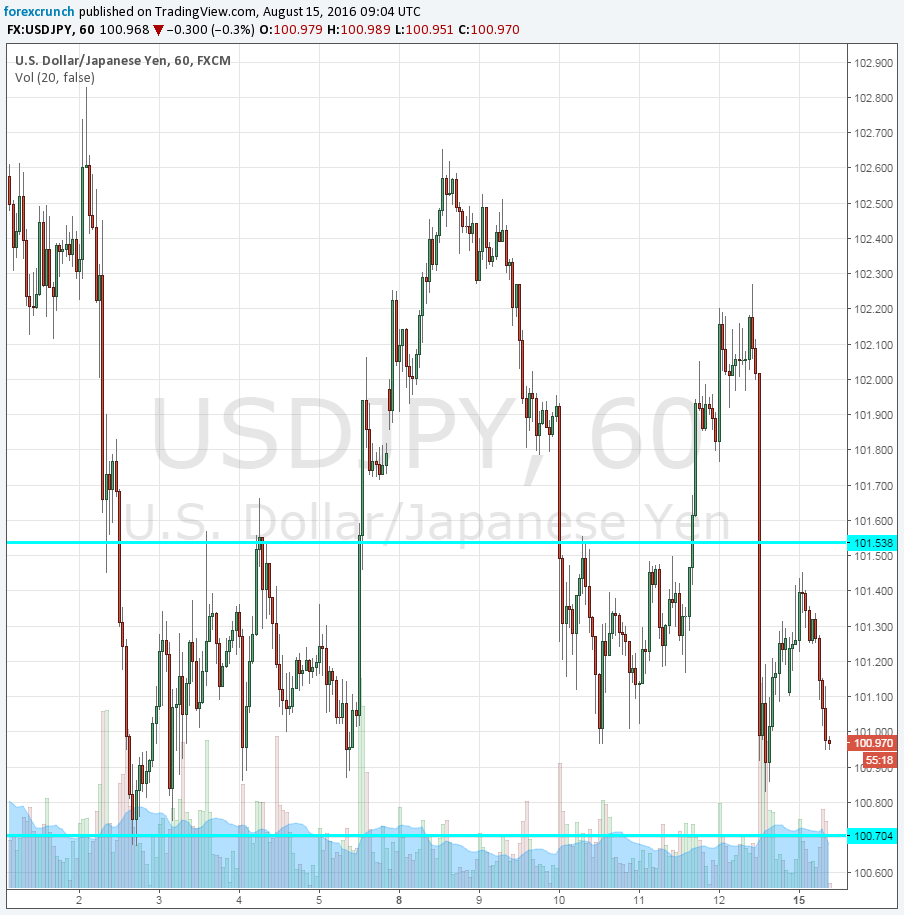

USD/JPY is sliding under 101 once again. The pair was struck by the poor US retail sales report and this one is not helping. The yen continues attracting safe haven flows and this is not about to change anytime soon.

As the chart shows, the 100.70 level is right around the corner. It provided support in early August. The round number of 100 is the obvious line below, and it is followed by the post-Brexit level of 99.

On the topside, 101.50 looms above and it is followed by 102.60.