Monetary policy divergence is weighing on EUR/USD, but it’s certainly not a one way street.

What’s next for the pair come December? Here is the view from Deutsche Bank:

Here is their view, courtesy of eFXnews:

Central bank divergence is an important driver of EUR/USD, but this is only part of the story,argues Deutsche Bank in a note today to clients.

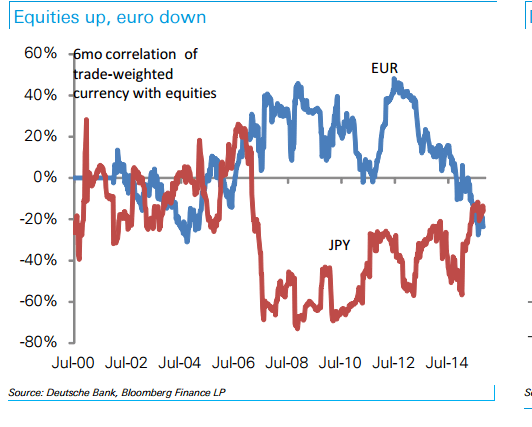

“Another is the emergence of the euro as the world’s preeminent “risk” currency, driven by increased euro funding usage as well as persistently strong European capital outflows (a term we have called Euroglut),” DB argues.

Thinking through to year-end, DB outlines 4 good reasons to believe that the risk-environment can stay positive.

“First, yesterday’s composite PMI surveys – the single best indicator of global growth momentum – bounced across almost all countries, invalidating recent downside global growth fears.

Second, global data have very strong year-end seasonals, with the average of G10 data surprises rising every year over the last decade except during the 2008-09 Great Recession.

Third, Chinese capital outflows (and the currency) have stabilized, with the delay of the SDR inclusion decision to month-end and the imposition of “macroprudential” measures encouraging continued stability.

Fourth, recent capital flow data indicates that inflows into EM are (tentatively) returning,” DB clarifies.

The conclusion from the above, according to DB, is that the risk appetite picture looks reasonable and continued improvement is just as important to DB’s bearish EUR/USD view as the Fed and ECB decisions.

“We see the risks as skewed towards more, rather than less ECB easing. Fed probabilities are a tougher call, but with the FOMC meeting not due until December 16th, there is plenty of potential for EUR/USD to reach the year’s 1.05 lows and beyond before then,” DB projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.