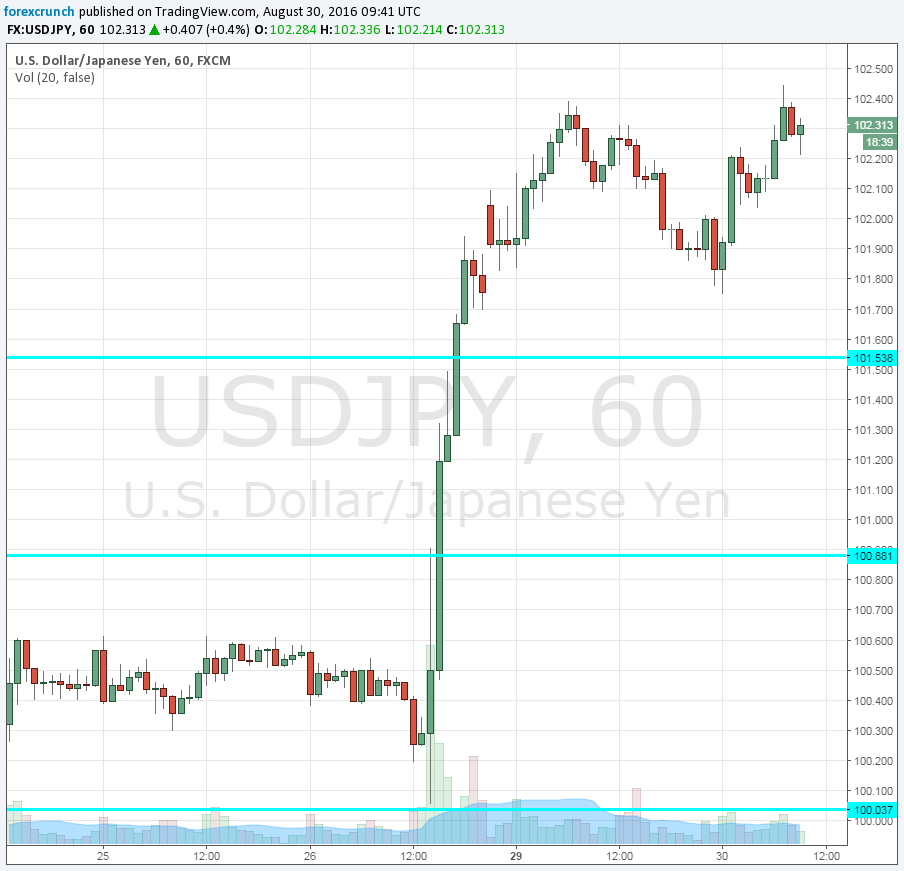

USD/JPY struggled to settle under the round 100 level. When something cannot go down, it comes back up. The relatively hawkish speech by Janet Yellen in Jackson Hole and the subsequent “clarification” by Vice Chair Stanley Fischer sent the dollar screaming across the board.

This greenback rally was also felt in USD/JPY, which topped 102. This might be a chance for the Bank of Japan to push the pair even higher.

BOJ Governor Kuroda also spoke in Wyoming and left the door open for more monetary stimulus, but the weakness of the yen could come sooner and from outright intervention rather than new policy measures.

“Make the trend your friend” is also relevant in interventions from central banks. The BOJ has struggled to weaken the Japanese yen, a move essential for lifting inflation and assisting exporters. It has met opposition from markets favoring the haven yen as well as international criticism that has come from the US and also from China. It has been quite hard to “catch a falling knife”.

However, this USD strength provides an opportunity to ride with the trend. We have already heard from Suga. Japan’s cabinet secretary said that they are watching markets very closely. This statement comes today, when USD/JPY is trading above 102, not last week, when it was around 100.

The government, led by the Ministry of Finance, orders an intervention, and the BOJ implements it. Is Suga preparing the ground for the BOJ to weaken the yen?

The mere threat, coming on top of an already existing weakness, could do the job as well. At the time of writing, dollar/yen is trading at 102.30, up 40 pips on the day and trading around the top of this week’s range. Is there more to come?

More: Scenarios For September BoJ MPM & USD/JPY Targets – Deutsche Bank