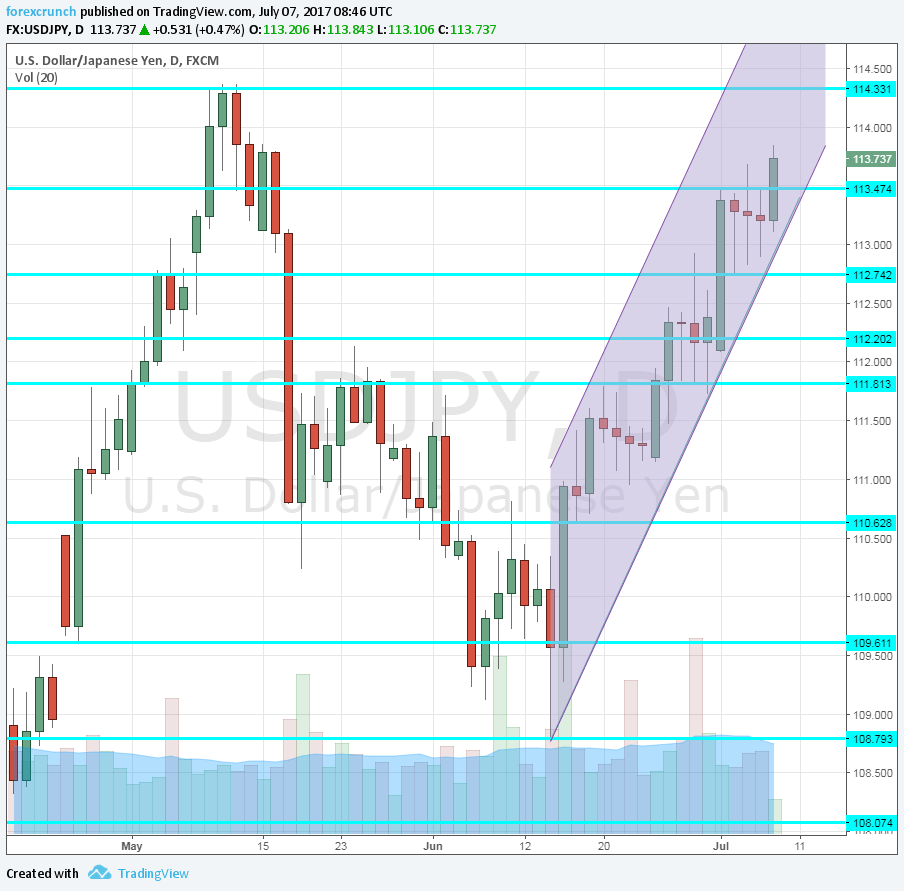

Dollar/yen advanced for the fourth week in a row, extending the rise alongside the uptrend support line. Can it continue further to the upside? It is getting closer to the cycle high of 114.30 and the steep uptrend could be hard to sustain.

This is a new format of the outlook and feedback is welcome. We cover the top fundamental news and outlook, a technical analysis on the daily chart and finally sentiment for the pair moving forward.

USD/JPY fundamental movers

Central bankers and Trump care

The Federal Reserve did not provide a clear message about the balance sheet reduction. Some want it to happen in September but others want to take their time. The unwinding of QE, aka Quantitative Tightening, is causing some jitters.

US data was mixed: soft data was mostly positive with strong showings from the various PMIs, while ADP and factory orders fell short of expectations.

North Korea tested an ICBM, rattling the US on Independence Day. The event sent USD/JPY quickly lower, but it recovered swiftly as well.

In Japan, some have called for an “implicit tapering” by the Bank of Japan: buying fewer bonds without making any announcement. So far, the BOJ continues buying bonds, pressuring the yen.

Yellen’s testimony, inflation, retail data

The upcoming week begins with echoes from the Non-Farm Payrolls report and also the G-20 Summit, including the first meeting between Trump and Putin. The focus then shifts to Yellen’s testimony on Wednesday and also on Thursday. This time, she will undoubtedly talk about monetary policy, moving markets.

Towards the end of the week, we will get inflation data, that has been quite weak and worrying in the US. Retail sales and consumer confidence will provide a picture of the wider economy.

See all the main events in the Forex Weekly Outlook

In Japan, we will get the current account, PPI, and the revised industrial output data, but none of these moves markets.

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

115.35 is the next line of resistance in case the pair break the cycle high of 114.30 which remains critical resistance after capping the pair back in May.

113.50 was a temporary line of resistance on the way up in July. 113.70 was a separator of ranges in June.

112.20 used to be important in the past. It is closely followed by 111.80, which capped the pair in May.

Looking down, 110.70 was a separator of ranges in June and remains important. 109.60 was a gap line in late April, a gap that was never closed.

In June, the pair found support several times at 109.10 and this also works as support. Further below, the cycle low of 108.10 is of high importance. Looking lower, we are back to levels seen in November, but the door is basically open to 105.

Steep Uptrend Support

The pair is riding on uptrend support, which is quite steep. A series of higher lows since the June low of 108.80 is quite consistent. Yet as it is quite steep, it may not be sustainable.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bearish on USD/JPY

Dollar/yen went up too far, too fast. The underlying US economy does not justify further gains and geopolitical risks are not priced into the safe-haven yen just yet.

Our latest podcast is titled Where are the wage hikes?